SECTION OVERVIEW AND POLICIES

The purpose of this section is to provide guidance to agencies regarding refund checks (i.e. checks issued from the Comptroller’s Refund Account) that are returned and/or need to be reissued. These checks can be easily identified by examining the face of the check. The heading reads: Comptroller State of New York - Refund Account. Refund checks also contain a letter “P” or “W” in the upper right hand corner and will contain one signature by the State Comptroller. Vendor checks have two signatures on the check – one from the State Comptroller and one from the Commissioner of Tax and Finance. For additional information regarding vendor checks that are returned or need to be reissued, see Section 9.C – Reissuing or Cancelling a Vendor Check of this Chapter.

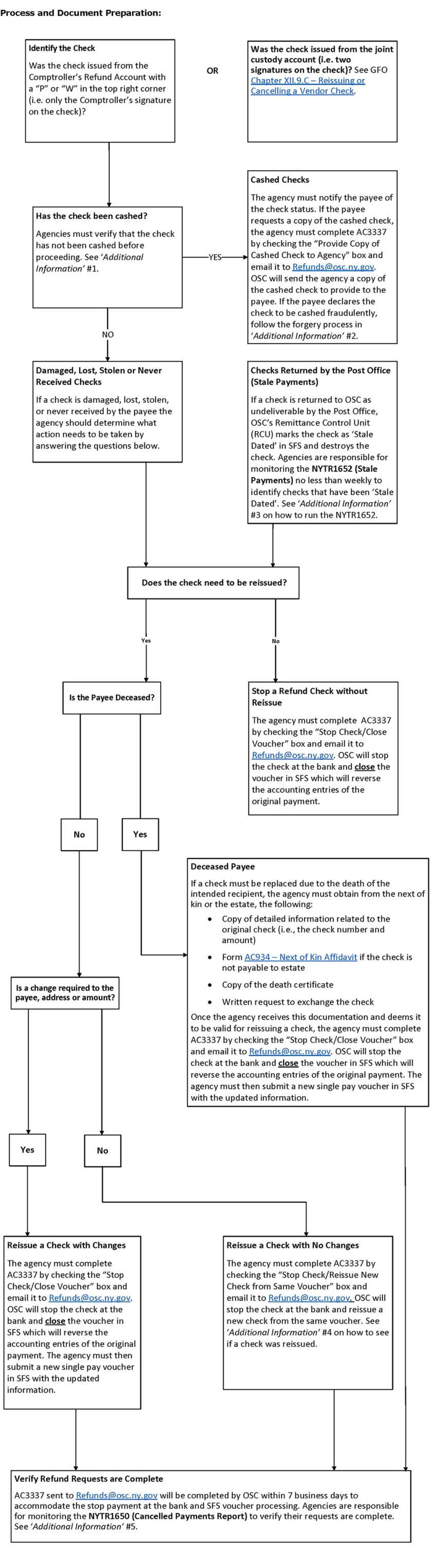

Occasionally, the Post Office may return a check because of an incorrect address. Other times, a payee may request that a check be reissued because it was damaged, lost, stolen or never received. In addition, an individual can return a check to the agency and request the check be reissued to a different payee due to the death of the original payee. Depending on the reason the check is returned, various actions may be necessary by the payee, agency and the Office of the State Comptroller (OSC). These actions will result in reissuing the check with appropriate changes, if necessary, or closing the voucher and reversing the accounting entries of the original payment.

ADDITIONAL INFORMATION

#1. Looking Up a Refund Check Status in SFS

Agencies can determine if a single check has been cashed, stopped, staled or escheated by completing the following steps:

- SFS Navigation: Accounts Payable > Review Accounts Payable Info > Payments > Payment.

- Enter the check number in the From Ref ID field and click Search.

- The Payment Date is the date the check was issued out of SFS.

- The Reconcile Date is the date the check was cashed or stopped at the bank.

- The Payment Status and the Reconciliation Status will tell you if the check has been cashed, stopped, staled or escheated as follows:

| Payment Status | Reconciliation Status | What Does the Status Mean? |

|---|---|---|

| Paid | Reconciled | Check is cashed at bank. |

| Paid | Unreconciled | Check is outstanding at bank. |

| Stopped | Reconciled | Check is stopped at bank. |

| Stopped | Unreconciled | Check is stopped in SFS but not yet stopped at the bank due to the timing of the bank extract files. |

| Staled Dated Payment | Unreconciled | Check was returned from the Post Office as undeliverable and destroyed by OSC. |

| Escheated | Reconciled | Check was uncashed and turned over to OUF. See Chapter XIV.1 – Outstanding Check Outreach and Escheatment of this Guide |

#2. Forgery Claims

If a payee declares a check to be fraudulently cashed the agency must update AC 1551 (Affidavit to Support Claim of Forgery Endorsement) with the check information and submit it to the payee. The payee must return the completed form to the agency with a notarized signature.

The agency must then complete AC 3337 by checking the “Submit Forgery Claim to Bank” box and email it to [email protected] with a copy of the notarized AC 1551. OSC will forward the affidavit to the “paying” bank who will collaborate with the “cashing” bank to render a decision on the claim.

- If the bank denies the claim they will provide the reason for the denial which will be forwarded to the agency. If the payee protests the denial, the agency must email [email protected]. OSC will contact the bank to determine the next step for the payee to take on a case by case basis.

- If the banks determine the claim is a valid forgery, a credit will be applied to the Comptroller’s Refund Account. OSC will notify the agency when the credit has been received. The agency must then notify the payee of the bank’s decision and submit a new single payment voucher through SFS to issue the payee a new refund check.

The fields listed in the following table provide the unique coding to use when submitting a single payment voucher for approved refund forgery claims. The agency's revenue will not be debited for this payment.

SFS Field Name SFS Voucher Coding Supplier ID 0202600001 – RFND FORGERY REFUND

This supplier ID is solely for use in reissuing a refund for approved refund forgery claims.Name Enter the name as it appeared on the forged check. Address Line 1 Enter the address as it appeared on the forged check or enter an updated address if provided. Address Line 2 City State Zip Invoice Number Enter “Replace Check XXXXXXXX” using the original check number. Business Unit Agency Specific Department Agency Specific Fund 70200 (Comptroller’s Refund Account) Program 99999 (Non Appropriated Program) Account 58981 (Refunds) Product 315423 (Forgery Refunds)This product code is solely for use in reissuing a refund for approved refund forgery claims. Budget Reference Current Fiscal Year Payment Amount Enter the amount of the original forged check.

#3. Check Returned by the Post Office (Stale Payments)

If a check is returned to OSC as undeliverable by the Post Office, OSC’s Remittance Control Unit (RCU) marks the check as ‘Stale Dated’ in SFS and destroys the check. Agencies are responsible for monitoring the NY_NYTR1652_AGY_QRY (Stale Payments) query no less than weekly and contacting payees to obtain updated information and submit a new voucher.

To run the NY_NYTR1652_AGY_QRY:

- SFS Navigation: Reporting Tools > Query > Query Viewer

- Enter the ‘From Date’ and ‘End Date’

- Bank SetID: SHARE

- SFS Bank Code: 10001

- SFS Bank Account: 1202 for “P” checks or 1203 for “W” checks

#4. Refund Check Reissuance Status

Agencies can determine if a check has been reissued by completing the following steps:

- SFS Navigation: Accounts Payable > Vouchers > Add/Update > Regular Entry.

- Click the Find an Existing Value tab.

- Enter the Business Unit and Voucher Number into the respective fields and click Search.

- Navigate to the Payments tab.

- On the dark blue Payment Information line, click View All.

- Scheduled Payment 1 contains the payment information for the stopped (cancelled) check.

- Scheduled Payment 2 contains the payment information for the reissued check.

#5. Verify Refund Requests are Complete

An AC 3337 sent to [email protected] will be processed by OSC in SFS within 7 business days to accommodate the stop payment at the bank and SFS voucher processing. OSC is not responsible for notifying the agencies when their requests have been completed in SFS. Agencies are responsible for monitoring the NY_AP_OSC_NYTR1650_QRY (Cancelled P & W Refund Payment) no less than weekly.

To run the NY_AP_OSC_NYTR1650_QRY:

- SFS Navigation: Reporting Tools > Query > Query Viewer

- Enter the ‘Cancelled From Date’ and ‘Cancelled To Date’

- Business Unit: Agency Business Unit

- Vendor ID: Optional

- Voucher: Optional

The query results will show the date the original payment was cancelled (stopped) by BSAO, the Hold Reason placed on the voucher (ie, SCL or SNR) and the date the voucher was closed by BSE for vouchers with a Hold Reason of SCL. When a voucher has been closed, the agency can then enter a new voucher if needed with the updated payment information.

Hold Reason Description:

- SCL – Single Vendor: Close Liability (New voucher must be submitted in SFS if needed with the updated payment information.)

- SNR – Single Vendor: No Change (New check will be issued from the same voucher.)

#6. Refunds Misapplied at the Depositing Bank

Occasionally a refund check that is deposited by the payee will be misapplied at the depositing bank. The check will show as cashed at the bank and in SFS even though the intended payee did not receive the credit. The depositing bank will recoup the funds from where it was misapplied and credit the Comptroller’s Refund Account. In order to issue the payee a new check the agency must submit a new single payment voucher in SFS upon notification from OSC of the misapplied payment.

The fields listed in the following table provide the unique coding to use when submitting a single payment voucher for misapplied refunds. The agency's revenue will not be debited for this payment.

| SFS Field Name | SFS Voucher Coding |

|---|---|

| Supplier ID | 0200000002 – RFND UNSPECIFIED REFUND |

| Name | Enter the name as it appeared on the original check. |

| Address Line 1 | Enter the address as it appeared on the original check or enter an updated address if provided. |

| Address Line 2 | |

| City | |

| State | |

| Zip | |

| Invoice Number | Enter “Replace Check XXXXXXXX” using the original check number. |

| Business Unit | Agency Specific |

| Department | Agency Specific |

| Fund | 70200 (Comptroller’s Refund Account) |

| Program | 99999 (Non Appropriated Program) |

| Account | 58981 (Refunds) |

| Product | 315545 (REFUND MISAPPLIED) This product code is solely for use in reissuing a refund for misapplied refunds upon notification from OSC. |

| Budget Reference | Current Fiscal Year |

| Payment Amount | Enter the amount of the original check. |

#7. Uncashed Checks

Pursuant to §102 of the State Finance Law, all refund checks issued out of the Comptroller’s Refund Account that remain uncashed one year from the date of issuance shall be paid into the Abandoned Property Fund. See Chapter XIV.1 - Outstanding Check Outreach and Escheatment of this Guide.

Guide to Financial Operations

REV. 06/04/2019