Purpose

To inform agencies of the change of the income code field on the Federal Tax Data page in PayServ for Non Resident Aliens (NRAs)

Affected Employees

Non-Resident Aliens (NRAs) working in the U.S who have income subject to withholding

Background

Non-Resident Aliens (NRA) working in the U.S are taxed based on tax treaties and types of earnings. The IRS has grouped various earnings paid to NRAs and assigned an Income Code to each group. This Income Code, in addition to treaty rules, are used to apply the correct taxation to the earnings of NRAs and to ensure accurate 1042-S reporting.

OSC Change in PayServ for Agency View

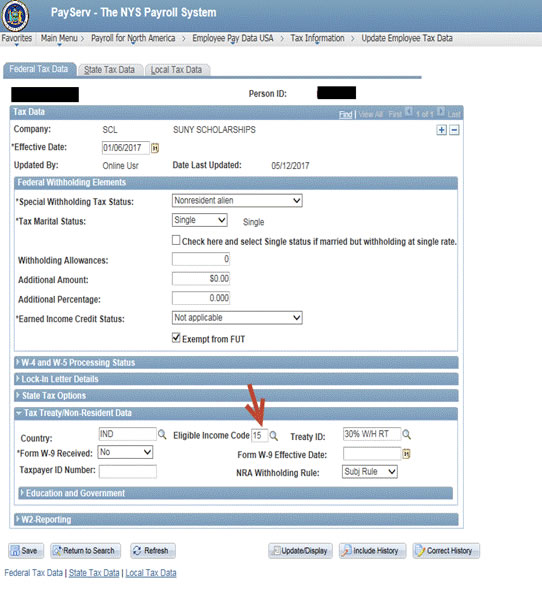

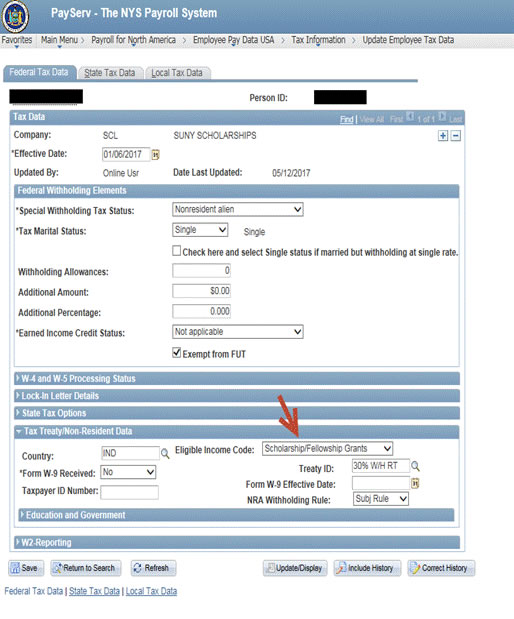

PeopleSoft has removed the numeric income code value field on the Federal tax Data page. Agencies will no longer see the income code number and must now select the narrative description of the income code.

OSC will make the following changes in PayServ:

On the Federal Tax Data page, the Eligible Income Code field will no longer display an income code number, only a narrative description of the income code.

Before

After

Agencies will see this change in PayServ as of December 1, 2017.

Agency Actions

Agencies should continue to select the same Earnings Codes using PayServ Income Codes, along with the corresponding Income Code Description. The IRS Income Codes will be reported to the IRS based on the following:

| PayServ Income Code | IRS Income Code | Income Code Description |

| 15 | 16 | Scholarships / Fellowship Grants |

| 16 | 17 | Independent Personal Services |

| 17 | 18 | Dependent Personal Services |

| 18 | 19 | Teaching |

| 19 | 20 | Studying and Training |

Questions

Questions regarding this bulletin may be emailed to the Tax and Compliance Mailbox.