Savings Programs

Residents can take advantage of two savings programs with tax benefits that help pay for college or disability expenses:

- NY's 529 College Savings

- NY Achieving a Better Life Experience (ABLE)

Comptroller DiNapoli administers the Direct Plan component of the college savings program with the New York State Higher Education Services Corporation. He is also trustee of the NY ABLE program and oversees all of its assets.

NY’s 529 College Savings Program

The best line of defense against the rising cost of higher education is to start saving early. The 529 College Savings Program helps you do just that. Just about anybody can open a 529 account — parents, grandparents, other relatives, friends — as long as he or she is a U.S. citizen or a resident alien.

Earnings on your contributions grow tax free and withdrawals are not taxed if used for qualified educational expenses. If you're a New York State taxpayer, you can also benefit from the state tax deduction.

NY's 529 College Savings Website

“The 529 Plan is a way to save for college education. Even if you put aside just a little bit of money each year, that money accumulates, and it’s a really great way to prepare for that expensive college education.” – New York State Comptroller DiNapoli

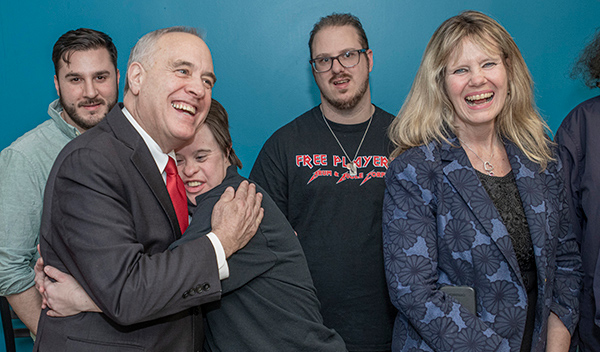

NY ABLE Program

The NY ABLE Program is a savings and investment plan that helps families and individuals with disabilities pay for medical and living expenses to maintain health, independence and quality of life.

This plan is intended to supplement benefits from programs like Medicaid, SSI and private insurance. Like a college savings account, there is no federal tax on savings added to a NY ABLE account, provided the funds are used to pay for qualified disability expenses.

“NY ABLE is an important program that helps change people’s lives for the better. The program allows New Yorkers to save for disability expenses without the risk of losing benefits from assistance programs.” – New York State Comptroller DiNapoli