Revenues are affected by economic changes and changes in federal and State policies. Tax base is a measure of the State’s ability to generate revenue. A decreasing tax base may force spending reductions, increased taxes, or both. Receipts are revenues that have been recorded on a cash basis.

See Appendix 3 for a breakdown of State receipts by major source for the past five years.

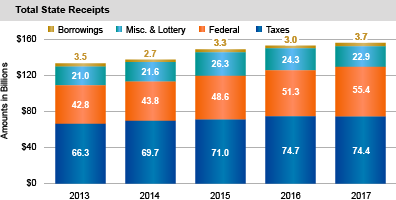

Total State Receipts Have Increased Over the Past Five Years

- From 2013 to 2017:

- Total receipts increased 17 percent.

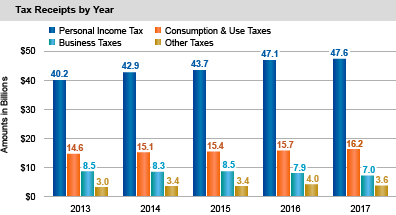

- Tax receipts increased 12.2 percent.

- Federal receipts increased 29.3 percent. Funding increases included:

- Disaster assistance for Superstorm Sandy and Hurricane Irene; and

- Medicaid funding under the Affordable Care Act.

Personal Income Tax and Consumer Tax Receipts Have Increased Over the Past Five Years

- Personal income tax and consumer (consumption and use) taxes:

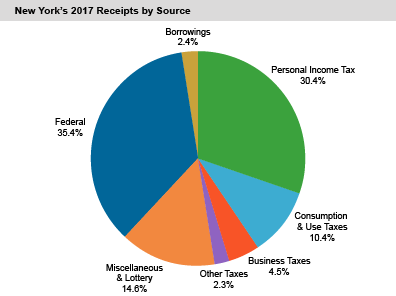

- Accounted for 40.8 percent of 2017 receipts; and

- Have increased 16.3 percent since 2013.

- In 2017, personal income tax receipts—the State’s largest tax revenue source—increased 1.1 percent over the previous year.