You can claim submit a claim on behalf on another person if you are the owner's:

- parent,

- custodian,

- guardian,

- conservator,

- trustee,

- power of attorney, or

- legal representative.

You can also submit a claim if you are the location service provider with a valid agreement, or a public official executing a court order.

If the owner is deceased, see Claims for Deceased Owners for instructions.

Search

Enter the name in the "Search for Individual box" on our Search for Lost Money page. Then select the item you wish to claim from the search results.

How to Submit a Claim

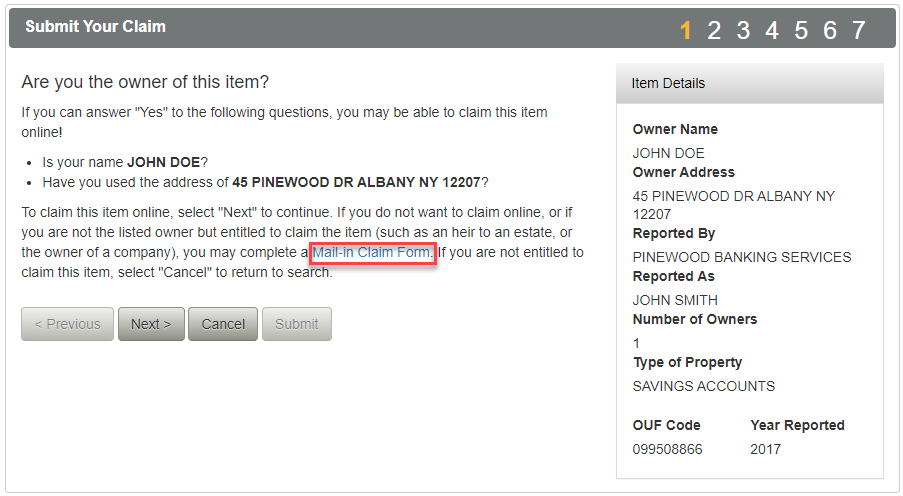

You cannot submit a claim on behalf of another person online. Instead, select the Mail-in Claim Form link in Step 1 and follow these instructions:

- Complete the information requested on the Mail-in Claim Form page.

- Print the form, sign it and have your signature notarized by a licensed notary public.

- Attach the documents listed in the Required Documentation section of the claim form. These documents may include:

- Proof of Address or Ownership connecting the owner to the address or funds.

- Court documents or other signed legal documents giving you authority to act on the owner's behalf.

- Affidavit from the Power of Attorney that the grantor is living, and the power of attorney remains in full force and effect.

- Copy of the child's birth certificate (if under age 18).

- Mail to:

Office of the State Comptroller

Office of Unclaimed Funds

110 State Street

Albany, New York 12236

See What to Expect from Us for timeframes on the review process and payment.