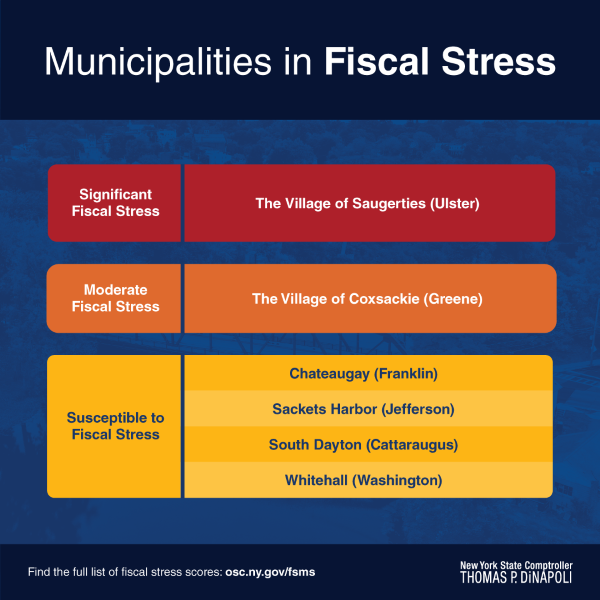

State Comptroller Thomas P. DiNapoli today announced that six villages were designated in fiscal stress under the Fiscal Stress Monitoring System (FSMS). DiNapoli’s office evaluated all non-calendar year local governments and designated one village in “significant fiscal stress,” one in “moderate fiscal stress,” and four as “susceptible to fiscal stress.”

The Village of Saugerties (Ulster County) was classified in “significant fiscal stress,” while the Village of Coxsackie (Greene County) was listed in “moderate fiscal stress.” The four villages classified as “susceptible to fiscal stress” are: Chateaugay (Franklin County), Sackets Harbor (Jefferson County), South Dayton (Cattaraugus County), and Whitehall (Washington County).

“The number of local governments in stress remains low after emergency federal aid helped many stabilize their finances over the past few years,” DiNapoli said. “With that aid winding down, local officials should be closely monitoring their financial conditions, as some may have tougher choices ahead. I encourage local governments to use our self-assessment tool to help them budget and avoid potential pitfalls.”

The latest round of fiscal scores evaluated local governments with fiscal years ending between Feb. 28 and July 31. DiNapoli’s office evaluated the fiscal health of 519 villages, which predominantly have a fiscal year ending on May 31, based on self-reported data for 2023. The scores also cover 17 cities with non-calendar fiscal years, including the “Big 4” cities of Buffalo, Rochester, Syracuse and Yonkers, each of which have fiscal years ending on June 30.

Red Flags Raised About Local Governments Not Submitting Financial Data

Local governments are statutorily required to file an Annual Financial Report (AFR) with the Office of the State Comptroller following the close of their fiscal year. In total, 106 local governments did not file their data in time to receive a FSMS score, a date that is at least three months past their statutory filing deadline. This represents approximately 20% of the local governments included in this round of scoring. Nearly 600,000 New Yorkers reside in one of these municipalities.

Some of the more populous localities that are listed as having not filed include the City of Syracuse, the Village of Hempstead (the state’s largest village), and the City of Lackawanna, all three of which are listed as not filed for the second year in a row. Additionally, the Village of Spring Valley, with a population over 33,000, has not filed in time to receive a score since 2013.

“The number of municipalities that have failed to file their financial data with our office is increasing,” DiNapoli said. “This is a red flag. Gaps in filing undermine transparency and create missed opportunities to identify fiscal stress earlier when it might be more easily remedied.”

The Village of Saugerties, for example, which is designated in significant fiscal stress for 2023, did not file in time to be scored in 2022 and had a score in 2021 that was just under the threshold to receive a stress designation. There are a number of entities that did not receive enough points to receive a stress designation when they last filed, but were showing some signs of stress, then subsequently stopped filing in time to be scored for FSMS. These include: the City of Rensselaer, and the villages of Hoosick Falls, Ellenville, and East Rockaway.

DiNapoli’s office also flagged that some localities were ranked in stress and then stopped filing in time to be scored. For example, the Village of Island Park, which was last scored in 2020 and received a designation of Significant Fiscal Stress, failed to file for the third consecutive year. The Village of Catskill, which received a designation of Susceptible to Fiscal Stress in 2019, has not filed for the fourth consecutive year. The villages of Huntington Bay and Wappingers Falls were both designated in the Susceptible to Fiscal Stress category when last scored in 2022 and 2021, respectively.

DiNapoli’s office continues to remind local officials of both the statutory filing deadlines, as well as the critical filing dates for receiving a fiscal stress score.

The system, which has been in place since 2012, assesses levels of fiscal stress in local governments using financial indicators including year-end fund balance, cash position, short-term cash-flow borrowing, and patterns of operating deficits. It generates overall fiscal stress scores, which ultimately drive final classifications. The system also analyzes separate environmental indicators to help provide insight into the health of local economies and other challenges that might affect a local government’s or school district’s finances. This information includes population trends, poverty, and unemployment.

DiNapoli’s office has a self-assessment tool that allows local officials to calculate fiscal stress scores based on current and future financial assumptions. Officials can use this tool to assist in budget planning, which is especially helpful during periods of revenue and expenditure fluctuations.

In January, DiNapoli released fiscal stress scores for school districts. In September, his office will release scores for municipalities with a calendar-year fiscal year, which includes counties, towns, most cities and a few villages.

List of Villages and Cities in Fiscal Stress

Municipalities in Fiscal Stress

List of Villages and Cities that Failed to File Financial Information

Municipalities that Failed to File or Inconclusive List

Complete List of Fiscal Stress Scores

Data Files

FSMS Search Tool

Tool