NYSLRS’ Actuary ensures that adequate assets are being accumulated to pay benefits as they become due using demographic (rates of employee mortality, disability, turnover and retirement) and economic (interest rates, inflation and salary growth) assumptions.

At the beginning of each fiscal year (April 1), the Actuary performs an actuarial valuation. First, the Actuary determines the dollar amount needed to pay all current and future benefits (actuarial liabilities). Some of the factors used to determine the value of future benefits include:

- Benefits for every member, retiree and beneficiary

- Future salary and service amounts

- Probabilities of disability, withdrawal and retirement

- Life expectancies

- Inflation for cost-of-living adjustments (COLA)

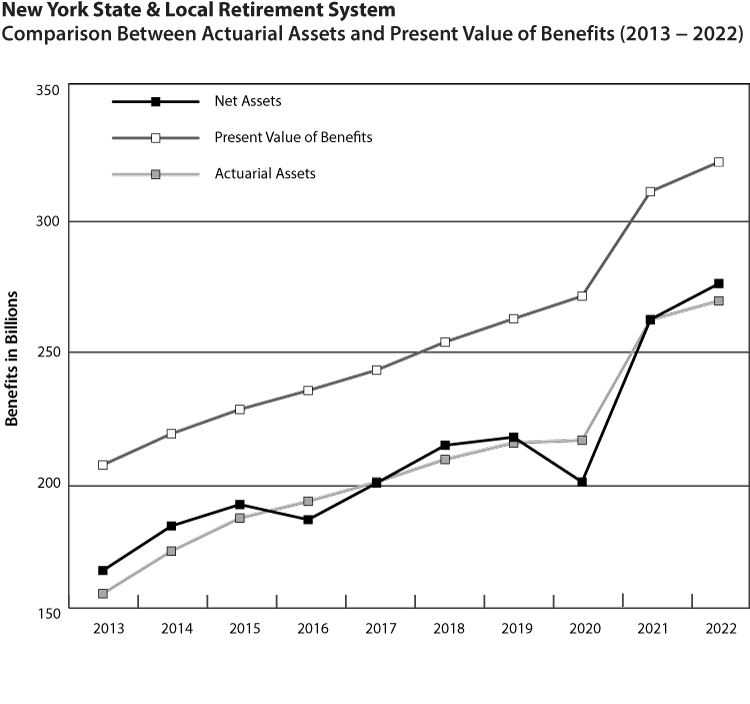

Once future benefits have been projected, the Actuary must discount that cost to its current or present value of benefits (PVB), based on expected investment earnings and mortality rates. The PVB reflects the amount of money needed in the Fund today to pay benefits in the future.

NYSLRS assumes a 5.9 percent rate of return on Fund investments. Therefore, the interest rate used for employer invoices is currently 5.9 percent, though this rate could change in the future based on investment returns. This assumed rate of return was set as of April 1, 2021 and is reviewed annually.

The mortality rates are based on NYSLRS’ own experience. The mortality improvement factors are from the Society of Actuaries’ MP-2021 table.

The Actuary also establishes the actuarial value of NYSLRS’ assets, using a smoothing method to mitigate employer contribution rate volatility. This smoothing method recognizes a portion of the market gains and losses over the past five years, and, for the purposes of calculating employer contribution rates, evens out the value of the Fund’s assets.

When the present value of benefits and the actuarial assets are equal, rates are near zero. When the current value of benefits is greater than actuarial assets, the difference must be made up through employer contributions. That difference is amortized or “spread” over the working lives of current members to determine annual contributions required. Separate calculations are done for each plan since each plan allows for different benefits.

Rev. 2/23