The Retirement and Social Security Law (RSSL) establishes benefits for members and the benefit options employers can choose for their employees. NYSLRS administers those benefits. The RSSL also establishes the overall methodology used to make sure we have assets available to pay for those benefits.

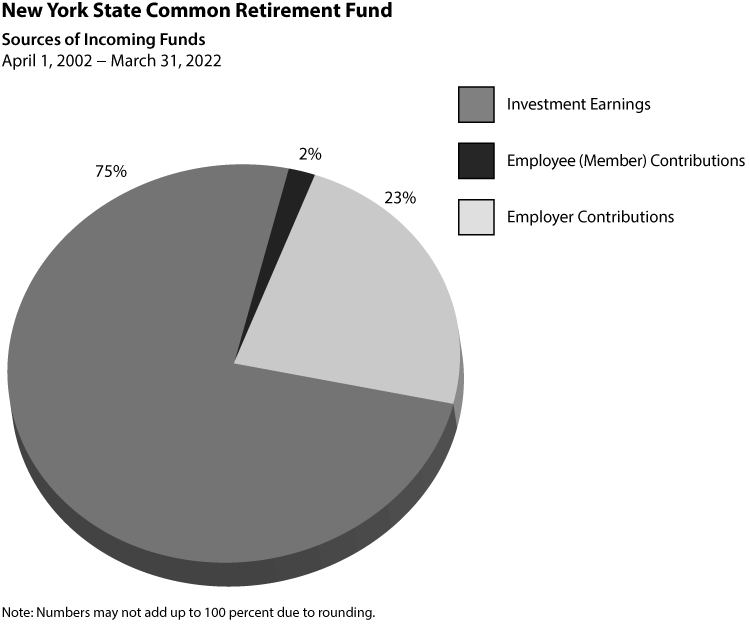

Sources of Income for the Common Retirement Fund

The assets of the Common Retirement Fund (Fund) come from three main sources of incoming funds: investment income, employee or member contributions and employer contributions. The value of the Fund was $248.5 billion as of March 31, 2023.1

Over the past 20 years, the Fund’s investment returns have covered 75 percent of the cost of pensions. Over this same period, employee (member) contributions represented 2 percent of the growth of the Fund’s assets, and employer contributions represented 23 percent of the Fund’s asset growth. Approximately $186.6 billion was paid in benefits from April 1, 2002 through March 31, 2022.

How the Fund Affects Employer Contribution Rates

The value of the Fund and the rate of return on our investments directly affect annual contribution rates.

Each year, we evaluate the Fund’s assets and compare the value of those assets to the funds needed to pay current and future benefits. The difference between these two amounts is spread over the future working lifetimes of active members to determine annual contribution rates.

The return on the Fund’s investments over time also affects the annual contribution rates. When the Fund’s investments earn a larger than expected return, the annual contribution rates normally decrease. Conversely, when the rate of return falls short of projections, the contribution rates normally increase. (As of the April 1, 2022 valuation, we assume a 5.9 percent annual rate of return on our investments.) NYSLRS’ Actuary is responsible for determining the contribution rates each year, which must be approved by the Comptroller.

1Updated 7/23

Rev. 2/23