This page is going to be removed in the near future. If you have this page bookmarked, please update your bookmark to one of the links below.

- Bookmark our How to Use Retirement Online page for help with legacy reporting, enrollment and viewing billing-related information for employers, including annual invoices, projected invoices, fiscal year earnings and prior years' adjustments, and GASB information.

- Bookmark our Post-Retirement Reporting (PRR) page if you are a school district or Boards of Cooperative Educational Services (BOCES) employer who is reporting employees under Legacy reporting. You use the Post-Retirement Reporting (PRR) online program to report annual salary for public retirees on payroll during the previous calendar year, and to provide notification when a NYSLRS retiree earns more than $35,000. Note: employers who report under Enhanced reporting use Retirement Online to report retirees who are on their payroll.

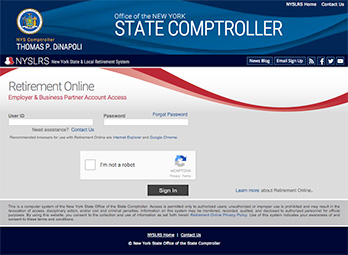

Use Retirement Online to:

- Report earnings

- Enroll members

- View employee contribution rates

- Submit resolutions for Elected and Appointed Officials

- View invoices

- View reported earnings

- View GASB information

Visit our How To Use Retirement Online page for short videos and quick guides on using Retirement Online.

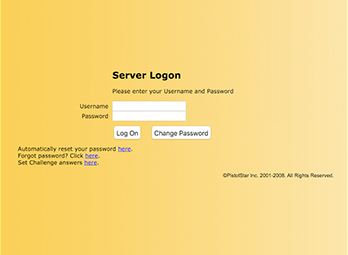

Post-Retirement Reporting (PRR) is the only RIR application still available for use.