What is a Cost-of-Living Adjustment (COLA)?

A Cost-of-Living Adjustment (COLA) is a permanent annual increase to your retirement benefit that is based on the cost-of-living index and a formula set by State law. Included in your monthly pension benefit (once you become eligible), it’s designed to help address inflation as it occurs.

How COLA is Determined

The law requires COLA payments to be calculated based on 50 percent of the annual rate of inflation, measured at the end of the State fiscal year (March 31). Once you are eligible, your annual COLA will be at least 1 percent, but no more than 3 percent, of your benefit. The percentage is applied to the first $18,000 of your annual pension benefit as if you had chosen the Single Life Allowance pension payment option, even if you selected a different option at retirement. Using the Single Life Allowance gives you the highest COLA amount possible, since this option pays the highest benefit. If your pension benefit under the Single Life Allowance option would be less than $18,000, your COLA payment will be calculated based on your actual pension benefit amount.

This Year’s COLA Increase

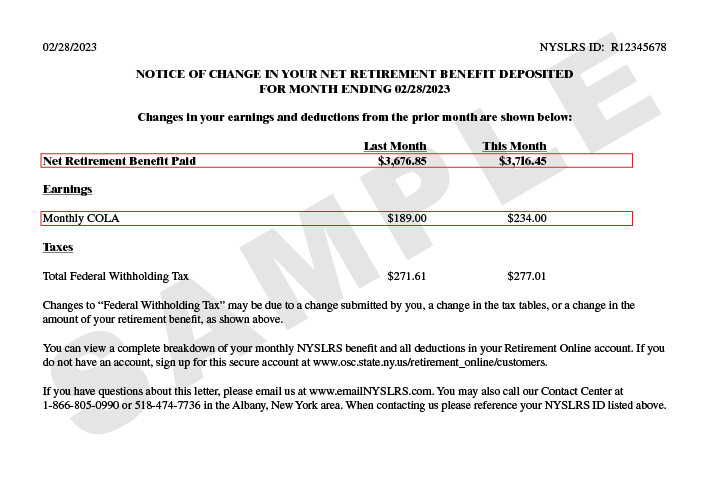

The September 2023 COLA is 2.5 percent, for a maximum annual increase of $450.00, or $37.50 per month before taxes. If you are eligible for this COLA and you receive your pension payment through direct deposit, you will also receive a notification of the net change in your monthly pension amount at the end of September.

To see a current breakdown of your pension payment, including your COLA amount, sign in to your Retirement Online account and view your benefit payment pay stub. Your Retirement Online account will also display changes to your COLA in the months when the adjustment is made.

Sample Net Change Letter

Eligibility

To begin receiving COLA payments, you must be:

- Age 62 or older and retired for five or more years; or

- Age 55 or older and retired for ten or more years (applies to uniformed employees such as police officers, firefighters and correction officers who are covered by a special retirement plan that allows for retirement, regardless of age, after 20 or 25 years); or

- A disability retiree for five years; or

- The spouse of a deceased retiree receiving a lifetime benefit under an option elected by the retiree at retirement; or

- A beneficiary receiving the accidental death benefit for five or more years on behalf of a deceased Employees' Retirement System (ERS) member.

Receiving COLA for the First Time

Your first COLA will be included in the payment that you receive the month after you become eligible. The first payment includes both the prorated portion due, if any, for the month in which you became eligible and the COLA for the month you receive the first payment. For example, if you become eligible for COLA on June 12, your end-of-July pension payment will include COLA for all of July and June 12 through June 30.

If you are the spouse of a deceased retiree and you are receiving a lifetime pension benefit, you are entitled to half of the COLA amount that would have been paid to the retiree.

Once you are eligible, you will automatically receive an annual COLA adjustment each September.

Rev. 6/23