This bulletin has been superseded by Payroll Bulletin No. 1665.

Purpose

To provide agencies with the steps required to calculate breaks in service for TIAA members (Plan Type 7Z) that appear on the weekly NBEN742A Control-D report - TIAA/CREF Employees with Active Jobs and No Projected Dates and the NBEN742B Control-D report – VDC Employee with Active Jobs and No Projected Dates.

- The NBEN742 reports list the employees by Department ID who have an Active job status, and the Projected 366 Completion Date and/or the 7 Year Completion Date are missing from the TIAA/CREF Suspense/NRI panel in PayServ.

- The missing completion date(s) could impact TIAA members’ employee and employer contributions from being transferred to TIAA timely when the suspense period has been completed.

- Breaks in service could also impact the seven year date, when the employer contribution rate increases.

Affected Employees

Employees who are TIAA members (Plan Type 7Z), have a break in service, have not completed the 366 day suspense period, and/or have not completed seven years of NYS service as a TIAA member. Active TIAA ORP participants with a break in service appear on the weekly Control-D NBEN742A report. Active TIAA VDC participants with a break in service appear on the weekly Control-D NBEN742B report.

Background

A break in service impacts the “continuance in service” provision of Section 392(4) of the Education Law, and therefore cannot be included toward the completion of the 366 day suspense or seven year periods.

Effective Date(s)

Immediately

Eligibility Criteria

TIAA ORP and TIAA VDC members that have a break in service, have not completed the suspense period or 7 year period, and appear on the NBEN742A and NBEN742B respectively

Control-D Reports Available Prior to Processing

The NBEN742 Control-D reports identify incomplete TIAA/CREF Suspense/NRI dates for TIAA members that have an Active payroll status and are missing fields from TIAA/CREF Suspense/NRI panel.

NBEN742A TIAA/CREF - Employees with Active Jobs and No Projected Dates

NBEN742B VDC Employees with Active Jobs and No Projected Date

Agency Actions

Agencies must review the weekly NBEN742 Control-D report in order to determine which active TIAA employees have incomplete TIAA/CREF Suspense/NRI panels in PayServ. Agencies will be required to calculate a new 366 Completion Date and/or 7 Year Completion Date for each TIAA member appearing on the NBEN742. The new dates should be recorded in the New TIAA NRI Dates – Agency Code (xxxxx) spreadsheet provided under Job Aids on the OSC Payroll web site.

Determine Which Employees Require the Calculation

TIAA (Plan Type 7Z) members that are currently active in Job Data and have a preceding row(s) with a status of Terminated will need to have new dates calculated. To identify those employees:

- View the NBEN742 (A or B) available in Control –D (PayServ>Control–D>Proceed to Control-D>Filter>NBEN742A* (for Report Name)>Apply).

- Select the report name to open.

- Print the report.

Verify TIAA/CREF Suspense/NRI panel in PayServ

TIAA members appearing on the NBEN742 should have missing fields verified by viewing the TIAA/CREF Suspense/NRI panel in PayServ. The TIAA/CREF Suspense/NRI panel automatically transfers funds from OSC to TIAA when the suspense period has been completed or increases the employer contribution rate after seven years of continuous service.

Confirming the “Projected 366 Day Completion Date” and/or “Projected 7 Year Completion Date” fields are blank for each TIAA member listed on the NBEN742 is required.

The following steps should be followed in PayServ when viewing a TIAA member that appeared on the NBEN742:

- Open the TIAA/CREF Suspense/NRI panel (PayServ>Main Menu>Benefits>Enroll in Benefits>TIAA/CREF Suspense/NRI).

- Enter the employee’s Empl ID.

- Select Search.

- Verify the “Projected 366 Day Completion Date” and/or “Projected 7 Year Completion Date” are blank.

- Print the panel or make note of which dates are missing.

Verify the TIAA Retirement Election Date

The retirement election date is required for the breaks in service calculation in order to determine and confirm the initial 366 Day Completion Date and 7 Year Completion Date.

TIAA Retirement Election Dates for each employee can be found in the Retirement Plans panel in PayServ. If an employee has multiple TIAA Retirement Plans records, verify the election date is the same for each record. Inconsistent election dates will need to be corrected by the agency.

- Open the Retirement Plans page (PayServ>Main Menu>Benefits>Enroll in Benefits>Retirement Plans).

- Enter the employee’s Empl ID.

- Check the box for “Include History.”

- Select Search.

- View TIAA Retirement Record(s).

- Select “View All” under the Coverage portion of panel.

- Print Retirement Plans panel or write down the election date.

Breaks in Service Identified

The 366 Completion Date and the 7 Year Completion Date will be removed for TIAA members that have not completed the required suspense period when Job Status is updated to Terminated. If these employees return to NYS service and Job Data has a status of Active, the TIAA/CREF Suspense/NRI panel will have blank fields for both the 366 Day Completion Date and the 7 Year Completion Date. Employees that have completed the required suspense period, but have not met the 7 Year Completion date are impacted when Job Data has been updated to show status of Terminate followed by Active.

Reviewing the employee’s employment history for Termination rows followed by Active rows is critical to performing the breaks in service calculation. This relationship of Terminate/Active will need to be captured. The number of calendar days the TIAA member did not have an Active payroll status will determine the new completion dates.

The Employee History Information page in PayServ summarizes Job Data, making identification of Termination and Rehire simpler:

- Open Employee History Inquiry page (PayServ>Main Menu>Workforce Administration>Job Information>Review Job Information>Employee History Inquiry).

- Enter the employee’s Empl ID in the Empl ID field.

- Select Search.

- Select “View All” on the History Information panel.

- Printing the Employee History Inquiry page is recommended.

- From the printout, locate the row where Effective Date matches the Election Date found from Retirement Plans panel. This is when the employee became eligible for TIAA.

- From the printout, continue to review the rows above the row found in step 6, stopping and noting or highlighting rows when EE status shows Terminate followed by a row reflecting EE status of Rehire. Note the Effective Date for both the Termination and Rehire rows.

Tools for Calculation

OSC has provided a TIAA Breaks Calculator Job Aid for assisting with the breaks in service calculation. This calculator should be used by the agency when calculating breaks in service for all TIAA members appearing on the NBEN742.

The TIAA Breaks Calculator can be found on the OSC Payroll web site.

Calculating Original Dates

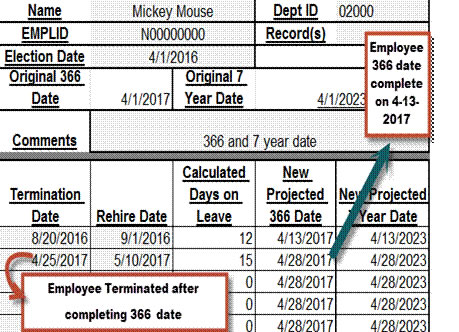

The original 366 Day Completion Date and 7 Year Completion Date will be automatically calculated in the “TIAA New Breaks Calculator”.

Open the “TIAA New Breaks Calculator”:

- Enter the employees name in the cell to the right of “Name”.

- Enter the Department ID in the cell to the right of “Dept ID”.

- Enter the employees NYSEmplid in the cell to the right of “EMPLID”.

- Enter the Employee Record Number or Numbers in the cell to the right of “Record(s)”.

- Enter the Original Retirement Election Date, found in the “Verify the TIAA Retirement Election Date” section above, in the cell to the right of “Election Date”.

- The “Original 366 Date” and “Original 7 Year Date” will automatically populate when moving to a different cell (Return, Arrow, Tab).

- Enter comments if necessary. (i.e. Election date prior to Hire date due to waiver, projected 366 date, projected 7 year date, projected 366 and 7 year dates, etc.)

- Complete the bottom half of the calculator using the information collected from the “Breaks in Service Identified to Perform Calculation” section.

- Enter the first Termination date, found in the “Breaks in Service Identified” section, in the first cell under “Termination Date”.

- Enter the first Active date recorded from “Breaks in Service Identified” section in the first cell under the “Rehire Date”.

- The number in the cell under “Calculated Days on Leave” represents the length of the break in days. This will automatically populate after the Termination and Rehire dates are entered.

- The number in the cell under “New Projected Date” represents the new projected 366 day completion date after each break.

- The number in the cell under “New Projected 7 Year Date” represents the new projected 7 year date after each break.

- Repeat the preceding steps (a and b) until all Terminated/Active rows have been captured (i.e. calculation stops when employee reaches 7 year completion date). Additional rows are not needed when the employee reaches the 7 year date or the employee has no more Terminated rows.

- After all breaks are entered the New Projected Dates will display at the bottom of the template in bold. The New Projected 366 Date will continue to calculate a new date, however employees will most likely have completed their 366 date in the preceding row.

Record New Dates and Send to OSC

Agencies will not be able to update the TIAA/CREF Suspense/NRI panel for any TIAA member in PayServ as agencies only have view access.

Agencies are required to complete the New TIAA NRI Dates – Agency Code (xxxxx) spreadsheet provided under Job Aids for TIAA members that need their TIAA/CREF Suspense/NRI panel updated.

Agencies should email the spreadsheet with the filename, “New TIAA NRI Dates – Agency Code (xxxxx)”, to the Payroll Retirement Mailbox.

OSC Actions

OSC Payroll Deductions staff will update the TIAA/CREF Suspense/NRI panel in PayServ from the agency submitted spreadsheet.

Control-D Reports Available After Processing

The following Control-D reports will be available for agencies to verify the dates have been updated in PayServ. Employee names will no longer appear on the reports when the updates are complete.

- NBEN742A - TIAA/CREF Employees with Active Jobs and No Projected Dates

- NBEN742B - VDC Employees with Active Jobs and No Projected Dates

Questions

Questions regarding the calculation process can be directed to the Payroll Retirement Mailbox.