Employer Billing

As a participating employer, you are billed each November for your share of the cost of your employees’ retirement benefits. The amount of your annual invoice is based on the retirement plans and options you offer, the contribution rates for those plans and options, and the pensionable earnings reported to NYSLRS for members employed during the last State fiscal year.

Your annual invoice is only one piece of the billing process. The resources below can help you understand the entire process. This Billing Dashboard Quick Guide will show employers with the Billing security role how to view billing information for your location.

Three Types of Invoices

Projected invoice

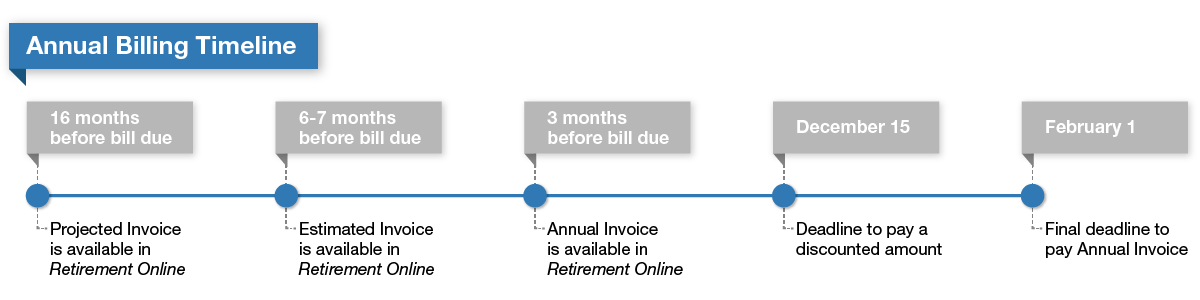

Projected invoices are provided 16 months in advance of the February 1 due date for budgeting purposes. To determine the projected invoice amount, we project your employees’ earnings for the next State fiscal year and apply the employer contribution rates for that fiscal year to the projected earnings.

Estimated Invoice

Estimated invoices are provided for informational purposes only. To determine the estimated invoice amount, we use your employees’ reported earnings from the last completed State fiscal year (April 1 – March 31) and the employer contribution rates for the current fiscal year.

Annual Invoice

Annual Invoices are issued in November. Payment is due on or before February 1, but you may choose to pay a discounted prepayment amount by December 15. Late payments are subject to interest, currently at the rate of 5.9 percent.

Determining the Amount Billed

Employer Contribution Rates

Employer contribution rates play a major role in determining the amount of your annual bill. Rates are issued in September and are used to calculate the projected, estimated and annual invoices with a payment due date February 1 of the next State fiscal year.

Fiscal Year Earnings and Prior Year’s Adjustments

Your annual bill is based, in part, on pensionable earnings you report to NYSLRS. Year-round, you can review pre-billed fiscal year earnings — the pensionable earnings reported by your organization that you have not been billed on yet. You can also review fiscal year earnings and prior years’ adjustments that you have already been billed on.

Amortization Programs

Contribution Stabilization Program

The Contribution Stabilization Program is an optional program that enables you to pay a portion of your annual contribution over time, leading to smoother, more predictable pension costs. If you have not elected to participate in the program, but wish to do so, you can opt in when you pay your annual invoice.

Alternate Contribution Stabilization Program

The Alternate Contribution Stabilization Program is an optional program that was available during the 2014 billing cycle only. If you did not opt in to this program during the one-time election period, you cannot participate.

Financial Statement Disclosures

Governmental Accounting Standards Board (GASB)

GASB specifies how participating employers account for and disclose pension-related information and their proportionate share of Net Pension Liability in their financial statements. NYSLRS provides all the information participating employers need to comply with GASB requirements.

Rev. 2/23