Information Technology Governance

Local Government Management Guide

OSC’s Annual Financial Report (AFR)

2023 Financial Condition Report

For Fiscal Year Ended March 31, 2023

Data Sources

- City University of New York

- College Board

- Federal Reserve Bank of New York

- Fitch Ratings

- IHS Markit/S&P Global

- Internal Revenue Service

- Moody’s Investors Service

- National Student Clearinghouse Research Center

- NYS Department of Corrections and Community Supervision

- NYS Department of Health

- NYS Department of Taxation and Finance

- NYS Department of Transportation

- NYS Division of Criminal Justice Services

- NYS Division of the Budget

- NYS Education D

2023 Financial Condition Report

For Fiscal Year Ended March 31, 2023

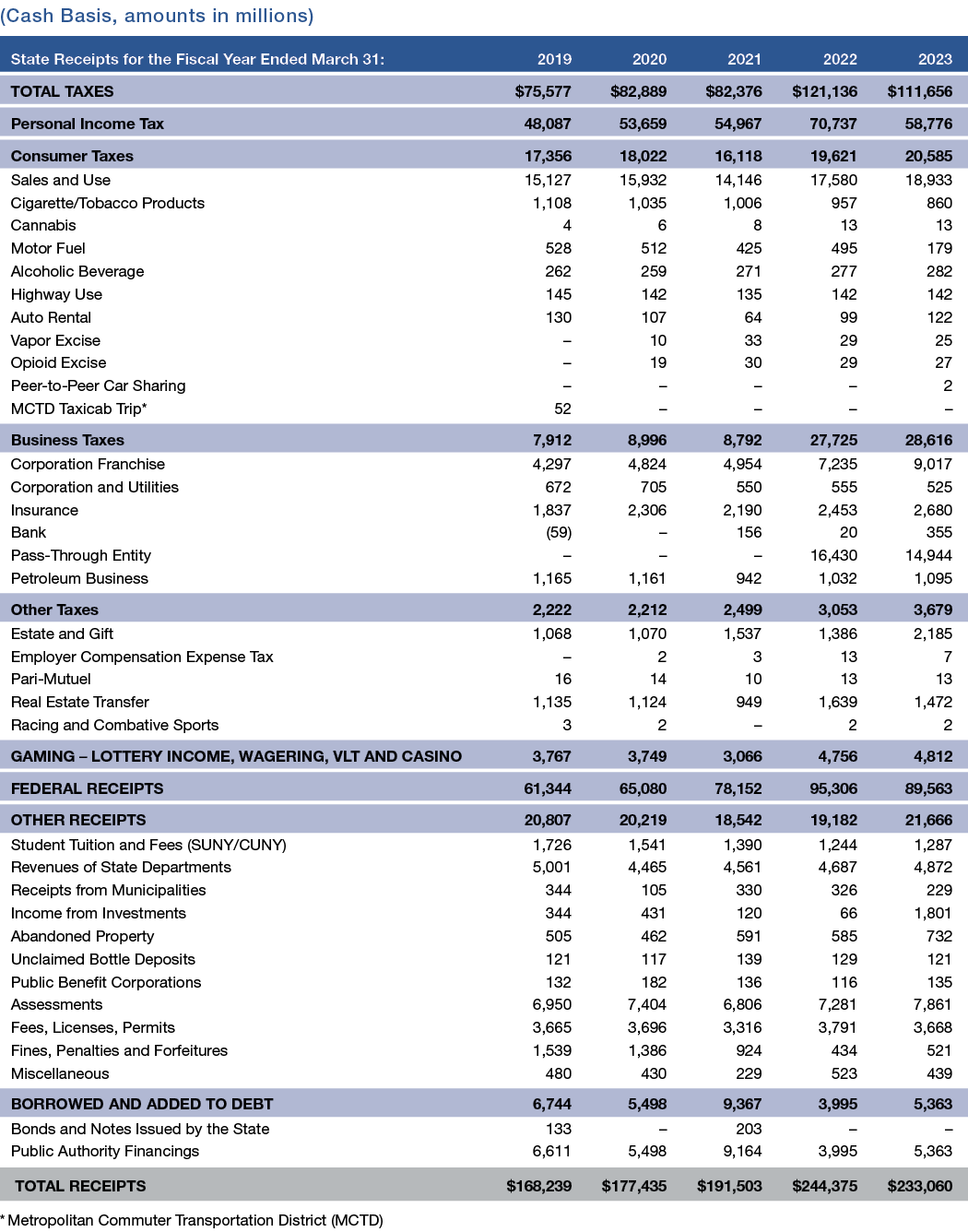

Appendix 3: State Receipts by Major Source

2023 Financial Condition Report

For Fiscal Year Ended March 31, 2023

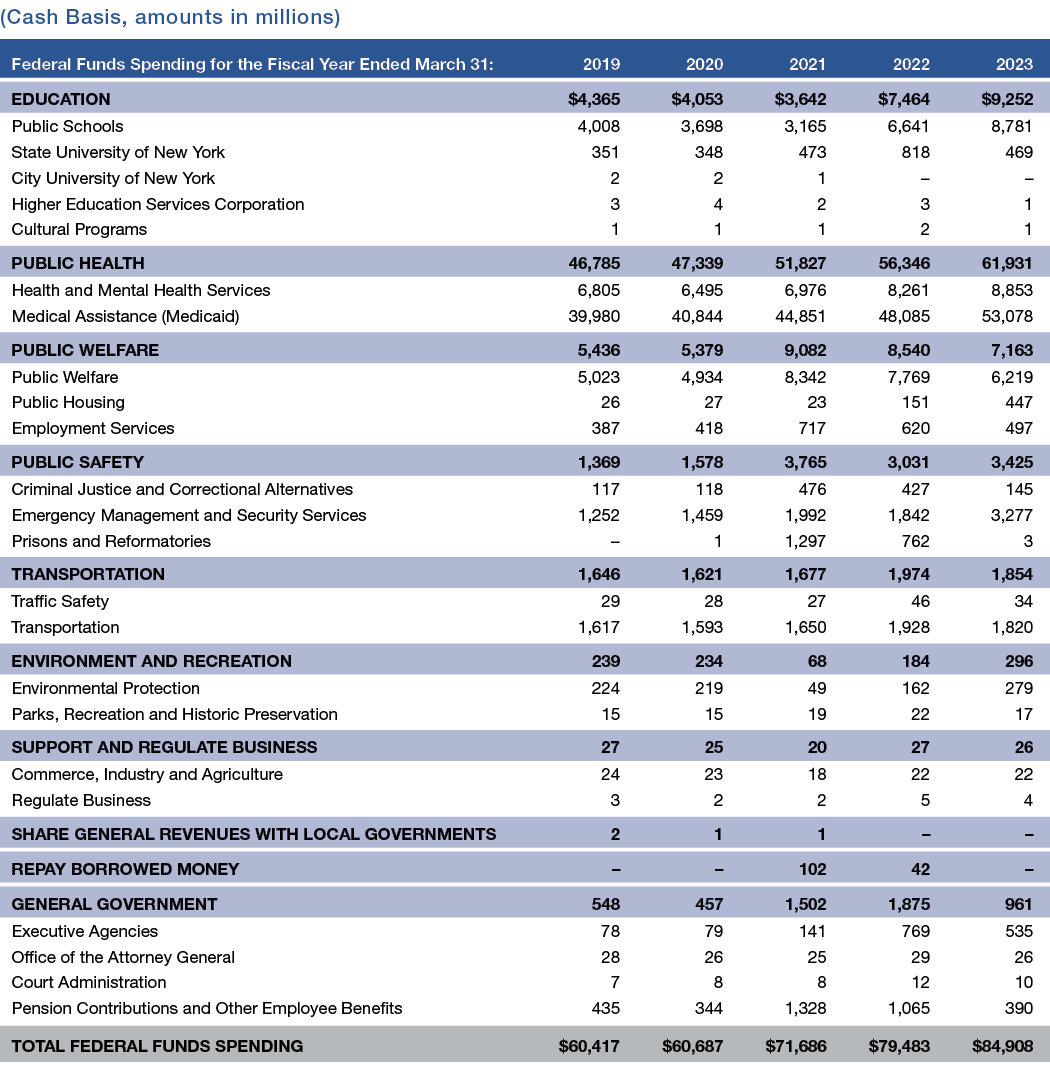

Appendix 2: Federal Funds Spending by Major Service Function

2023 Financial Condition Report

For Fiscal Year Ended March 31, 2023

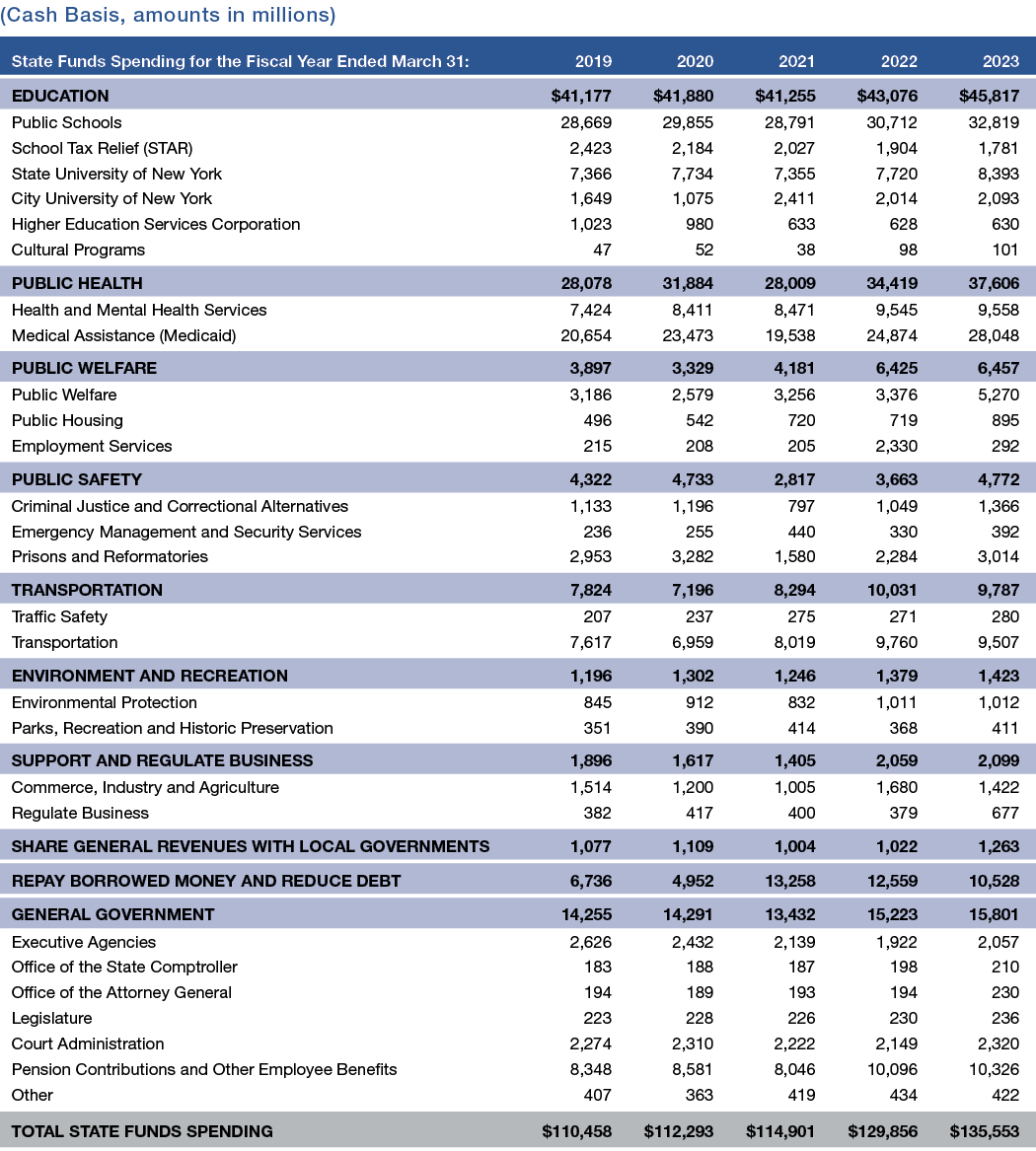

Appendix 1: State Funds Spending by Major Service Function

2023 Financial Condition Report

For Fiscal Year Ended March 31, 2023

Implications for the Future

The Economic Outlook: Uncertainty Remains

Looking ahead, numerous factors will continue to present risks to economic growth, and many forecasters continue to believe that a recession is more likely than not. These factors include persistent inflation, the effects of elevated interest rates due to Federal Reserve Bank actions, and global uncertainty. In New York, lagging employment and labor force recovery relative to the nation will heighten those risks.

2023 Financial Condition Report

For Fiscal Year Ended March 31, 2023

Taxes

State Tax Collections Declined in SFY 2022-23 from $121.1 Billion to $111.7 Billion

- In SFY 2022-23, reported New York State tax collections decreased by 7.8 percent, primarily reflecting the one-time homeowner’s property tax relief credit, and enhanced earned income and child tax credits.

- Personal income tax (PIT) collections declined by 16.8 percent due, in part, to financial market volatility during 2022 which resulted in a 26 percent decline in securities industry bonuses as well as lower tax rates on the middle class effective January 1, 2023.

- The

2023 Financial Condition Report

For Fiscal Year Ended March 31, 2023

Economic and Demographic Trends

Employment Still Below Pre- Pandemic Levels in 2022

- In calendar year 2022, the State gained over 443,000 jobs, an increase of 5 percent compared to growth nationally of 7.3 percent.

- Employment in the State was still 3 percent lower than that in 2019.

- The State’s unemployment rate fell from 7 percent in 2021 to 4.3 percent in 2022.

- The leisure and hospitality sector realized the largest job gains in 2022, 19.2 percent, but was still 10.4 percent below that in 2019.

- Employment in four industry sectors exceeded 2019 levels: information,

2023 Financial Condition Report

For Fiscal Year Ended March 31, 2023

Public Authorities

Public authorities are distinct legal entities that provide services to the public as well as to the State and local governments. New Yorkers pay for public authorities in a variety of ways including service charges, tolls, fees, and in some cases, taxes. Public authorities are generally self-supporting through their revenue-generating activities; however, in some cases, governmental financial assistance and support is provided for operating and other expenses.