New York City Economic and Fiscal Monitoring

The Office of the State Deputy Comptroller for the City of New York monitors New York City's fiscal condition, assists the New York State Financial Control Board, and regularly reports on the City's financial plans, major budgetary and policy issues; economic and economic development trends, and budgetary and policy issues affecting public authorities in the region, including the Metropolitan Transportation Authority. For questions, contact us at [email protected].

Featured Dashboard

Agency Services Monitoring Tool

MONTHLY UPDATES TRACK PERFORMANCE, STAFFING AND SPENDING

The Office of the New York State Comptroller developed a tool that displays performance indicators, staffing levels and spending commitments assigned to a City service since January 2020. While there are many factors that affect service demand and provision, the tool can provide some insight on existing operational or budgetary phenomena or the emergence of potential risks to the City’s budget and the provision of certain services.

View Dashboard

A Review of NYC Capital Project Delivery

Better Reporting and Monitoring of NYC Capital Projects Needed

The majority of New York City’s capital projects are over their initial budgets and behind schedule, suggesting better monitoring and reporting could lead to adjustments to improve capital project delivery. Recent reforms to the City’s capital planning process have focused on improving the delivery of projects, but little detail is available in public documentation about what is fueling these cost and schedule overruns. With closer, more uniform monitoring of capital projects, the City can better identify where additional improvement is needed.

New York City's Uneven Recovery: Foreign-Born in the Workforce

NYC IMMIGRANT WORKFORCE BELOW 2015 PEAK

The size of New York City’s immigrant workforce was flat over nearly a decade. Through 2023, the foreign-born labor market grew 18.5% since 2015 nationally, while New York City’s declined 0.6%, according to data analyzed from the Bureau of Labor Statistics. Still, in 2023, New York City’s 1.8 million foreign-born workers made up 44.3% of its total labor force, more than double the national share of 18.6%.

Review of the Financial Plan of the City of New York

New York City's Budget Outlook Improves

Better-than-projected revenues and planned cost savings benefited New York City’s budget outlook for Fiscal Year 2025, but outyear budget gaps remain large due to the end of federal pandemic aid and a lack of federal funding to support asylum seeker costs. Additional City funding for education and social services programs that support working-class families may be needed if those programs will be maintained at current levels in the future.

A Review of Capital Needs at the Metropolitan Transportation Authority

Calls on MTA to Explain Priorities and What Is Planned in Next Capital Program

In October 2023, the MTA issued its latest 20 Year Needs Assessment (TYNA), which provides an unrestrained view of the capital needs of the system. This report from the Comptroller’s office examines the TYNA, reviews the depth of work needed to upgrade New York’s regional transit and highlights the urgent need for the MTA to state its priorities and funding plans as early as it can.

Read Report

The Cost of Living in New York City: Housing

RISE IN NYC METRO AREA HOUSING COSTS OUTPACES OTHER U.S. CITIES

New York City housing costs have grown more than 68% over the last decade, the largest increase of selected major metropolitan areas in the U.S. Housing affordability, which considers the incomes of households, has also worsened in New York City over the last decade, as median rent prices, in particular, grew faster than median incomes. Many New Yorkers may continue to be priced out of their preferred neighborhoods without a substantial increase in the supply of affordable housing units for low- and moderate-income households.

Read Report

Issues Facing New York City's Agencies

updated reports on three major city-supported agencies

New York City is financially accountable for numerous entities that are legally separate but can impact its budget. State Comptroller Thomas P. DiNapoli released updated reports on three major city-supported agencies — the New York City Department of Education , the New York City Housing Authority and New York City Health + Hospitals — highlighting the major financial and other issues they are confronting.

New York City Department of Education

New York City Industry Sector Dashboards

MONTHLY UPDATES TRACK THE CITY’S ECONOMIC RECOVERY

The COVID-19 pandemic hit New York City particularly hard, causing massive job losses at major employers such as restaurants, hotels and retail stores. These dashboards follow a series of reports released over the past two years tracking economic data and the effect of the pandemic on these critical sectors and will help identify areas of weakness as well as positive developments.

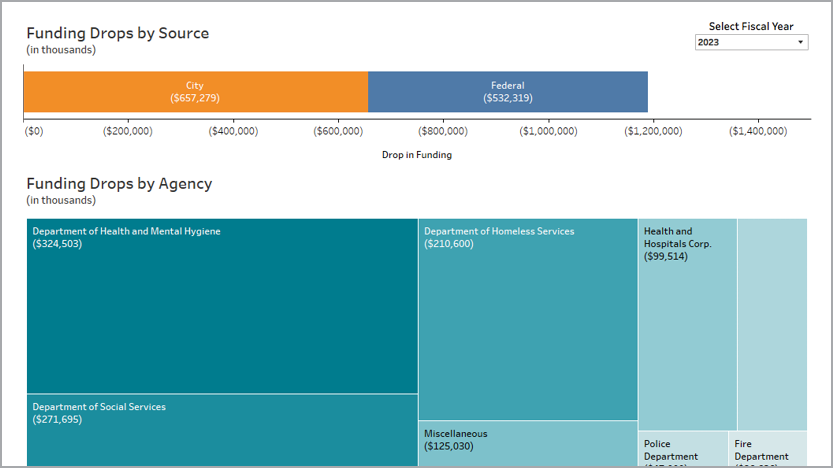

Identifying Fiscal Cliffs in New York City’s Financial Plan

DROP IN FUNDING COULD IMPACT SERVICES FOR RESIDENTS

New York City’s published financial plan includes funding for some recurring spending initiatives for only a limited period, creating additional risks to already identified budget gaps. The Office of the State Comptroller has created a tool to identify sources and uses of funds for City programs that are not fully funded during the remaining years of the City’s financial plan.

View Online Tool

Subway Ridership Dashboard

impact of the covid-19 pandemic on subway ridership

Comptroller DiNapoli has launched an interactive online tool of subway ridership that details where straphangers are, and are not, returning to the subway system, alongside neighborhood and local demographics, employment and income. While many New Yorkers and businesses turned to telecommuting to protect themselves from the virus, others have not had that luxury. As a result, ridership as a percentage of pre-COVID levels has remained much higher in lower-income neighborhoods than in wealthy ones.

View Dashboard