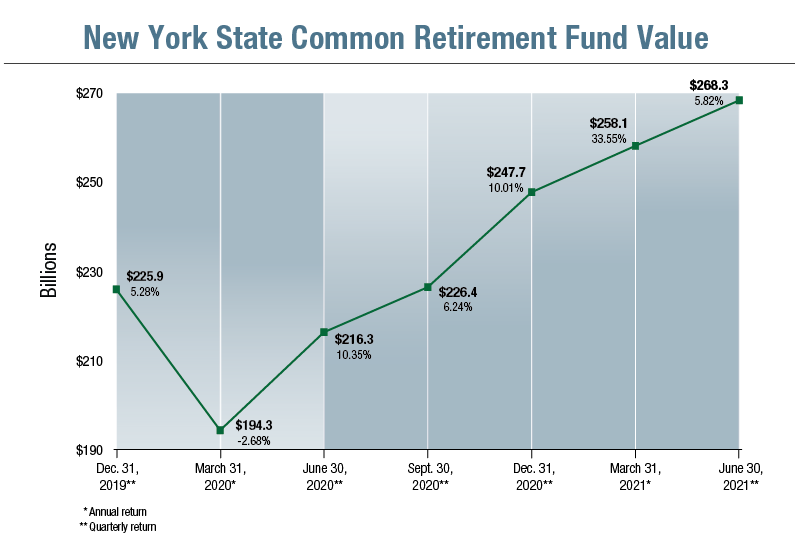

The New York State Common Retirement Fund’s (Fund) estimated return in the first quarter of the State Fiscal Year (SFY) 2021-22 was 5.82% for the three-month period ending June 30, 2021, according to New York State Comptroller Thomas P. DiNapoli. It ended the quarter with an estimated value of $268.3 billion.

“The financial markets remain strong, as industry sectors and companies recover and adapt to the pandemic,” DiNapoli said. “We continue to seek prudent investments and manage the state pension fund to be able to withstand additional economic disruptions and unpredictable market swings. We are one of the best funded retirement systems in the nation because we look ahead and manage risk.”

The Fund's estimated value reflects benefits of $3.52 billion paid out to retirees and beneficiaries during the quarter. Its audited value as of fiscal year end March 31, 2021 was $258.1 billion and the annual return was 33.55%.

As of June 30, 2021, the Fund had 53.68% of its assets invested in publicly traded equities. The remaining Fund assets by allocation are invested in cash, bonds and mortgages (21.96%), private equity (11.21%), real estate and real assets (7.96%) and credit, absolute return strategies and opportunistic alternatives (5.19%).

DiNapoli initiated quarterly investment performance reporting in 2009 as part of his ongoing efforts to increase accountability and transparency. Quarterly rates of return provide a snapshot of performance over three months and reflect a fraction of the Fund’s annual investment return.

About the New York State Common Retirement Fund

The New York State Common Retirement Fund is the third largest public pension fund in the United States. The Fund holds and invests the assets of the New York State and Local Retirement System on behalf of more than one million state and local government employees and retirees and their beneficiaries. The Fund has consistently been ranked as one of the best managed and best funded plans in the nation. The Fund's fiscal year ends March 31.