After two years of extraordinary volatility in state finances, the State Fiscal Year (SFY) 2022-23 Enacted Budget Financial Plan from the Division of the Budget (DOB) projects fiscal stability for the next five years and includes plans to bolster rainy day reserves significantly, according to a report by State Comptroller Thomas P. DiNapoli. However, DiNapoli’s analysis identifies several revenue, spending, and sustainability risks that could disrupt the Financial Plan that should be monitored closely.

“Amidst tremendous uncertainty, the state’s fiscal position is currently stable, providing an opportunity to build reserves that should not be lost,” DiNapoli said. “While the state Financial Plan expects revenue growth to continue, economic risks are growing and may jeopardize the state’s fiscal footing. Making deposits to the rainy-day reserves on or ahead of schedule may help prevent disruptions in critical programs and services.”

Financial Plan Overview

The DOB Financial Plan projects disbursements in SFY 2022-23 of $222.2 billion from All Funds, including $122.7 billion from State Operating Funds. General Fund disbursements (including transfers to other funds) are projected by DOB to total $96.1 billion in SFY 2022-23, increasing to $115.8 billion by SFY 2026-27, for an average annual growth of 4.8%. General Fund receipts are projected to total $88.3 billion in SFY 2022-23, growing to $113.2 billion by SFY 2026-27, reflecting average annual growth of 6.4%. While planned disbursements exceed receipts in some years, the Financial Plan indicates that surplus General Fund resources, mostly accumulated in SFY 2021-22, will be used to balance the budget in SFY 2022-23 and the out-years.

DOB’s projected growth in General Fund spending reflects continuing temporary funding for pandemic recovery and the health care and direct care workforce in SFY 2022-23, as well as significant growth in spending over the Financial Plan period in school aid and Medicaid.

Risks and Causes for Concern

Spending may escalate beyond the current Financial Plan projections. For example, the Financial Plan assumes Medicaid enrollment will peak at nearly 7.7 million in SFY 2022-23 and return to near pre-pandemic levels of 6.1 million in SFY 2023-24. If Medicaid enrollment declines at a slower rate than projected or fails to decline as much as projected, the state will incur significant additional costs.

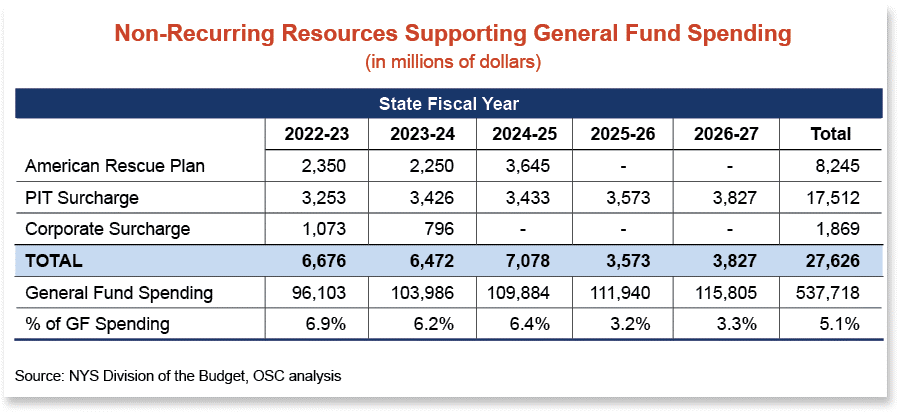

Over the longer term, the elevated level of General Fund spending may be difficult to sustain as temporary resources are depleted or expire. Notably, the American Rescue Plan included $12.7 billion for New York state that may be used for a wide range of purposes, including to cover loss of revenues due to the economic impacts of COVID-19. DOB intends to transfer this funding to the General Fund over four fiscal years. While spreading out the use of these funds over several years is prudent, DOB indicates that the majority of the SFY 2021-22 funding went to “government services.” Without greater detail, it is difficult to assess to what extent the temporary funds are sustaining recurring spending. However, this temporary funding is a significant factor in the projected General Fund balance throughout the Financial Plan period.

The Financial Plan’s reliance on certain SFY 2021-22 Enacted Budget actions, including temporary personal income tax (PIT) increases on high earners, creates additional risk. In 2019, taxpayers with incomes of at least $1 million represented 1.2% of total PIT taxpayers and provided 38.2% of PIT liability. The temporary PIT rate increase results in the state being more dependent on high-income taxpayers; these taxpayers typically have income from more volatile sources, such as capital gains.

PIT revenues are also reliant upon taxpayers, particularly high-income taxpayers, continuing to be residents of New York. According to analysis by the Office of the State Comptroller a larger number of taxpayers moved out of New York than moved in annually from 2015 to 2019. While this occurred at every income level, the number of taxpayers with incomes over $1 million that left the state were nearly double those that moved in.

Over the life of the Financial Plan, temporary tax rate increases in PIT and corporate franchise taxes and largely unrestricted federal aid are expected to total $27.6 billion or more than 5% of General Fund spending over the Financial Plan period. By the end of the plan period, when the PIT rate increase is slated to expire, nearly $4 billion in annual resources would become unavailable.

Recommendations

Given the backdrop of uncertainty facing the state, DiNapoli’s report notes that this Financial Plan will be challenging to execute, requiring careful and continuous attention. To maximize the likelihood of success, the report recommends:

- Implementing Reserve Funds Plan on or Ahead of Schedule. The Financial Plan proposes to increase “principal reserves” from $9 billion at the end of SFY 2021-22 to $19.4 billion in SFY 2024-25, which would result in reserve funds equal to 15% of State Operating Funds spending. Achieving this level of reserves would have a significant stabilizing effect on the state’s long-term finances, and would reduce the likelihood of the state needing to take destabilizing actions to manage unexpected budget shortfalls.

- Effectively Implementing Recovery Programs. DOB estimates that $40.1 billion of federal funding will be disbursed between SFY 2021-22 and SFY 2026-27 for pandemic-related assistance programs, including $15.1 billion in the current fiscal year. Given the importance of these funds to the economic and fiscal recovery of the state, a greater level of public disclosure regarding the actual and intended uses of funds is needed to allow policymakers and the public to monitor the allocation of these resources. In particular, it is essential to ensure that funds are provided in an equitable fashion to the most impacted communities and that they are deployed as quickly as possible. The Office of the State Comptroller will continue to update and expand the COVID-19 Relief Program Tracker to support this effort.

- Monitoring Risks to Economic Growth. The current environment includes several risks that should be carefully monitored, including continuing supply chain disruptions, high levels of inflation, and uncertainty due to the conflict in Ukraine. These factors have further complicated the economic recovery in the state, which has lagged the nation in job recovery – only 79% of jobs lost during the pandemic have been recovered as compared to 96% nationally.

- Reforming Capital and Debt Practices. With the state’s financial condition stabilized, policymakers should seek to restore prudent debt policies. The state should use more “pay-as-you-go” funding to reduce future debt issuances and long-term debt service costs, as well as seek to limit the uses of debt to capital projects related to state assets.

Report

State Fiscal Year 2022-23 Enacted Budget Financial Plan

Additional Resources for Tracking Federal and State Relief Spending

COVID 19 Relief Program Tracker

New York State Personal Income Taxpayer Migration Trends

Medicaid Enrollment Growth, COVID-19 and the Future

Track state and local government spending at Open Book New York. Under State Comptroller DiNapoli’s open data initiative, search millions of state and local government financial records, track state contracts, and find commonly requested data.