New York state has the lowest homeownership rate in the nation, driven by low rates in New York City, according to a report released today by State Comptroller Thomas P. DiNapoli. Only 53.6% of New York households owned a home in the second quarter of 2022, compared to 65.8% nationally. New York also has a racial and ethnic ownership disparity that is higher than the rest of the country.

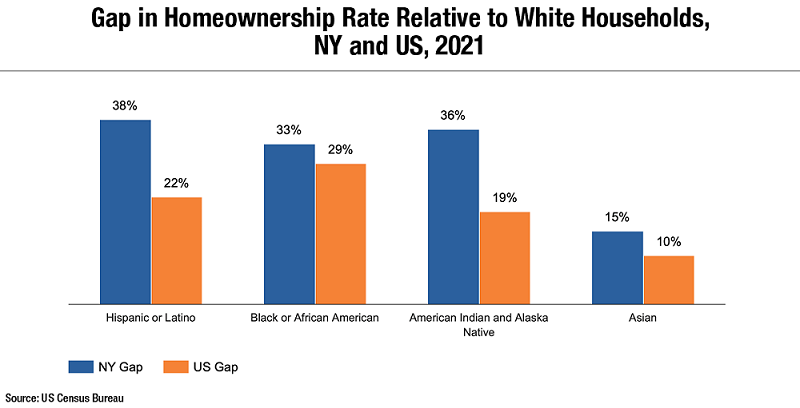

In 2021, 67% of White households in New York owned their home, compared to 52% of Asian households, 34% of Black households, and 29% of Hispanic households. The homeownership gap is highest for Hispanics in New York, and 16% higher than the national Hispanic gap compared to White households.

“Owning a home is the ‘American Dream,’ but for too many New Yorkers that dream has been unattainable,” DiNapoli said. “The low rate of ownership for Black, Asian, and Hispanic New Yorkers is especially troubling. Housing and mortgage discrimination have prevented generations of New Yorkers from taking advantage of the economic benefits of homeownership. Reducing inequities in real estate practices and boosting homeownership are important priorities for maintaining New York’s competitiveness as a place where everyone has an equal opportunity.”

New York’s overall homeownership rate has trailed the nation since 2005, with the gap between the state and the nation as high as 14%. During this time, the state’s rate went from a high of 56.6% in the first quarter of 2005 to a low of 50.2% in the second quarter of 2018. New York’s rate has grown steadily since then, including a pandemic-spurred rise from 53% in the first quarter of 2020 to 54.4% in the second quarter of 2020. Only California and Nevada had homeownership rates lower than 60% in 2021.

One reason New York’s homeownership rates are low generally and lower among Hispanic, Black, and Asian households relative to the national average is the concentration of these households in New York City, which is predominantly comprised of multi-family housing. Homeownership rates exceed the state average in all other counties, where single-unit homes comprise the majority of housing stock.

Homeownership can provide economic benefits, serving as a vehicle to build wealth as home prices appreciate and equity grows over time. In 2020, the median net value of assets held by American households was largest for real estate assets and the median net worth of homeowners was $336,600, compared to just over $5,700 for renters.

The Biden Administration announced a series of initiatives to eliminate discriminatory practices and promote homeownership, including $100 million in new funding for states to support sustainable homeownership. In addition, New York City has announced new initiatives to improve understanding of homeownership and make supporting affordable homeownership an objective of its housing blueprint.

DiNapoli’s report also suggested ways the state can take action to facilitate homeownership and remedy racial and ethnic homeownership gaps:

- First, it can work to ensure that the availability of homeownership assistance through the State of New York Mortgage Agency is widely known.

- Second, improved reporting on available homeowner assistance programs is necessary to understand who benefits from these programs, identify underserved populations, and pinpoint constraints that may be leading to underserved borrowers being excluded from programs; policymakers have to consider retooling or reconfiguring some of these services to ensure broader availability.

- Third, expanded monitoring of and enforcement against discriminatory practices in the housing industry, including mortgage financing, appraisals and other services should be pursued to ensure that illegal, systemic barriers do not remain.

- Finally, the state can redouble efforts to educate potential homebuyers on the value of homeownership. As indicated by DiNapoli’s recent audit, state agencies should improve their financial literacy programs, particularly through greater outreach to consumers.

Report

Homeownership Rates in New York

Track state and local government spending at Open Book New York. Under State Comptroller DiNapoli’s open data initiative, search millions of state and local government financial records, track state contracts, and find commonly requested data.