Stronger-than-anticipated revenue and savings initiatives will allow New York City to maintain budget balance in the coming fiscal year, but the city faces significant financial pressures that are likely to exacerbate already large out-year budget gaps, according to a report on the city Fiscal Year (FY) 2024 Executive Budget released today by State Comptroller Thomas P. DiNapoli.

“The city’s economy continues to show resilience, supporting relatively strong revenues in the near-term,” DiNapoli said. “Still, the city faces considerable challenges, including costs to assist asylum seekers and fiscal cliffs for several programs. Given current reserve levels, budget risks, and an uncertain economy, the city should leverage short-term revenue strength and deposit more funds into its reserves to better weather the years ahead.”

DiNapoli’s report notes that FY 2024 budget balance is projected as the city is returning to a revenue composition that more closely resembles pre-pandemic norms with city funds making up 72.1% of total revenues, the largest share since FY 2020. Federal funding is anticipated to decline to $10.4 billion in FY 2024 (from $11.7 billion in FY 2023) and decline to pre-pandemic levels by FY 2025.

Continued strength in tax collections has led the city to raise projections with an estimated $3 billion surplus to carry into FY 2024 to prepay a portion of spending in that year. The reported surplus could rise given continued better-than-anticipated tax collections since the release of the city’s April financial plan. The city also raised its tax revenue projections by at least $2 billion in each of fiscal years 2024 through 2026 and about $4 billion in FY 2027.

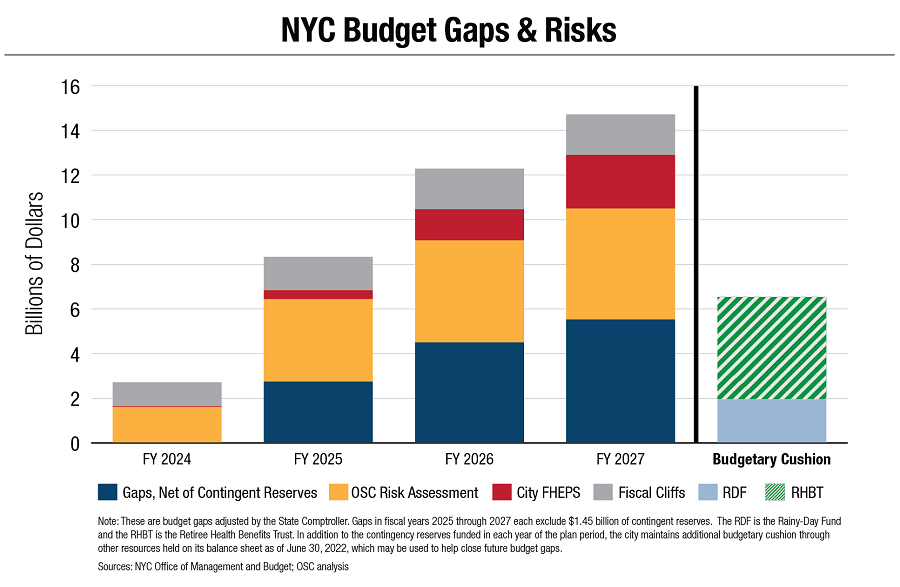

Still, the city projects budget gaps of $4.2 billion in FY 2025, $5.9 billion in FY 2026 and nearly $7 billion in FY 2027. As a share of city fund revenues, these out-year gaps average 7.1% and are the highest level at this point in the budget cycle since FY 2011.

The city’s largest cost, personal services, has been updated to reflect recent collective bargaining agreements with District Council 37 and the Policeman’s Benevolent Association. The city has set aside an additional $16 billion through FY 2027 for these costs, which increased out-year gaps but also resolved a major source of fiscal uncertainty. These costs will be partially offset by the higher projected revenue and the city’s reinstatement of its Program to Eliminate the Gap (PEG), which identified recurring savings of $3 billion beginning in FY 2025.

DiNapoli’s report notes the city faces significant ongoing and new operational challenges that are not included in its budget gap projections, including the cost of services for asylum seekers. The city significantly altered its assumptions for these costs in FY 2023, increasing current year expenditures to $1.4 billion (from $1 billion), while forgoing its expectation that the federal government will fund the associated costs in the current year. The financial plan also includes a $2.9 billion expense in FY 2024 and $1 billion in FY 2025 to manage services to asylum seekers. While the state has budgeted $1 billion for the city, there are still risks for receiving an anticipated $600 million of federal support in FY 2024 and $290 million from the state in FY 2025.

DiNapoli’s report also notes the state budget, which was released after the April Plan, will result in costs unanticipated by the city amounting to more than $500 million annually beginning in FY 2025 for funding the MTA and changes to the way the state passes on Medicaid savings. Overall, OSC-identified risks could increase budget gaps to $8.4 billion in FY 2025 growing to $12.3 billion in FY 2027. These gaps also do not include the potential fiscal impact of a new package of bills for housing vouchers (city FHEPs), or funding for discretionary programs which face “fiscal cliffs” that could reach $2.4 billion and $1.8 billion in FY 2027, respectively.

Report

Review of the Financial Plan of the City of New York

Related Reports

NYC Taxable Sales and Purchases: Resilient Amid Economic Uncertainty

Pandemic Impacts on NYC Fiscal Year 2024 Budget Priorities

Fiscal Cliffs Online Tool

Identifying Fiscal Cliffs in New York City’s Financial Plan