Subscribe for Latest Updates

The State Comptroller’s office is committed to keeping New Yorkers regularly updated on the state’s economy and finances. Subscribe to get the latest update.

July 22, 2020 Edition

Economic and Health Impacts

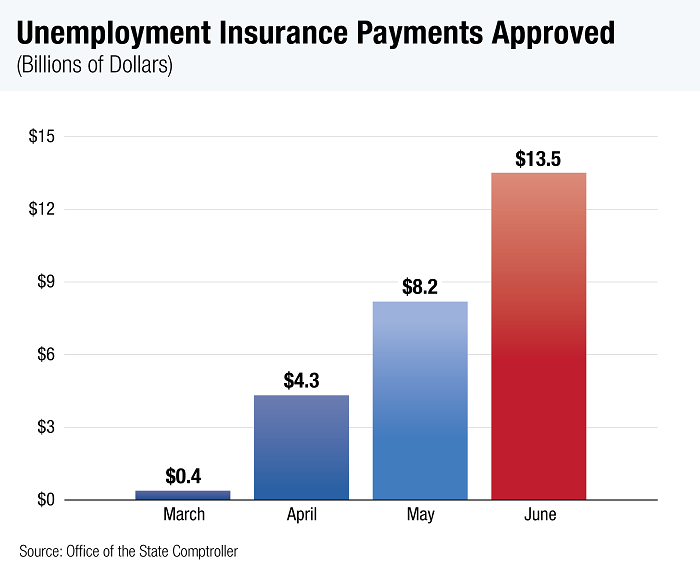

Unemployment Insurance Payments Balloon During COVID-19

Approved payments to New York recipients for Unemployment Insurance totaled $32.1 billion from March 1 through July 17, with steep increases in payments following the onset of the pandemic. In the most recent weeks for which data are available, approved payments during the first half of July added $5.7 billion to those in the preceding months shown in the nearby chart. By comparison, during all of calendar year 2019, approved Unemployment Insurance payments for New Yorkers totaled just $2.1 billion.

Unemployment payments have been a financial lifeline for households all across New York. But the flow of support to the unemployed is scheduled to slow significantly in coming days, as some supplemental benefits Congress enacted earlier this year are set to expire in late July.

New Business Applications Drop in New York

Business applications for federal tax identification numbers, which provide an early look at business formation activity, fell in New York by 16.8 percent from the first quarter to the second quarter of 2020, according to new data from the Census Bureau. Nationally, applications rose by 4.8 percent.

On a seasonally adjusted basis, 45,890 business applications were filed from New York in April through June, compared to 55,144 during the first quarter. The nearby map shows New York’s decline was among the largest in the nation.

Within the overall count of business applications, those considered by the Census Bureau to have a “high propensity” to develop into businesses with employees declined by 26.1 percent in New York, compared to a drop of 2.7 percent nationwide. Nationwide, “high propensity” applications represent about 34 percent of the total, while in New York they represent 41 percent of the State’s total.

An even smaller sub-set of business applications consists of those that have indicated an expected first date for paying wages – which the Census Bureau considers “associated with a high likelihood of transitioning into a business with payroll.” Such applications from New York totaled 4,223 in the second quarter, down 27.2 percent from the first quarter. Nationally, these applications declined by 3.5 percent.

1 in 3 Adult New Yorkers Report Symptoms of Anxiety

Significant numbers of New Yorkers are experiencing symptoms of anxiety or depression during the COVID-19 pandemic, according to recent U.S. Census Bureau data. For the week ending July 7:

- one-third of State residents aged 18 and older felt nervous, anxious or on edge more than half of the time or nearly every day in the last seven days;

- 29 percent were unable to stop or control their worrying;

- one-quarter took little interest or pleasure in doing things; and

- 24 percent felt down, depressed or hopeless.

National percentages were generally lower than those in New York.

Any New Yorker can call the COVID-19 Emotional Support Hotline at 1-844-863-9314 for free, confidential help. The State Department of Health suggests getting help immediately if you experience significant changes in your energy level, eating patterns, or sleeping patterns, difficulty concentrating on normal tasks, prolonged and overwhelming worry and hopelessness, or thoughts of self-injury or suicide. Help is available at the National Suicide Prevention Hotline at 1-800-273-TALK (8255) or text Got5 to 741741.

New York State’s Budget

State’s Cash Balance Driven by Extraordinary Measures

The State started the new fiscal year on April 1 facing significant concerns about cash flow during the first quarter and potentially later in the year due to the economic impact of the pandemic and the shift in the tax filing deadline from April 15 to July 15. Despite such concerns, the State’s General Fund balance was $6.9 billion as of June 30, $3 billion higher than the Division of the Budget (DOB) projected in February, primarily due to extraordinary measures. Resources available for State purposes in the State’s Short Term Investment Pool, which includes the General Fund as well as certain other funds, totaled $19.7 billion as of June 30. Major factors that have contributed to the positive bottom line include:

- In May and June, the State borrowed a total of $4.5 billion through short-term personal income tax notes for cash flow needs. While the notes can be converted to long-term bonds, DOB has indicated it expects to repay the borrowing before the end of the fiscal year.

- The State has received $5.1 billion from the federal Coronavirus Relief Fund, which was created by the CARES Act enacted by Congress and the President earlier this year. DOB has begun charging certain expenditures against these dollars, with $129.6 million used for State Police personnel costs, medical supplies and other expenses through June 30.

- As of July 8, DOB has withheld more than $1.5 billion including local aid payments and scheduled general salary increases for certain State employees, according to a supplement to the State’s Annual Information Statement. “It is expected that, in the absence of unrestricted Federal aid, DOB will continue to withhold a range of payments in the second quarter of FY 2021,” the announcement states.

Local governments, school districts, nonprofit organizations and other recipients of State funding face tremendous uncertainty about the level of State funding that can be expected. In addition, the State faces significant budgetary risks related to the economic and revenue outlook, new costs related to the COVID-19 pandemic, and federal funding for health care and other services. DOB should provide more frequent public updates on fiscal developments to keep policy makers and the public fully informed throughout the fiscal year, including how billions in Coronavirus Relief Fund or other federal resources may affect the need for spending cuts.

Census 2020: The Time Is Now!

Fifty-eight percent of New Yorkers had responded to the 2020 Census as of July 19. The nationwide response rate was 62 percent, and New York is lagging behind 36 other states. A complete count of New York’s population can help drive federal funding to our State, while ensuring that New Yorkers’ views are fully reflected in the enactment of federal laws and in the determination of our national leadership.