The Economic Outlook: Extraordinary Uncertainty

Over the course of the national economic expansion from mid-2009 to February 2020, New York State’s job growth lagged the nation. In addition, employment trends were uneven across the State. While New York City experienced relatively robust job creation, most upstate regions saw more modest, if any, net employment gains.

The COVID-19 recession began with more than 1.9 million jobs lost in New York State during March and April. While several hundred thousand jobs were regained during the next several months, many economists do not expect economic conditions to return to pre-pandemic levels for several years. Adding to the difficulty of assessing State budget impacts, forecasts by well-established sources may differ considerably. For example, forecasts issued in mid-2020 by the Federal Reserve, the Division of the Budget and the consulting firm IHS projected U.S. unemployment rates of 7.6 percent, 9.1 percent and 8.4 percent, respectively.

Economic forecasts are always inherently subject to risk, but because economic activity will be heavily influenced by the path of the coronavirus pandemic, this is especially true in the era of COVID-19. Thus, it is difficult to predict with any reasonable level of certainty the number of total jobs and the unemployment rate in the State, or the levels of personal income, retail sales, Wall Street bonuses and other key economic indicators. Extraordinary uncertainty with regard to these factors—perhaps to an unprecedented degree in modern times—makes it unusually difficult to predict the levels of tax revenues and spending on programs (such as publicly funded health coverage and public assistance) that are influenced by

such factors.

The Key Role of Federal Funding

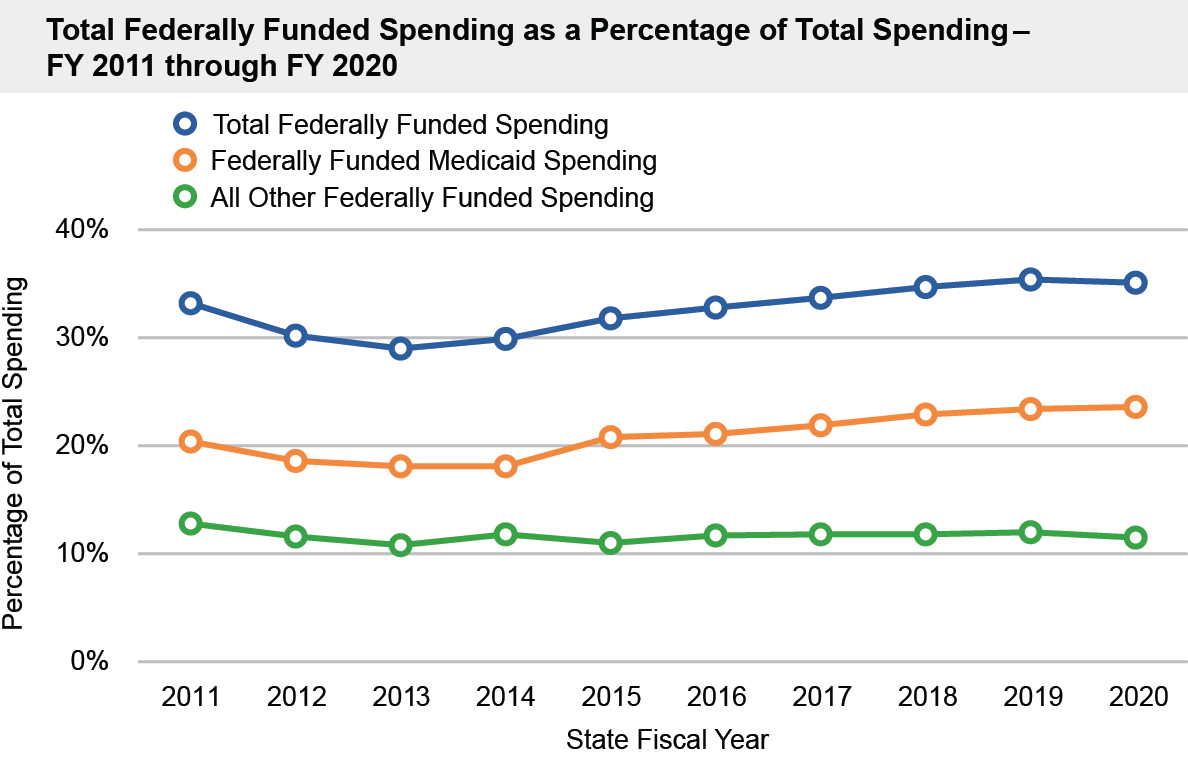

Federal aid has long played an essential role in the State’s budget and its ability to provide health care, education, human services and other essential programs. In recent years, for example, new federal funding has helped to extend health coverage to more than 2 million additional New Yorkers. During SFY 2019-20, federal aid represented 37 percent of total State receipts, with most of that going to Medicaid and other health care programs.

In the wake of the COVID-19 pandemic, tax receipts have fallen sharply, and the Division of the Budget projects these revenues will not again reach the SFY 2019-20 level until SFY 2023-24. Federal relief/stimulus funding has helped support certain State spending required to respond to the pandemic, but has fallen well short of backfilling the revenue gap driven by the associated recession. Comptroller DiNapoli has repeatedly warned that absent significant further response from Washington, the State will face the need for significant budgetary actions, potentially including cuts in spending and services, increases in taxes or other revenues, borrowing, or some mix of these difficult choices.

New Yorkers consistently pay more in federal taxes than the State receives in federal spending, as several reports by the Office of the State Comptroller have shown. The most recent report, issued in January 2020, found that in Federal Fiscal Year 2018, New York generated $26.6 billion more in taxes paid to Washington than in federal spending received. At the time this Financial Condition Report was released, a new report with updated figures on New York’s balance of payments in the federal budget was expected to be issued soon.

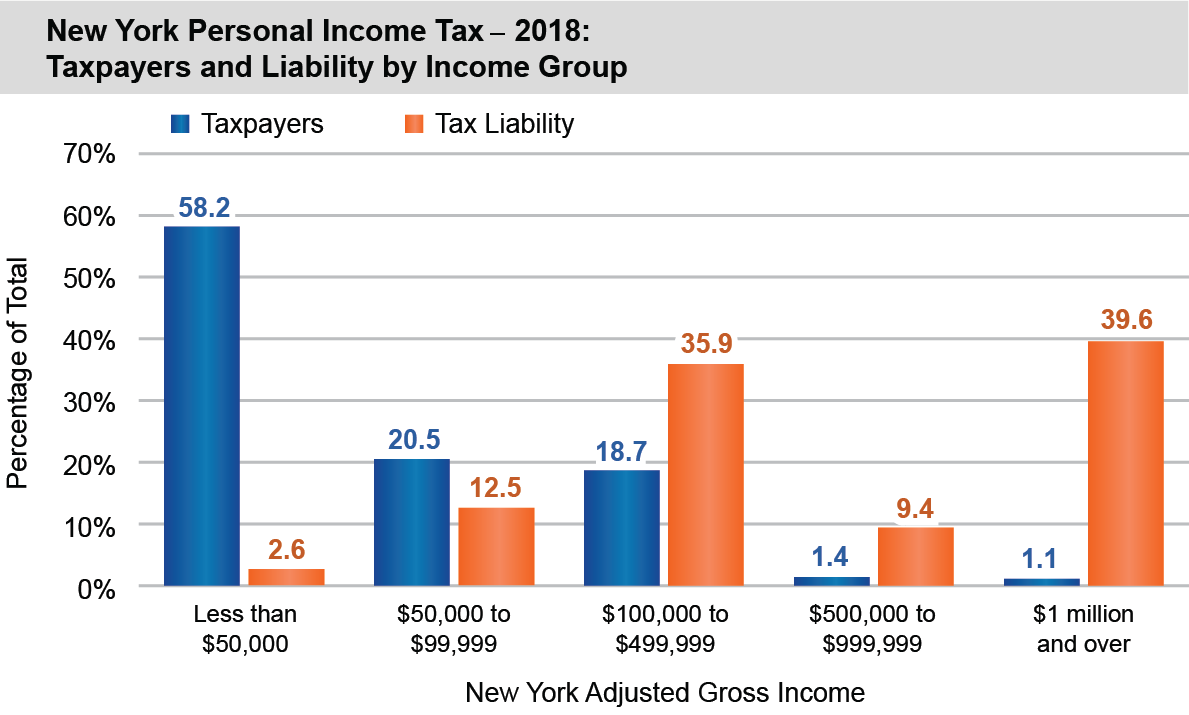

The State Relies Heavily on a Small Segment of Taxpayers

New York State relies heavily on its Personal Income Tax (PIT), which produces nearly two-thirds of all State tax revenues. High-earning individuals, whose income from capital gains and other sources can be volatile, generate a disproportionately large share of PIT receipts. In 2018, the highest-earning 1.1 percent of taxpayers in New York reported 27.3 percent of gross income and generated nearly 40 percent of all PIT liability. Depending on the specific nature of any economic downturn, taxable income and tax liability from such individuals may drop sharply. This disproportionate volatility in the State’s revenue mix magnifies the impacts of both good and bad economic times on the State’s budget.

The limit on federal deductions for state and local taxes that took effect in 2019 has resulted in shifts to the timing of certain revenues over the past two years and may continue to have unpredictable effects.

Going Forward, Statutory Rainy Day Reserves Should Be More Robust

Comptroller DiNapoli repeatedly warned in the years before the COVID-19 recession hit New York and the nation that the State’s budgetary reserves were not sufficient to guard against unwanted spending cuts, tax increases or other actions in case of an economic downturn or catastrophic event. Unfortunately, the fiscal impacts of the pandemic have proven those warnings were well founded.

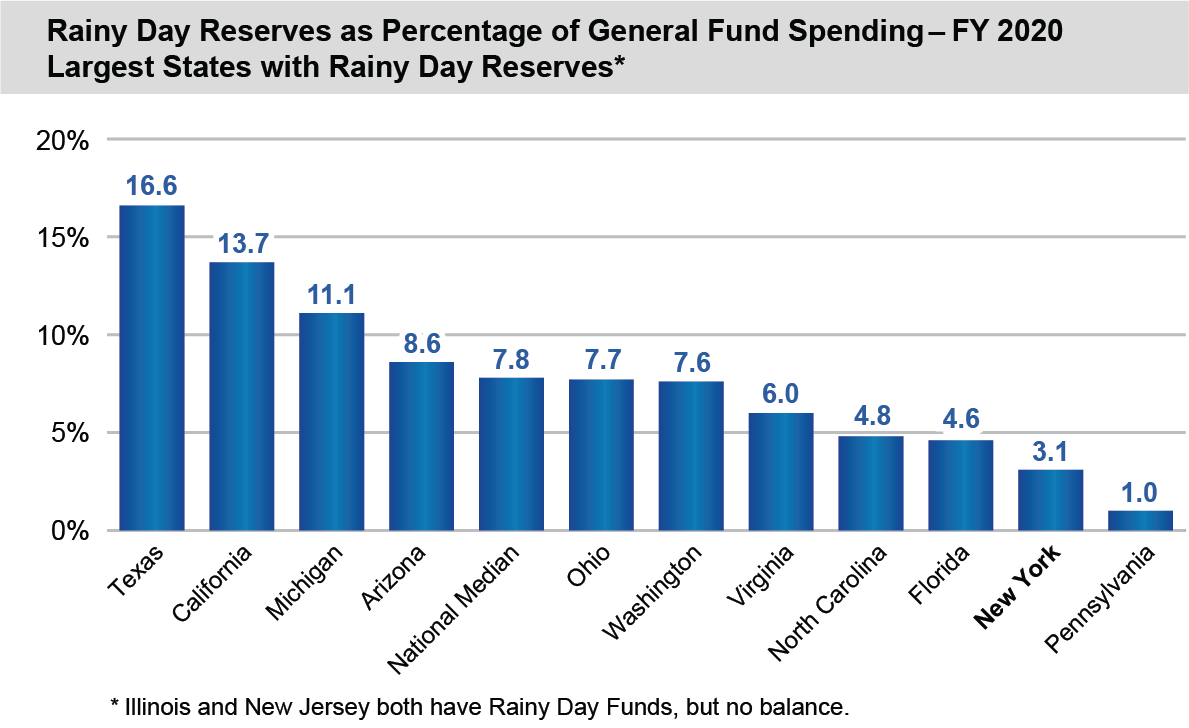

As of March 31, 2020, combined balances in the State’s two major statutory rainy day reserves totaled just less than $2.5 billion, roughly 47 percent of their statutorily allowed levels and approximately 3.1 percent of General Fund spending. While DOB has indicated that certain General Fund resources outside the statutory rainy day reserve funds could be drawn upon if needed, the combination of available funds does not approach the more than $14 billion gap that DOB has identified in the current fiscal year. As a result of that gap, DOB has begun withholding substantial amounts from payments to school districts, local governments, nonprofit organizations and other entities.

As noted above, the economic and revenue impacts of the pandemic are likely to continue over multiple State fiscal years. As soon as possible, the State should develop and implement concrete plans to build up its statutory reserves. This will help to counterbalance the inherent volatility of PIT receipts in the State’s budget and strengthen its ability to avoid harmful budgetary actions during the next economic downturn.