The Economic Outlook: Uncertainty Remains

As the world faced the third year of the COVID-19 pandemic, its impact on the economy continued to be felt and was heightened by other factors, such as the Russian invasion of Ukraine. Supply chain disruptions, increased demand of goods, and a tight labor market pushing wages higher combined to boost inflation to its highest level since the early 1980s, causing the Federal Reserve Board to aggressively raise interest rates by 225 basis points between January and August 2022. Nevertheless, job growth has continued nationally through August 2022.

These factors have heightened the uncertainty of economic forecasts. The pace of inflation, the Fed’s interest rate response, and continued volatility in the financial markets all impact whether the trajectory and pace of the economic recovery and tax revenues and resource levels available to support spending for State programs.

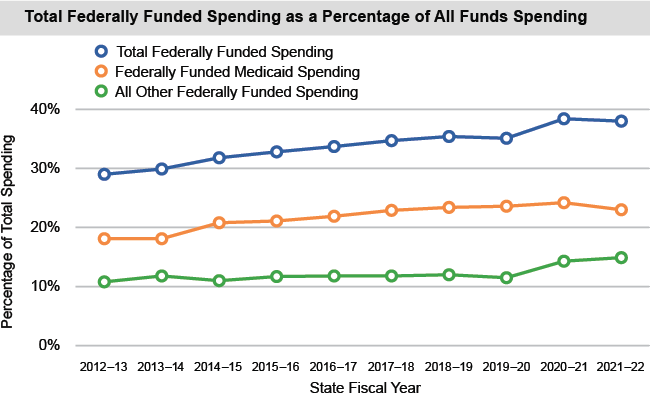

The Importance of Federal Funding

Federal aid has long played an essential role in the State’s budget and its ability to provide health care, education, human services and other essential programs. In recent years, for example, new federal funding has helped to extend health coverage to more than 1.5 million additional New Yorkers. In SFY 2021-22, federal aid was 38 percent of total State receipts, higher than the 33 percent average from the previous 10 years. The largest share of federal aid supports Medicaid and other health care programs.

At the beginning of the COVID-19 pandemic, tax receipts fell sharply, and the Division of the Budget (DOB) projected that tax revenues would not again reach the SFY 2019-20 level until SFY 2023-24. However, total tax collections for SFY 2020-21 ended the year $6.8 billion higher than projected in the Enacted Budget Financial Plan for SFY 2020-21. Tax collections in SFY 2021-22 ended the year $13.6 billion higher than initial projections and $21.8 billion higher than SFY 2019-20 (not including newly enacted Pass-Through Entity Tax receipts that are expected to be offset by personal income tax credits). Significant federal COVID-19 recovery funding helped support State spending for both pandemic needs and new initiatives. As a result, by the end of SFY 2021-22, DOB was able to make over $7.5 billion in debt service prepayments and defeasements, and deposit nearly $5 billion more than anticipated into formal and informal reserves. These actions will contribute to fiscal stability in subsequent years.

Up until Federal Fiscal Year (FFY) 2020, New Yorkers consistently paid more in federal taxes than the State received in federal spending, as several reports by the Office of the New York State Comptroller have shown. However, the most recent report, issued in March 2022, found that every state, including New York, received more than it paid in FFY 2020. For every dollar New York paid, it received $1.59 in return; however, this was still well below the $1.92 national average.

In the SFY 2022-23 Enacted Budget Financial Plan, DOB identifies $36 billion in pandemic-related federal spending over a five-year period with significantly more going directly to local governments, school districts, businesses and individuals. In addition, the federal Infrastructure and Jobs Act is expected to provide $4.6 billion in highway and bridge funding for New York State.

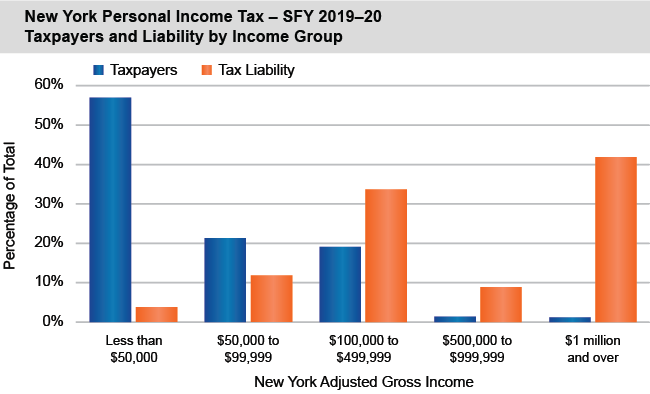

The State Relies Heavily on a Small Segment of Taxpayers

New York State’s budget relies heavily on its Personal Income Tax (PIT), which produces almost 60 percent of all State tax revenues. The SFY 2021-22 Enacted Budget increased rates for high-income taxpayers and increased dependence on the personal income tax and the potential volatility of tax collections even more. High-income individuals generate a large share of PIT receipts. In SFY 2019-20, the top 1.2 percent of taxpayers in New York generated 42 percent of all PIT liability. An economic downturn may cause taxable income and tax liability from such individuals to drop sharply because they tend to rely on non-wage income, such as capital gains, which are more volatile than wages. This disproportionate volatility in the State’s revenue mix magnifies the impacts of both good and bad economic times on the State’s budget.

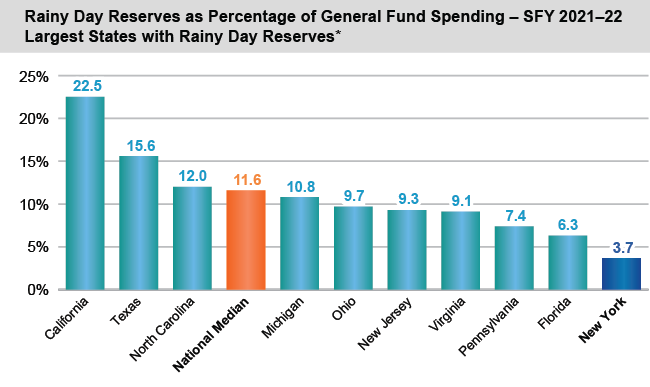

Going Forward, Continue with Commitment to Increasing Statutory Reserves

Comptroller DiNapoli repeatedly warned in the years before the COVID-19 pandemic and ensuing recession hit New York that the State’s budgetary reserves were not sufficient to guard against unwanted spending cuts, tax increases or other actions in case of an economic downturn or catastrophic event. Unfortunately, the fiscal impacts of the pandemic proved those warnings were well founded and DOB had to rely on other budget actions, including withholding payments and raising taxes to keep the budget in balance.

As of March 31, 2022, combined balances in the State’s two major statutory rainy day reserves totaled $3.3 billion, roughly 50 percent of their statutorily allowed levels and approximately 3.7 percent of General Fund spending. This level is low compared to other large states and the national median. However, the DOB has historically also set aside unrestricted funds for economic uncertainties, and the current plan is to deposit those funds ($5.7 billion as of March 31, 2022) into the State’s existing rainy day reserves by SFY 2025-26, at which point New York’s rainy day reserves are expected to reach 15 percent of General Fund spending, well above the current national median. Maintaining this commitment is important for safeguarding New Yorkers in the face of economic uncertainty. It is important to achieve this level of restricted reserves on or ahead of the proposed schedule to mitigate against future economic downturns.