Message from the Comptroller

Owning a home has long been described as “The American Dream.” In New York, that dream appears unattainable for a large share of the population: New York has the lowest homeownership rate among the states, with only 53.6 percent owning a home in the second quarter of 2022, compared to 65.8 percent nationally.

For New York, the low percentage is driven by the high share of multi-family housing in New York City, where about 40 percent of the population resides. Homeownership rates are as low as 20 percent in the Bronx and 24 percent in Manhattan. In counties outside New York City, homeownership rates exceeded the statewide average, and in some places, the national average.

Concerningly, New York also has racial and ethnic homeownership gaps that are higher than the nation, with Latino homeownership rates particularly low in our state. While these gaps originate in historic injustices against communities of color, their persistence is troubling.

Homeownership remains an important vehicle for building wealth, and reducing inequities in real estate practices and boosting homeownership should be important priorities for maintaining New York’s competitiveness as a place of opportunity.

Thomas P. DiNapoli

State Comptroller

New York Has Lowest Homeownership Rates in the Nation

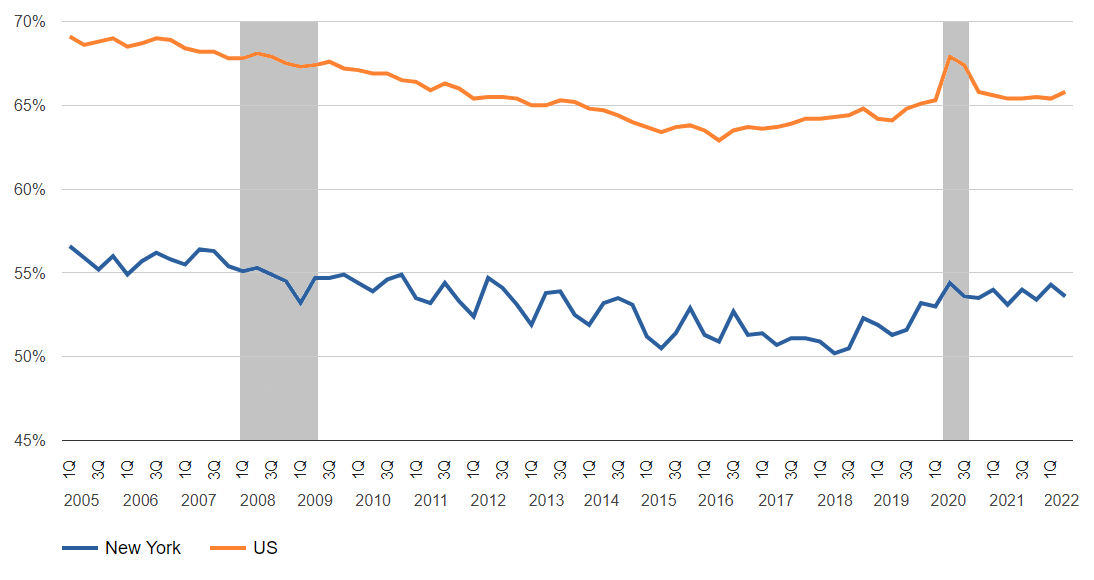

As shown in Figure 1, New York has long trailed the nation in homeownership rates; the gap between New York and the nation has been as high as 14 percentage points. Homeownership rates were higher prior to the Great Recession, which lasted from December 2007 to June 2009. According to data from the U.S. Census Bureau’s Housing Vacancies and Homeownership Survey, national homeownership rates declined steadily from 69.1 percent in the first quarter of 2005 to a low of 62.9 percent in the second quarter of 2016. In New York, quarterly homeownership rates show greater volatility, but declined from 56.6 percent in the first quarter of 2005 to a low of 50.2 in the second quarter of 2018.

FIGURE 1 – Quarterly Homeownership Rate, US and NY, 2005 Q1 to 2022 Q2

Source: US Census Bureau

New Yorkers’ homeownership has grown steadily since then, including a pandemic-spurred rise from 53.0 percent in the first quarter of 2020 to 54.4 percent in the second quarter of 2020. According to the Census Bureau, the increase in remote work unlocked homeownership opportunities for renters who may have been unable to afford homes in the metro areas in which they worked by allowing them to purchase more affordable housing farther from their work locations. Growing incomes prior to the pandemic, slowing foreclosures, and low interest rates also contributed to the rise.1 Nationally, the 2020 jump was the Association of Realtors; however, rates have not yet returned to 2005 levels. In the second quarter of 2022, homeownership rates were 53.6 percent in New York and 65.8 percent nationally.

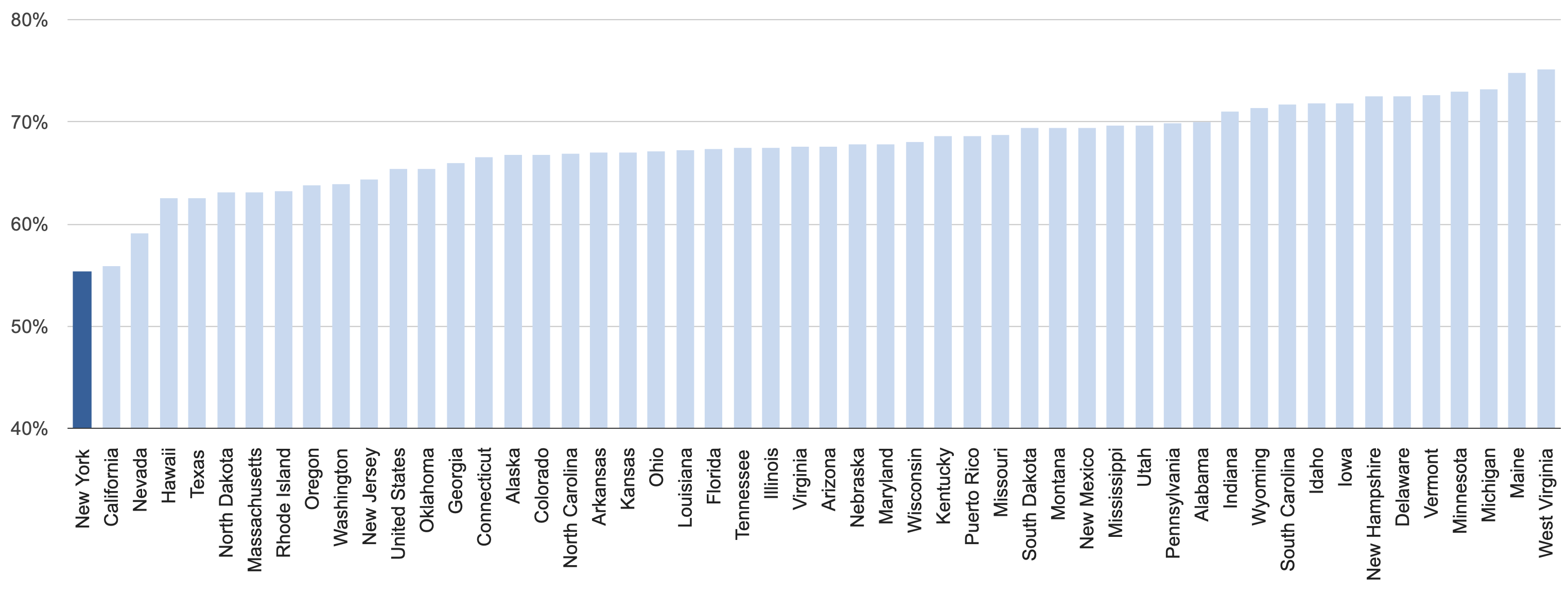

In 2021, New York’s annual homeownership rate was the lowest in the nation at 55.4 percent. Only two other states have rates lower than 60 percent: California (55.9 percent) and Nevada (59.1 percent). Like New York, these states have high shares of housing with 10 or more units; in contrast, in almost all 13 states with homeownership rates greater than 70 percent, single family housing comprises more than 70 percent of the housing stock.2

FIGURE 2 – Homeownership Rates by State, 2021

Source: US Census Bureau

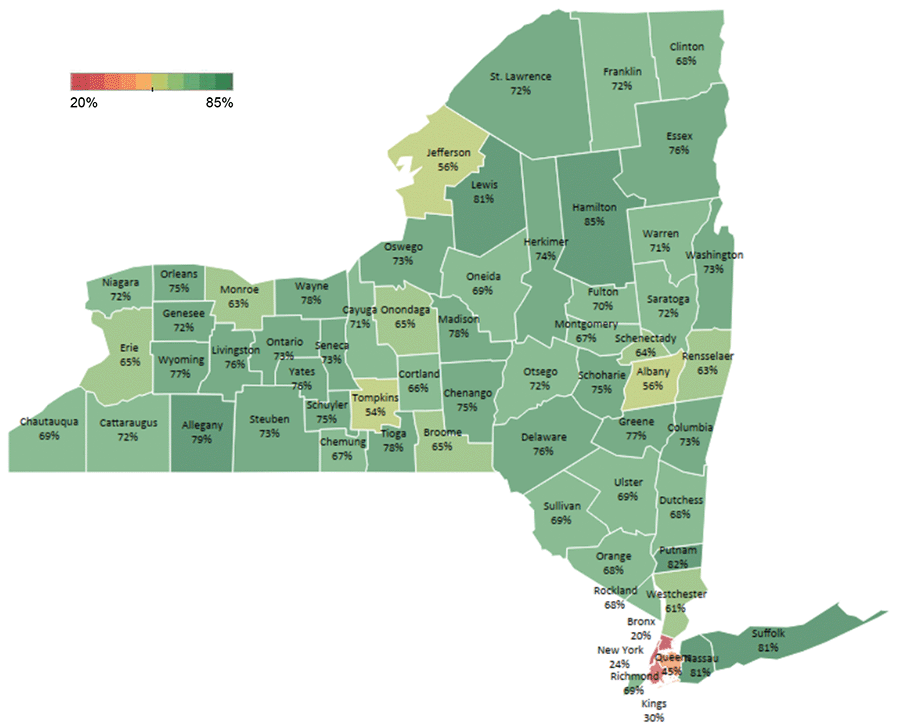

Large population centers tend to have more multi-family housing, and New York’s low homeownership rate is mostly attributable to the prevalence of multi-family housing in New York City, the nation’s most populous city. In 2020, the most recent year for which local data are available, multi-family homes with 10 or more units comprised the greatest shares of housing stock in Manhattan (90 percent), the Bronx (68 percent), Brooklyn (42 percent) and Queens (36 percent). These counties, where more than 40 percent of the State’s population resides, are also the only counties that had homeownership rates lower than the State average in 2020:3 Queens, 45 percent; Brooklyn, 30 percent; Manhattan 24 percent; and the Bronx, 20 percent. Homeownership rates exceed the state average in all other counties and are greater than 70 percent in 35 counties.4 Single-unit homes comprise the majority of housing stock in all other New York counties.5

FIGURE 3 – Homeownership Rates by County, 2020

Source: US Census Bureau

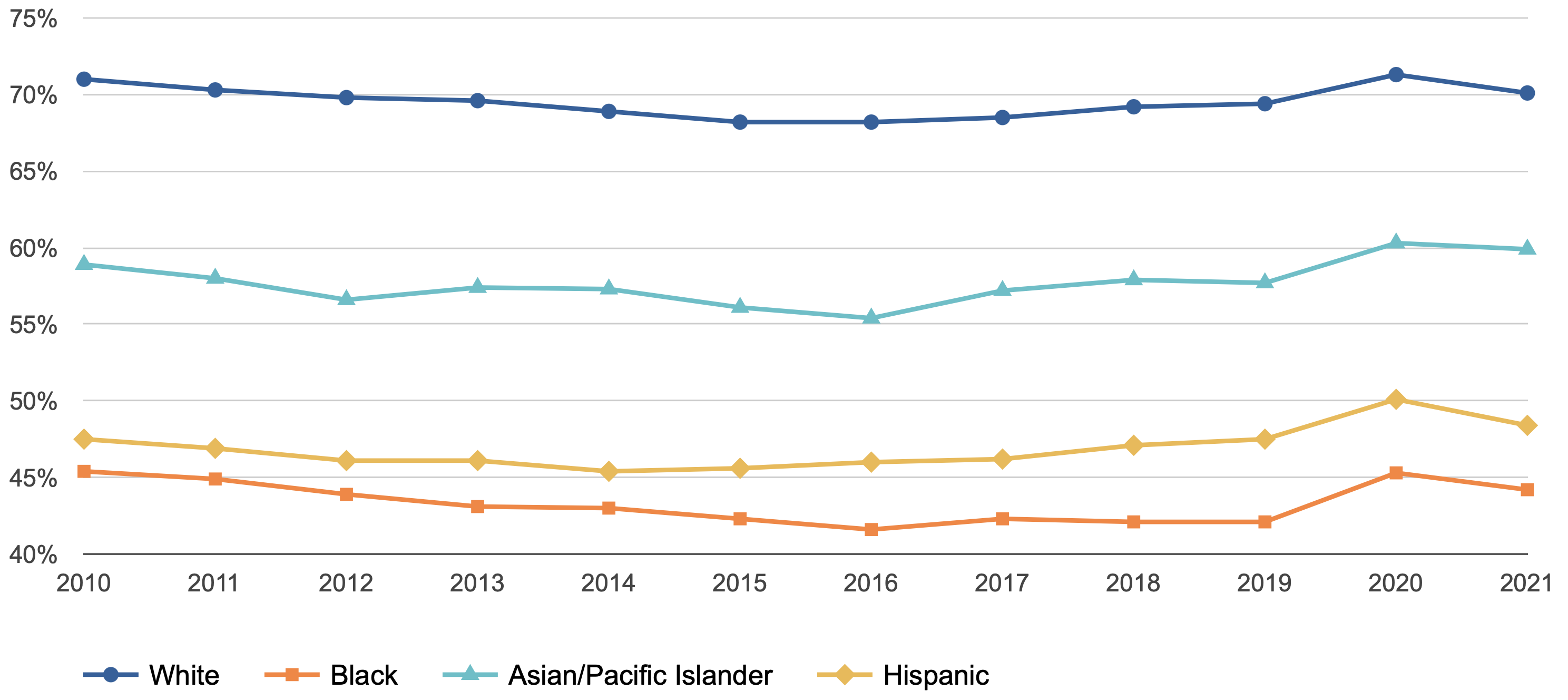

Racial and Ethnic Homeownership Gaps Are Higher than the Nation

Historically, homeownership rates have varied widely by race and ethnicity. As shown in Figure 4, national homeownership rates have been highest for Whites, followed by Asians, and Hispanics.6 Black Americans have had the lowest rates, and the gap between White and Black homeownership averaged 26 percentage points nationally in the period between 2010 and 2021, the most recent year for which data are available. While homeownership rates increased across all races and ethnicities in 2020, by 2021, the homeownership gap relative to White households had been reduced only for Hispanic and Asian households.

FIGURE 4 – U.S. Homeownership Rates by Race and Ethnicity, 2010-2021

Note: Hispanic homeowners may be of any race.

Source: US Census Bureau

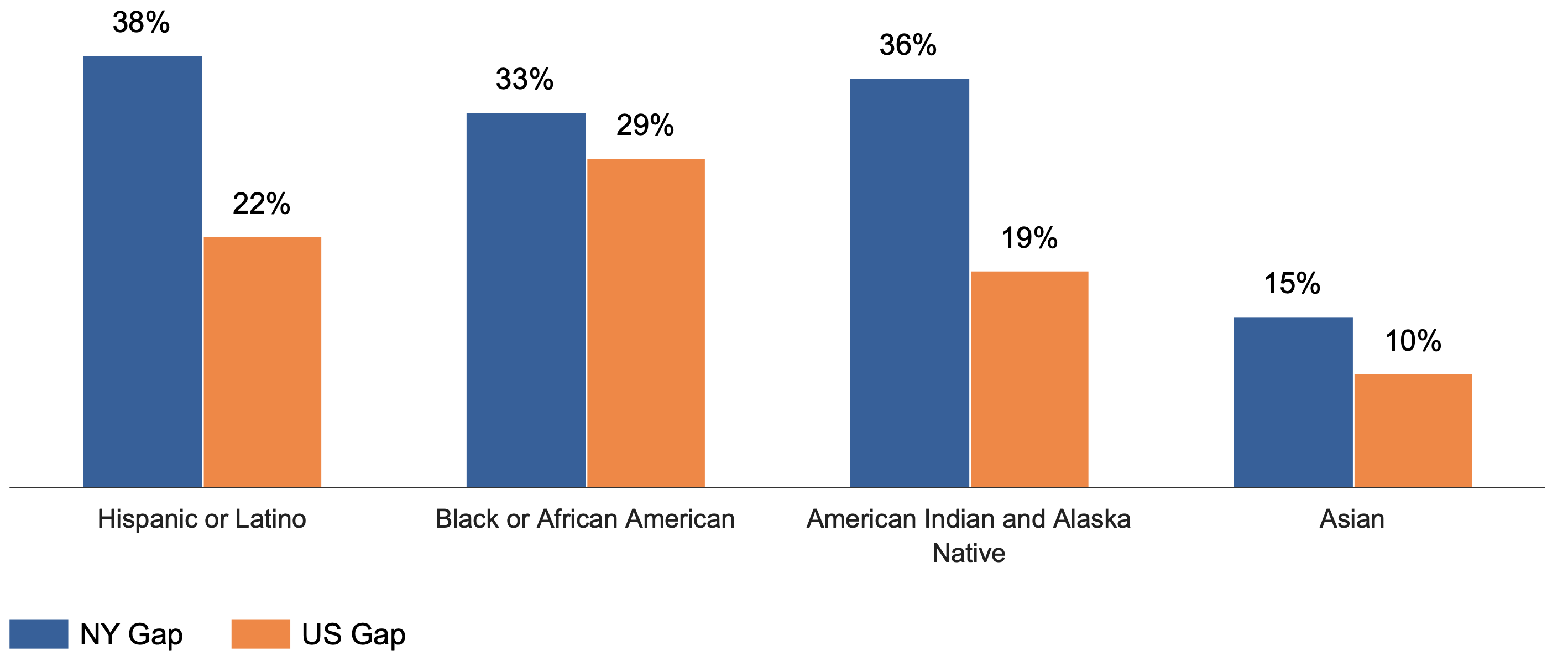

New York’s racial and ethnic homeownership gaps are larger than the nation’s, as shown in Figure 5. In 2021, homeownership rates were 67 percent for White households, 52 percent for Asian households, 34 percent for Black households, and 29 percent for Hispanic households in New York.7 One reason homeownership rates are lower among New York’s Hispanic, Black and Asian households relative to the national average is that a majority of these New Yorkers live in New York City.8 With Hispanic homeownership rates significantly below the national average, the homeownership gap is highest for Hispanics in New York, and 16 percentage points greater than the national Hispanic homeownership gap relative to White households.

FIGURE 5 – Gap in Homeownership Rate Relative to White Households, NY and US, 2021

Note: Hispanic homeowners may be of any race.

Source: US Census Bureau

Discussion and Implications

Homeownership can present many advantages. Research finds that homeownership has social benefits that include higher rates of neighborhood stability, civic participation and community engagement, as well as better maintained housing stock and greater housing security.9

Homeownership also has economic benefits. While purchasing, maintaining, and supporting the mortgage of a home entails financial risk and does not always prove to be a solid investment for everyone, overall, homeownership has served as an important vehicle for Americans to build wealth, which occurs as home prices appreciate and equity grows over time.10 In 2020, the median net value of assets held by American households was largest for real estate assets, and the median net worth of homeowners was $336,600 compared to just over $5,700 for renters.11 Research from the Federal Reserve Board of New York finds home equity is a larger part of the net worth for Black and Hispanic households than it is for White households that own their homes.12 Homeownership has also been important for building intergenerational wealth; for example, the Urban Institute finds children of homeowners are more likely to own homes themselves.13

These benefits highlight both the importance of promoting homeownership and the perils of maintaining racial and ethnic homeownership gaps that are larger than the national averages. There are multiple, complex reasons for disparities in homeownership rates, many stemming from historically unjust policies, including racially restrictive housing covenants and “redlining” practices by the Federal Housing Administration and financial institutions that denied provision of loans to Black households or in predominantly black neighborhoods.14 While the federal Fair Housing Act of 1968 was enacted to prohibit discrimination in the sale or rental of housing, the exclusionary practices in effect during the widespread homeownership expansion that occurred in the post-World War II era have had compounding generational effects.15

A 2020 report from the Joint Center for Housing Studies of Harvard University states, “Racial disparities in housing are both a cause and a consequence of other social inequalities. Discriminatory practices have limited the opportunities for people of color to live in neighborhoods that offer good-quality schools and public services, while also increasing their exposure to crime and other environmental hazards. The nation’s long history of housing and mortgage market discrimination has also prevented generations of Black and Hispanic households from buying homes and accruing wealth.”16

Furthermore, there is evidence of persistent inequitable real estate and financing practices. In August 2022, three brokerage houses on Long Island were fined for discriminatory practices, including steering prospective homebuyers of color away from white neighborhoods, in violation of the Fair Housing Act.17 A 2021 analysis from the Federal Home Loan Mortgage Corporation (commonly known as “Freddie Mac”) finds higher shares of appraisals below the contract price in majority-Black and -Hispanic neighborhoods relative to majority-White neighborhoods.18 Research from the Federal Reserve Board of Philadelphia also indicates Black loan applicants were denied for mortgages for properties in Philadelphia at higher rates than White applicants, with Black applicants far more likely to be denied based on credit histories and low credit scores.19 Student loan debt may play a role; Black students are more likely to take on more debt and to default, and increases in student loan burdens have been found to depress homeownership rates.20

Governmental Initiatives

The Biden Administration has announced a series of initiatives to eliminate discriminatory practices and aid homeownership, including the creation of a new interagency taskforce to address inequity in home appraisals (Property Appraisal and Valuation Equity [PAVE] Taskforce), formulating a new legal framework under the Fair Housing Act, proposing $100 million in new funding to states to support sustainable homeownership, and awarding grants to support housing counseling and families enrolled in the Family Self-Sufficiency Program, which places funds in escrow for families participating in the Housing Choice Voucher Program.21

The State can also take action to facilitate homeownership and remedy racial and ethnic homeownership gaps. First, the State can work to ensure that the availability of homeownership assistance is widely known. The State of New York Mortgage Agency provides low-cost mortgages, down payment assistance, and housing counseling services to expand access to affordable homeownership. Second, improved reporting on available homeowner assistance programs is necessary to understand who benefits from these programs, identify underserved populations, and pinpoint constraints that may be leading to underserved borrowers being excluded from programs; policymakers have to consider retooling or reconfiguring some of these services to ensure broader availability. Third, expanded monitoring of and enforcement against discriminatory practices in the housing industry, including mortgage financing, appraisals, and other services should be pursued to ensure that illegal, systemic barriers do not remain. Finally, the State can redouble efforts to educate potential homebuyers on the value of homeownership. As indicated by recent audit, State agencies can improve their financial literacy programs, particularly through greater outreach to vulnerable consumers.

New York City has announced new initiatives to improve understanding of homeownership and to make supporting affordable homeownership an objective of the housing blueprint. Specific efforts to support this goal include expanding housing supply, including through the creation of smaller homes, transforming “zombie homes,” and expanding financing opportunities and down payments assistance programs.

Endnotes

1 Richard Fry, “Amid a pandemic and a recession, Americans go on a near-record homebuying spree,” March 8, 2021, Pew Charitable Trusts, https://www.pewresearch.org/fact-tank/2021/03/08/amid-a-pandemic-and-a-recession-americans-go-on-a-near-record-homebuying-spree/.

2 Generally, the correlation coefficient between state homeownership rate and share of housing stock that has one housing unit in the structure is .7; including the District of Columbia, it is .8. Similarly, the correlation coefficient for state homeownership rate and share of housing stock that has 10 units or more is -0.7 and -0.8 when including the District of Columbia. Housing stock information available from the U.S. Census Bureau, American Community Survey (ACS), 2021 ACS 1-Year Data Tables, Table DP04, Selected Housing Characteristics; see also ACS, and 2021 ACS 1-Year Data Tables, Table B25003, Tenure.

3 U.S. Census Bureau, ACS 5-Year Estimate, 2016-2020.

4 U.S. Census Bureau, ACS 5-Year Estimate, 2016-2020, Table B25003.

5 U.S. Census Bureau, ACS 5-Year Estimate, 2016-2020, Table B25024.

6 U.S. Census Bureau, 2021 Housing Vacancies and Homeownership Survey, (CPS/HVS), https://www.census.gov/housing/hvs/files/annual21/ann21t_22.xlsx.

7 U.S. Census Bureau, 2021 ACS 1-Year Data Tables, 2016-2020, Table B25003.

8 Within New York State, 67 percent of Asian, 65 percent of Hispanic or Latino, and 59 percent of Black or African American residents live in New York City. See U.S. Census Bureau, 2021 American Community Survey Quickfacts, https://www.census.gov/quickfacts/fact/table/newyorkcitynewyork,NY/PST045221#qf-headnote-b. For additional information on Hispanic homeownership in New York City, see Laura Limonic, Homeownership Rates Among New York City’s Racial/Ethnic Groups and Latino Nationalities in 2000, Center for Latin American, Caribbean, and Latino Studies at the City University of New York, 2007.

9 William M Rohe, Shannon Van Zandt and George McCarthy, “The Social Benefits and Costs of Homeownership: A Critical Assessment of the Research,” May 2000, Center for Urban and Regional Studies, University of North Carolina at Chapel Hill, Working Paper No. 00-01.

10 George McCarthy, Shannon Van Zandt and William M Rohe, “The Economic Benefits and Costs of Homeownership: A Critical Assessment of the Research,” May 2001, Center for Urban and Regional Studies, University of North Carolina at Chapel Hill, Working Paper No. 01-02; U.S. Department of Housing and Urban Development, Office of Policy Development & Research, “Wealth Accumulation and Homeownership: Evidence for Low-Income Households,” December 2004, https://www.huduser.gov/publications/pdf/wealthaccumulationandhomeownership.pdf; and Christopher E. Herbert, Daniel T. McCue, and Rocio Sanchez-Moyano, “Is Homeownership Still an Effective Means of Building Wealth for Low-income and Minority Households? (Was it Ever?)” September 2013, Harvard University, Joint Center for Housing Studies, HBTL-06.

11 Real estate assets refer to rental property equity and equity in own home, for which the median values were $175,000 and $150,000, respectively, greater than all other assets and financial instruments identified by the survey and larger than the total ($140,000). See U.S. Census Bureau, Survey of Income and Program Participation, Survey Year 2021, Public Use Data, released August 31, 2022.

12 Andrew Haughwout, Donghoon Lee, Joelle Scally, and Wilbert van der Klaauw, “Inequality in U.S. Homeownership Rates by Race and Ethnicity,” July 8, 2020, Liberty Street Economics, Federal Reserve Board of New York, https://libertystreeteconomics.newyorkfed.org/2020/07/inequality-in-us-homeownership-rates-by-race-and-ethnicity; and Christopher E. Herbert, Daniel T. McCue, and Rocio Sanchez-Moyano, “Is Homeownership Still an Effective Means of Building Wealth for Low-income and Minority Households? (Was it Ever?)” September 2013, Harvard University, Joint Center for Housing Studies, HBTL-06.

13 Jung Hyun Choi, Jun Zhu, and Laurie Goodman, “Intergenerational Homeownership: The Impact of Parental Homeownership and Wealth on Young Adults’ Tenure Choices,” October 25, 2018, The Urban Institute, https://www.urban.org/research/publication/intergenerational-homeownership.

14 The Urban Institute provides a concise explanation of these forces and further resources in “Structural Racism Explainer Collection,” accessed September 29, 2022, at https://www.urban.org/racial-equity- analytics-lab/structural-racism-explainer-collection/causes-and-consequences-separate-and-unequal-neighborhoods; see also Brian J. McCabe, “Why Buy a Home? Race, Ethnicity, and Homeownership Preferences in the United States,” 2018, Sociology of Race and Ethnicity, vol.4 no 4, pages 452-472.

15 See Don Layton, “What Will it Take to Sustainably Increase the Homeownership Rate?” January 22, 2022, Joint Center for Housing Studies at Harvard University, at https://www.jchs.harvard.edu/blog/what-it-will-take-sustainably-increase-homeownership-rate; and The Homeownership Rate and Housing Finance Policy: Part 1: Learning from the Rate’s History, August 2021, Joint Center for Housing Studies at Harvard University, at https://www.jchs.harvard.edu/sites/default/files/research/files/harvard_jchs_homeownership_rate_layton_2021.pdf.

16 Joint Center for Housing Studies of Harvard University, The State of the Nation’s Housing: 2020, https://www. jchs.harvard.edu/sites/default/files/reports/files/Harvard_JCHS_The_State_of_the_Nations_Housing_2020_Report_Revised_120720.pdf

17 The practices were first exposed by Newsday. See New York Attorney General, “Attorney General James and Governor Hochul Tackle Discriminatory Practices at Long Island Real Estate Brokerages,” August 30, 2022, at https://ag.ny.gov/press-release/2022/attorney-general-james-and-governor-hochul-tackle-discriminatory-practices-long.

18 Freddie Mac Economic and Housing Research, “Racial and Ethnic Valuation Gaps in Home Purchase Appraisals,” September 2021, available at https://www.freddiemac.com/fmac-resources/research/pdf/202109-Note-Appraisal-Gap.pdf.

19 Jacob Whiton, Theresa Singleton, Lei Ding, “What’s Behind the Racial Homeownership Gap in Philadelphia?” December 2021, Federal Reserve Board of Philadelphia, at https://www.philadelphiafed.org/-/media/frbp/assets/community-development/briefs/cdro-brief-homeownership2-final.pdf.

20 Katherine Fallon, “How Student Loan Debt Affects the Racial Homeownership Gap,” September 14, 2022, Urban Institute, available at https://housingmatters.urban.org/articles/how-student-loan-debt-affects-racial-homeownership-gap; and Andrew Haughwout, Donghoon Lee, Joelle Scally, and Wilbert van der Klaauw, “Inequality in U.S. Homeownership Rates by Race and Ethnicity,” July 8, 2020, Federal Reserve Bank of New York, at https://libertystreeteconomics.newyorkfed.org/2020/07/inequality-in-us-homeownership-rates-by-race-and-ethnicity.

21 U.S. Department of Housing and Urban Development. “Statement from Secretary Marcia L. Fudge on Black Homeownership Remaining Lower Than A Decade Ago Despite the U.S. Homeownership Rate Experiencing the Largest Annual Increase on Record,” February 24, 2022, at https://www.hud.gov/press/press_releases_media_advisories/HUD_No_22_029.