New York’s Economy and Finances in the COVID-19 Era

February 18, 2021 Edition

Selected Economic Trends

More Than 1.7 Million New York Adults Suffer from Food Scarcity

New York ranks seventh among all the states in the percentage of adults who are experiencing food scarcity, at 14 percent compared to the 11 percent national rate, according to the U.S. Census Bureau’s latest Household Pulse Survey.

More than 1.7 million New York adults live in households that sometimes or often in the past week did not have enough to eat, according to the Census survey in late January and early February. (The Census Bureau refers to either “food scarcity” or “food insufficiency” to characterize these findings.) Children are not counted in the Census data. Including them would add substantially to the total.

Nationally, rates of food insufficiency are especially high for Black and Hispanic households, at 21 and 20 percent respectively, according to the Census data. Rates for White and Asian households were lower, at 7 and 8 percent respectively. The interactive map above shows the latest Census Bureau estimates of the percentage of adults in each state whose households sometimes or often have not had enough to eat during the most recent Census survey period and in previous surveys dating to August 2020.

New York State SNAP Recipients Total More Than 2.7 Million in December

More than 2,742,000 New Yorkers received Supplemental Nutrition Assistance Program (SNAP, formerly known as food stamps) benefits in December 2020, up by about 182,000 or 7.1 percent since February, according to data from the State Office of Temporary and Disability Assistance (OTDA).

The statewide total jumped by nearly 122,000 in April and another 53,000 in May, and has remained relatively stable since then, with a peak of around 2,789,000 in September 2020. The pre-pandemic February 2020 figure, just over 2.5 million, was the lowest since September 2009. The overall increase since February is driven largely by New York City, with growth of nearly 165,000 or 11.1 percent. Suffolk and Albany counties have also seen double-digit percentage increases, and caseloads in most other counties are up more modestly over the period. However, in 22 counties, including Broome and Monroe, SNAP numbers have decreased. Reasons for such declines are not clear. The table below provides figures for all counties and New York City.

- SNAP Recipients in New York State by County, February–December 2020

-

County Recipients,

December 2020Change, February to

December 2020% Change, February to

December 2020Albany 34,589 3,299 10.5% Allegany 4,885 (140) -2.8% Broome 25,291 (1,626) -6.0% Cattaraugus 10,519 125 1.2% Cayuga 9,071 104 1.2% Chautauqua 23,356 (393) -1.7% Chemung 13,404 485 3.8% Chenango 5,831 (25) -0.4% Clinton 10,782 575 5.6% Columbia 5,404 110 2.1% Cortland 5,571 93 1.7% Delaware 4,334 128 3.0% Dutchess 17,161 (405) -2.3% Erie 142,274 3,122 2.2% Essex 3,079 (20) -0.6% Franklin 6,253 (394) -5.9% Fulton 7,124 147 2.1% Genesee 4,595 84 -1.8% Greene 4,369 46 1.1% Hamilton 287 6 2.1% Herkimer 8,481 84 1.0% Jefferson 14,231 (394) -2.7% Lewis 2,815 41 1.5% Livingston 5,838 158 2.8% Madison 5,994 (329) -5.2% Monroe 106,740 (5,426) -4.8% Montgomery 7,681 (150) -1.9% Nassau 42,027 878 2.1% New York City 1,645,956 164,699 11.1% Niagara 25,921 (662) -2.5% Oneida 36,423 (393) -1.1% Onondaga 65,962 1,465 2.3% Ontario 8,559 238 2.9% Orange 37,328 (695) -1.8% Orleans 5,207 81 1.6% Oswego 17,443 (328) -1.8% Otsego 5,208 (53) -1.0% Putnam 2,123 15 0.7% Rensselaer 13,936 (19) -0.1% Rockland 41,021 433 1.1% St. Lawrence 13,191 (109) -0.8% Saratoga 13,323 598 4.7% Schenectady 20,989 889 4.4% Schoharie 3,467 (39) -1.1% Schuyler 2,061 (51) -2.4% Seneca 3,154 38 1.2% Steuben 9,792 2 0.0% Suffolk 98,207 11,479 13.1% Sullivan 12,561 23 0.2% Tioga 5,003 202 4.2% Tompkins 7,315 183 2.6% Ulster 16,314 193 1.2% Warren 6,409 15 0.2% Washington 6,166 7 0.1% Wayne 8,145 0 0.0 Westchester 73,848 4,245 6.1% Wyoming 2,480 105 4.4% Yates 2,079 (97) -4.5% New York State 2,742,577 182,479 7.1% Source: NYS Office of Temporary and Disability Assistance

Those SNAP recipients who were not already receiving the maximum allotment for their household size have been issued emergency supplemental benefits due to federal legislation enacted in March 2020. An additional, temporary 15 percent increase in benefits was authorized as part of federal legislation enacted in December, in effect for January through June 2021. According to OTDA, a household of four may currently receive a maximum monthly allotment of $782, including those additional benefits.

Home Mortgage Delinquencies Rose Sharply in 2020

Delinquencies among single-family home mortgages doubled or tripled in communities across New York State in the third quarter of 2020 compared to a year earlier, with especially high percentages in New York City and other downstate areas, according to new data from the Federal National Mortgage Association (FNMA or Fannie Mae).

- FNMA Mortgage Delinquencies, One-Family Homes, Third Quarters 2019 and 2020

-

Area Total

Mortgages% 90 Days

DelinquentTotal %

DelinquentChange in

Total % Delinquent,

2019 to 2020Albany 23,527 2.5% 4.3% 1.7% Binghamton 5,851 2.8% 4.9% 2.1% Bronx 13,956 5.8% 8.6% 5.6% Brooklyn 43,204 5.7% 8.1% 5.9% Buffalo 47,043 1.9% 3.5% 1.8% Elmira 3,207 2.7% 4.6% 2.2% Glens Falls 7,629 2.9% 5.0% 2.2% Hicksville 4,299 5.9% 7.7% 5.9% Jamestown 2,303 2.0% 3.6% 1.4% Mid-Hudson 26,261 4.0% 6.5% 3.4% Mid-Island 94,935 4.5% 6.8% 3.8% New Rochelle 2,986 4.4% 6.4% 4.8% Manhattan 23,067 3.6% 5.1% 4.2% Niagara Falls 1,417 2.3% 3.6% 2.0% Plattsburgh 2,828 2.6% 4.4% 1.8% Poughkeepsie 2,807 3.7% 6.4% 3.2% Queens 67,739 6.2% 8.1% 6.1% Rochester 32,598 1.9% 3.4% 1.9% Schenectady 4,990 2.4% 4.7% 2.3% Staten Island 22,148 5.1% 7.4% 4.9% Syracuse 20,798 1.8% 3.5% 1.5% Utica 5,958 1.9% 3.6% 1.1% Watertown 2,340 1.9% 4.0% 1.5% Westchester 53,873 4.5% 6.8% 4.2% Western Nassau 32,722 5.2% 7.9% 5.3% White Plains 3,955 3.3% 5.2% 3.4% Yonkers 8,868 3.9% 6.0% 3.8% Source: Federal National Mortgage Association

Note: Figures reflect FNMA data on single-family, 30-year fixed-rate home mortgages owned or guaranteed by FNMA on or after January 1, 2000.

In Bronx, Brooklyn and Queens, delinquency rates for single-family home mortgages backed by FNMA were all over 8 percent in the third quarter of 2020, reflecting sharp increases in the wake of the COVID-19 pandemic, as shown in the nearby table. For Queens, the 8.1 percent figure was more than four times the year-earlier rate.

In each of those areas, as well as in Staten Island and several others, more than 5 percent of mortgages were 90 days or more delinquent, compared to 1 percent or less a year earlier. While federal and State protections against foreclosure that were implemented in response to the pandemic may also affect the 2020 figures, the 90-day measure is considered to reflect serious financial stress for increasing numbers of households.

In both Westchester and the Mid-Island area of Long Island, 6.8 percent of mortgages were delinquent in the third quarter of 2020, including 4.5 percent that were 90 or more days late. Areas north of New York City and its closest suburbs also saw delinquency rates spike upward over the year. In the Mid-Hudson region, 6.5 percent of mortgages were late, with 4 percent delinquent by 90 or more days. For Poughkeepsie, those figures were 6.4 percent and 3.7 percent, respectively; and in Glens Falls, 5 percent and 2.9 percent.

By contrast, and in keeping with certain broader economic trends, some upstate housing markets have seen more muted impacts in the wake of the pandemic. Among others, Buffalo, Rochester and Syracuse delinquency rates were below 4 percent in the third quarter of 2020, despite increases over the year.

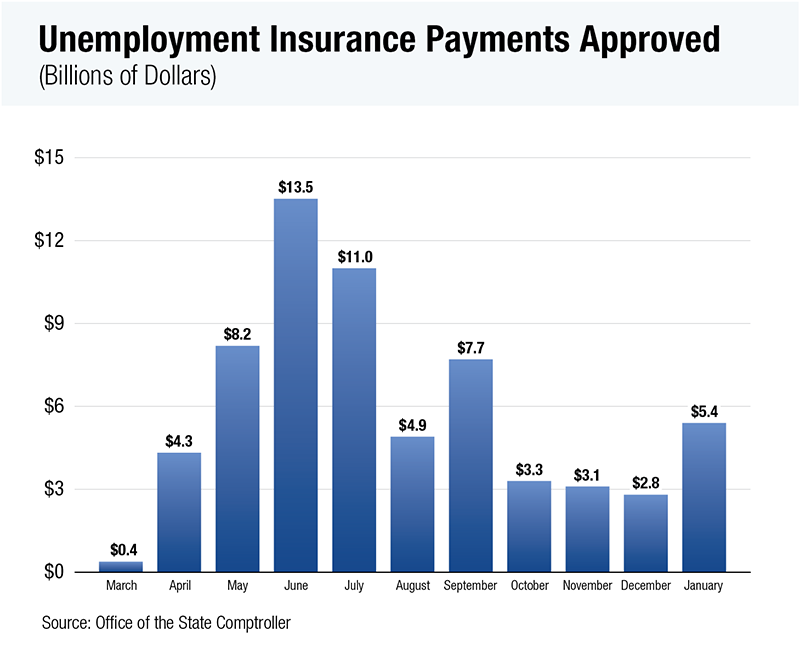

Unemployment Insurance Payments Rise in January After Late 2020 Declines

Total unemployment insurance (UI) payments approved by the Office of the State Comptroller rose to $5.4 billion in January, nearly twice the December figure. Payments approved since March 1, 2020, now total nearly $67.4 billion. In calendar year 2019, these payments totaled $2.1 billion.

Unemployment benefits have provided badly needed support to millions of New Yorkers who are struggling with the economic impact of the COVID-19 pandemic. Over 2.5 million New Yorkers claimed unemployment benefits through State and federal programs for the week ending January 23. The sharp increase in total payments in January, after three months with payments of approximately $3 billion, largely reflected the restoration of additional federally funded benefits that had been in place for certain periods during 2020 as well as changes in the numbers of New Yorkers officially eligible for unemployment benefits.

The traditional state UI program is funded by employer contributions. When funds from those contributions are depleted, states may draw advance payments from the U.S. Treasury’s Unemployment Trust Fund; New York has been doing so since May 2020. As of January 29, New York’s outstanding advance balance from such payments was $9.6 billion. Under current law, that balance must be repaid by future employer contributions.

New York State Budget and Spending

State tax receipts in January 2021 totaled $11.4 billion, 5 percent higher than those a year earlier. January collections were $1.7 billion higher than projected in the Executive Budget Financial Plan issued by the Division of the Budget (DOB) in January, as shown in the Comptroller's January cash report. Personal income tax collections during the month were 5 percent above those a year earlier, while sales tax receipts were down by 5.9 percent compared to January 2020. Through the first 10 months of the current fiscal year, total tax collections were down by $2 billion from the previous year.

The State’s General Fund balance was $19.2 billion as of February 12. The balance is driven partly by withheld payments as well as receipts from short-term borrowing that DOB anticipates repaying before the end of the fiscal year. The State has repaid $1 billion of that borrowing, with the remaining $3.4 billion due by March 31.

Prior Editions

- February 3, 2021

- January 21, 2021

- January 7, 2021

- December 16, 2020

- December 2, 2020

- November 12, 2020

- October 28, 2020

- October 14, 2020

- September 30, 2020

- September 16, 2020

- September 2, 2020

- August 19, 2020

- August 5, 2020

- July 22, 2020

- July 9, 2020

Additional Resources

- COVID-19 Financial Survival Toolkit

- State Cash Basis Reports

- Report on the State Fiscal Year 2020-21 Enacted Budget Financial Plan

- Report on the State Fiscal Year 2020-21 Enacted Budget: Budgeting in a Time of Crisis

Subscribe for Latest Updates

The State Comptroller’s Office is committed to keeping New Yorkers regularly updated on the State’s economy and finances. Subscribe to get the latest update.