Pursuant to §98 of the State Finance Law, the State Comptroller shall invest and keep invested all moneys belonging to any and all funds of the State.

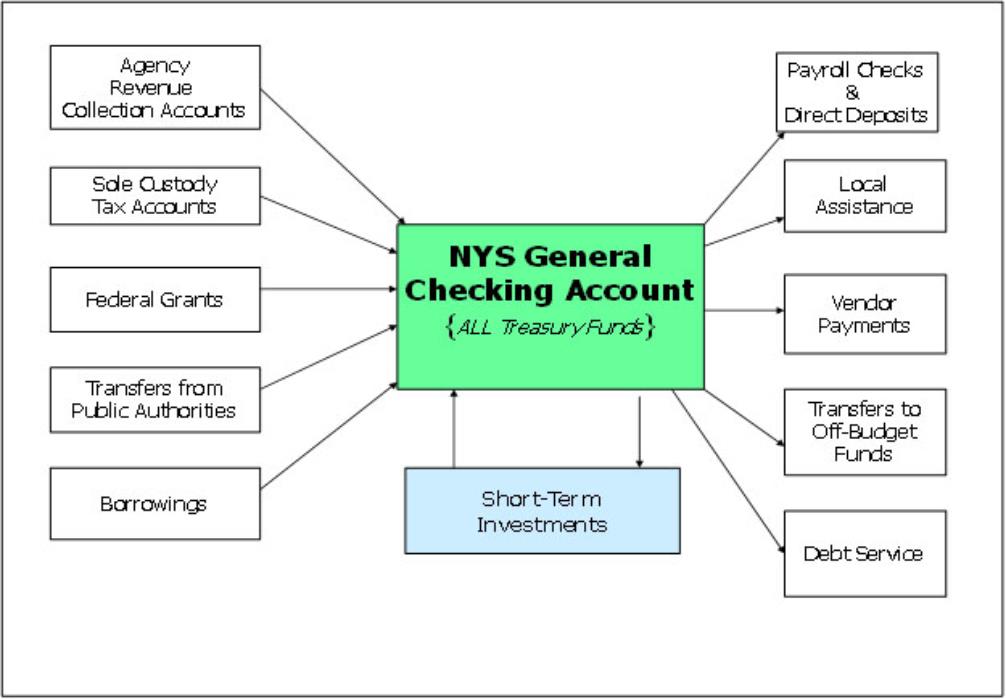

The Short Term Investment Pool (STIP) represents a mechanism that allows for separate accounting for individual fund receipts and disbursements AND the pooling of cash assets of the funds within the State’s General Checking Account (GCA) for the purposes of short-term investments. This permits investment decisions to be made based on the assets and liquidity needs of the checking account as a whole, rather than the needs of its component parts. In this way STIP can be compared with a money market fund, with the individual funds investing moneys not needed for day-to-day activities or to make payments in the money market fund.

Although state funds are pooled in the STIP, separate accounting records are maintained to provide complete and accurate accountability for individual fund assets.

Accounting for STIP Investments

STIP investments managed by the Office of the State Comptroller are recorded in a separate fund (70151). The amount of cash available for investment each day is calculated by the Bureau of State Accounting Operations – Cash Management Unit after consideration for known daily deposits, agency collection account sweeps, payments and maturing investments. All investment purchases that are made are recorded with an investment account code in Fund 70151. As investments mature or are sold, the STIP investments are reduced and the interest earned on these investments are recorded as revenue in the STIP fund. Interest earnings of the STIP are accumulated and distributed to the participating funds after all monthly reconciliations are performed and investment yields are calculated.

Each month the Bureau of Financial Reporting within OSC publishes the STIP interest rate and total interest earned on a statewide basis. Large fluctuations of STIP interest earned within your funds may be easily explained by changes in the STIP rate, which can be found on the Summary of the Operating Fund Investments of the monthly Cash Basis Report on the NYS Comptroller’s website.

Guide to Financial Operations

REV. 03/22/2021