Purpose

The purpose of this bulletin is to notify agencies of new deduction codes and deduction codes that will be discontinued in PayServ v 9.2 for Optional Retirement Plans (ORP), the Voluntary Defined Contribution (VDC) Plan, and Tax Deferred Annuities/Supplemental Annuities (403(b)).

Affected Employees

Employees who are currently enrolled in ORP or VDC plans or who have 403(b) deductions are affected.

Background

The Office of the State Comptroller is upgrading PayServ to PeopleSoft version 9.2 on March 15, 2021. ORP/VDC and 403(b) deduction codes have been created, consolidated, and/or moved from the General Deduction page (Main Menu > Payroll for North America > Employee Pay Data USA > Deductions > General Deductions Data) to the Savings Plan page (Main Menu > Benefits > Enroll in Benefits > Savings Plans) in order to reduce customizations and utilize delivered functionality.

Effective Dates

All deduction code changes described will be effective at Go Live, scheduled for March 15, 2021.

OSC Actions

Obsolete Deduction Codes

OSC will convert ORP/VDC and 403(b) deductions to Savings Plans in v 9.2; for detailed information on Savings Plans refer to Payroll Bulletin No. PIP-011, Changes to Savings Plans in PayServ v 9.2. Using Savings Plans allows the same deduction code to be used for both before and after tax deductions.

OSC will convert v 9.1 ORP/VDC contribution deduction codes to new deduction codes based on Benefit Plans in v 9.2. New arrears deductions will be created to correspond to the new ORP/VDC plan structures. The v 9.1 arrears deduction codes will be discontinued.

The following v 9.1 deduction codes will no longer be used:

| 9.1 Deduction Code | Description |

|---|---|

| 400 | CUNY ROTH |

| 412 | SUNY ROTH |

| 601 | TIAA Retirement Before Tax |

| 602 | TIAA Retirement After Tax |

| 603 | TIAA Before Tax Arrears |

| 604 | TIAA After Tax Arrears |

| 661 | VDCP TIAA Retirement Bef Tax |

| 663 | VDCP TIAA Before Tax Arrears |

Agencies may refer to the 403(b) Conversion Crosswalk for detailed information.

New Deduction Codes

OSC has created a total of 27 new deduction codes for the new ORP/VDC process.

There are six new interest deduction codes that will appear on the employee’s General Deduction Data page when the employee is enrolled in a new ORP/VDC suspense Benefit Plan on the Savings Plans page. These interest deduction codes will calculate the employee and employer interest sent to the ORP/VDC vendor once the employee has vested. No agency action is required for these deductions, and they will not appear on the employee’s pay stub or advice statement:

| Deduction Code | Description | Tax Class | Calculation | Deduction Type | Agency Update Required |

|---|---|---|---|---|---|

| 664 | SUNY ORP Employer Interest | Non-taxable | Percent of Earnings | General Deduction | No Created when New Suspense Savings Plan Added |

| 665 | SUNY ORP Employee Interest | Non-taxable | Percent of Earnings | General Deduction | No Created when New Suspense Savings Plan Added |

| 666 | VDC Employer Interest | Non-taxable | Percent of Earnings | General Deduction | No Created when New Suspense Savings Plan Added |

| 667 | VDC Employee Interest | Non-taxable | Percent of Earnings | General Deduction | No Created when New Suspense Savings Plan Added |

| 668 | CUNY ORP Employer Interest | Non-taxable | Percent of Earnings | General Deduction | No Created when New Suspense Savings Plan Added |

| 669 | CUNY ORP Employee Interest | Non-taxable | Percent of Earnings | General Deduction | No Created when New Suspense Savings Plan Added |

There are eight new deduction codes for ORP/VDC contributions in place of the three v 9.1 codes that will be discontinued. These deductions are calculated according to the Benefit Plan selected on the Savings Plans page:

| Deduction Code | Description | Tax Class | Calculation | Deduction Type | Agency Update Required |

|---|---|---|---|---|---|

| 670 | SUNY ORP Before Tax | EE Before Tax ER Non-taxable | Percent of Earnings | ORP/VDC Savings Plan | No Deduction Calculated by Benefit Plan |

| 671 | SUNY ORP After Tax | EE After Tax ER Non-taxable | Percent of Earnings | ORP/VDC Savings Plan | No Deduction Calculated by Benefit Plan |

| 672 | SUNY ORP Suspense | EE Before Tax ER Non-taxable | Percent of Earnings | ORP/VDC Savings Plan | No Deduction Calculated by Benefit Plan |

| 675 | CUNY ORP Before Tax | EE Before Tax ER Non-taxable | Percent of Earnings | ORP/VDC Savings Plan | No Deduction Calculated by Benefit Plan |

| 676 | CUNY ORP After Tax | EE After Tax ER Non-taxable | Percent of Earnings | ORP/VDC Savings Plan | No Deduction Calculated by Benefit Plan |

| 680 | CUNY ORP Suspense | EE Before Tax ER Non-taxable | Percent of Earnings | ORP/VDC Savings Plan | No Deduction Calculated by Benefit Plan |

| 681 | VDC Before Tax | EE Before Tax ER Non-taxable | Percent of Earnings | ORP/VDC Savings Plan | No Deduction Calculated by Benefit Plan |

| 683 | VDC Suspense | EE Before Tax ER Non-taxable | Percent of Earnings | ORP/VDC Savings Plan | No Deduction Calculated by Benefit Plan |

There are 13 new deduction codes for ORP/VDC arrears. These deductions will need to be calculated and entered by the agency on the General Deduction Data page:

| Deduction Code | Description | Tax Class | Calculation | Deduction Type | Agency Update Required |

|---|---|---|---|---|---|

| 673 | SUNY Before Tax Arrears | Before Tax | Flat Amount | General Deduction | Yes Refer to PIP-014 |

| 673ER | SUNY ORP Employer Arrears | Non-taxable | Flat Amount | General Deduction | Yes Refer to PIP-014 |

| 674 | SUNY Suspense BTax Arrears | Before Tax | Flat Amount | General Deduction | Yes Refer to PIP-014 |

| 674ER | SUNY ORP Employer Arrears Susp | Non-taxable | Flat Amount | General Deduction | Yes Refer to PIP-014 |

| 678 | CUNY Before Tax Arrears | Before Tax | Flat Amount | General Deduction | Yes Refer to PIP-014 |

| 678ER | CUNY ORP Employer Arrears | Non-taxable | Flat Amount | General Deduction | Yes Refer to PIP-014 |

| 679 | CUNY After Tax Arrears | After Tax | Flat Amount | General Deduction | Yes Refer to PIP-014 |

| 680 | CUNY Suspense BTax Arrears | Before Tax | Flat Amount | General Deduction | Yes Refer to PIP-014 |

| 680ER | CUNY ORP Employer Arrears Sus | Non-taxable | Flat Amount | General Deduction | Yes Refer to PIP-014 |

| 682 | VDC Before Tax Arrears | Before Tax | Flat Amount | General Deduction | Yes Refer to PIP-014 |

| 682ER | VDC Employer Arrears | Non-taxable | Flat Amount | General Deduction | Yes Refer to PIP-014 |

| 685 | VDC Suspense Before Tax Arrear | Before Tax | Flat Amount | General Deduction | Yes Refer to PIP-014 |

| 685ER | VDC Employer Arrears Suspense | Non-taxable | Flat Amount | General Deduction | Yes Refer to PIP-014 |

Refer to Payroll Bulletin No. PIP-011, Changes to Savings Plans in PayServ v 9.2 for more information on the ORP/VDC contributions and interest.

Refer to Payroll Bulletin No. PIP-014, ORP/VDC Arrears for more information on calculating and entering arrears deductions.

Paycheck Impact

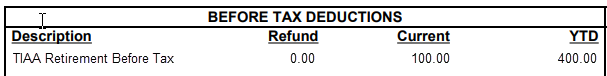

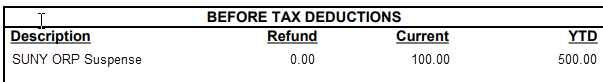

The v 9.1 deduction codes that will be discontinued will be converted to v 9.2 deduction codes. The conversion will include moving the year-to-date deduction balance for the discontinued deduction to the corresponding new deduction. Employee pay advices display the deduction code description, the current deduction amount, and the total year-to-date amount. After conversion, the description will be for the new v 9.2 code, and the year-to-date amount will be the total of the old and new deductions combined. The only change for the employee will be the description.

The sample images below show the before tax deduction section of a 9.1 and 9.2 check for an employee who is enrolled in SUNY ORP and has not met the 366 day suspense period. The 9.2 check will display with a different description beginning in the first paycheck confirmed after go live. The year-to-date balance will include the 9.1 deduction balances.

SAMPLE 9.1 CHECK DATE 02/17/2021

SAMPLE 9.2 CHECK DATE 03/03/2021

Agency Actions

Upon Go Live, agencies must use 9.2 deduction codes when entering deductions or reviewing deduction balances. Agencies may refer to Payroll Bulletin No. PIP-011, Changes to Savings Plans in PayServ 9.2 and the included crosswalks when reviewing or entering Savings Plans. Agencies may refer to Payroll Bulletin No. PIP-014, ORP/VDC Arrears when calculating and entering new arrears deduction codes.

Questions

Questions regarding this bulletin may be directed to the Payroll Improvement Project mailbox. Please include “Bulletin No. PIP-016” in the Subject line of the email.