This bulletin is superseded by Payroll Bulletin 1800.1

Purpose

The purpose of this bulletin is to inform agencies of the new Federal Form W-4, Employee’s Withholding Certificate, and the update to the PayServ Federal Tax Data page.

Affected Employees

Newly hired employees, employees claiming Head of Household, and existing employees who wish to change their Federal tax withholding are affected.

Background

The IRS has released the new Form W-4, Employee's Withholding Certificate, and Publication 15-T, Federal Income Tax Withholding Methods, for use in 2020. Additionally, effective December 23, 2019, the PayServ Federal Tax Data page will be modified to reflect the changes associated with the new Form W-4.

The new 2020 Form W-4 eliminates the use of allowances for purposes of calculating adjustments to wages when calculating federal income tax withholding. Instead, annual amounts based on the employee’s filing status, along with optional adjustments, will be used to calculate the amount of wages that will be subject to Federal income tax withholding. Only new hires paid for the first time in 2020 and existing employees who wish to change their federal tax withholding, claim Head of Household, or claim exemption from withholding will need to complete a 2020 Form W-4.

Agencies should use the Form W-4 from 2019 or earlier for new hires until the 2020 Form W-4 is available in PayServ. Once the form is available, agencies can add a new row dated January 1, 2020 or after and enter data in the 2020 Form W-4, as detailed later in this bulletin.

Employees who are rehired are not required to fill out a new Form W-4. If they do not fill out a 2020 Form W-4, their existing Form W-4 will be used. Agencies are reminded, however, that it is appropriate for rehired employees to evaluate their tax withholding upon being rehired as their tax statuses may have changed.

The 2020 Form W-4 contains 5 steps. Steps 1 and 5 are mandatory, while steps 2-4 will only need to be completed based on an employee’s personal tax situation:

- Step 1: Employee name, address, social security number, and filing status

- Step 2: Multiple jobs – Single and more than 1 job, or Married Filing Jointly and both employees working

- Step 3: Claiming dependents

- Step 4: Other adjustments

- Step 5: Signature and date of employee

See attached Job Aid for a comparison of the new Form W-4 to the previous version.

If an employee is required to submit a new Form W-4, as noted above, but does not submit a new Form W-4, the default withholding will be Single with no additional adjustments.

The new form W-4 will be available in Payroll Online on January 1, 2020. Until then, only the 2019 or earlier version will be available.

Effective Date(s)

Institution paycheck dated January 2, 2020

Administration paycheck dated January 8, 2020

Agency Actions

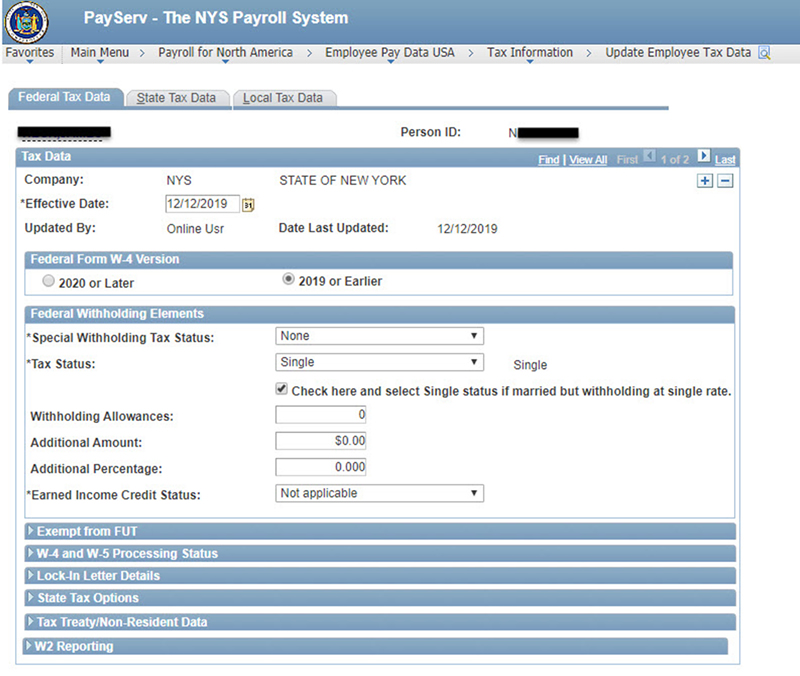

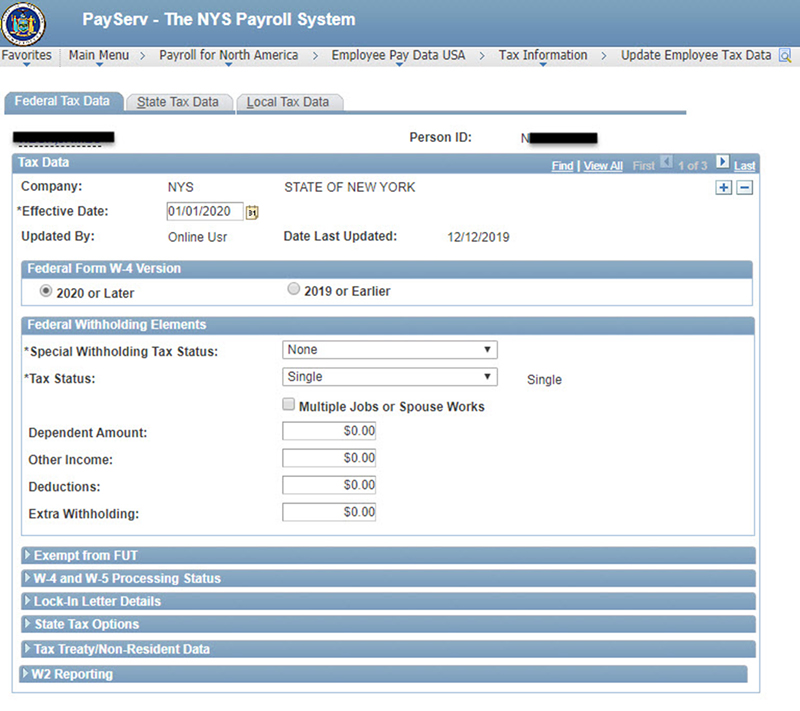

Agencies are responsible for becoming familiar with the new Form W-4, IRS Publication 15-T, the attached Job Aid, and the Federal Tax Data panel(s), based on Form W-4 version, as depicted below:

2019 or Earlier

Note: The Federal Tax Data panel is similar to the previous version for those employees who do not submit a new Form W-4. Their federal income tax withholding will be calculated using the same criteria as before, though the tax tables have been updated.

2020 or Later

Employees submitting a new Form W-4 must have their Federal Tax Data panel completed according to what is reflected on their form.

For new hires, the following fields should be populated according to the employee Form W-4:

- Federal Form W-4 Version: Default will be “2020 or Later” if you are hiring in 2020. If you are hiring in 2019 and the employee’s first paycheck will be in 2020, select “2020 or Later”.

- Effective date: If using the new 2020 Form W-4, use 1/1/2020 or later.

- Special Withholding Tax Status: Default is None. Guidance on employees claiming exemption from Federal income withholding tax will be provided when available.

- Employee Tax Status: Step 1 filing status (mandatory)

- Multiple Job check box: Step 2 (optional)

- Dependent Amount: Step 3 amount (optional)

- Other Income: Step 4a (optional)

- Deductions: Step 4b (optional)

- Extra Withholding: Step 4c (optional)

For employees wishing to change their filing status or withholding in 2020 or later, add a row and populate the following fields:

- Federal Form W-4 Version: Default will be “2020 or Later”

- Effective date: According to IRS Publication 15, an employee’s new Form W-4 must be effective as of the first payroll period ending on or after the 30th day from the date when you received the form. If using the new 2020 Form W-4, use 1/1/2020 or later.

- Special Withholding Tax Status: Default is None. Guidance on employees claiming exemption from Federal income withholding tax will be provided.

- Employee Tax Status: Step 1 filing status (mandatory)

- Multiple Job check box: Step 2 (optional)

- Dependent Amount: Step 3 amount (optional)

- Other Income: Step 4a (optional)

- Deductions: Step 4b (optional)

- Extra Withholding: Step 4c (optional)

Until the Automated Interface file (AI) is modified, agency staff will need to enter changes to the Federal Tax Data page on-line and not through AI.

Agencies are reminded that if an employee’s State or Local Tax Data page needs to be updated, they should add a row in the Federal Tax Data page, not make any further changes to the Federal Tax Data, and then navigate to the State/Local Tax Data. If agencies make any changes in the Federal tax data, a 2020 Form W-4 will be populated.

Agency staff are cautioned not to provide tax advice to employees. Employees should be directed to their tax advisor or to the IRS Tax Withholding Estimator for assistance.

OSC Actions

As guidance is provided by the IRS, OSC will issue bulletins for any changes related to lock-in letters, nonresident aliens, and claiming exemption from withholding.

OSC will notify agencies when the AI files have been modified for the changes to the Federal Tax Data page.

In addition, OSC will provide Job Aids regarding New Hires and Tax Withholding calculations.

Questions

Questions regarding this bulletin should be directed to the Tax and Compliance mailbox.