This bulletin supersedes Payroll Bulletin 1800

Purpose

The purpose of this bulletin is to inform agencies of the new Federal Form W-4, Employee’s Withholding Certificate, and the update to the PayServ Federal Tax Data page.

Affected Employees

The following employees are affected:

- Newly hired employees

- Employees terminated in a previous year and rehired in 2020

- Existing employees claiming Head of Household status; and

- Existing employees who wish to change their Federal tax withholding

Background

The IRS has released the new Form W-4, Employee's Withholding Certificate, and Publication 15-T, Federal Income Tax Withholding Methods, for use in 2020. Additionally, effective December 23, 2019, the PayServ Federal Tax Data page was modified to reflect the changes associated with the new Form W-4.

The new 2020 Form W-4 eliminates the use of allowances for purposes of calculating adjustments to wages when calculating federal income tax withholding. Instead, annual amounts based on the employee’s filing status, along with optional adjustments, will be used to calculate the amount of wages that will be subject to Federal income tax withholding. Only new hires paid for the first time in 2020, employees terminated in a previous year and rehired in 2020, and existing employees who wish to change their federal tax withholding, claim Head of Household, or claim exemption from withholding will need to complete a 2020 Form W-4.

The 2020 Form W-4 contains 5 steps. Steps 1 and 5 are mandatory, while steps 2-4 will only need to be completed based on an employee’s personal tax situation:

- Step 1: Employee name, address, social security number, and filing status

- Step 2: Multiple jobs – Single and more than 1 job, or Married Filing Jointly and both employees working

- Step 3: Claiming dependents

- Step 4: Other adjustments

- Step 5: Employee’s signature and date

Employees who wish to claim exemption from Federal withholding should write “Exempt” on the line between Step 4c and Step 5. Similarly, employees who wish to claim nonresident alien status should write “Nonresident Alien” on the line between Step 4c and Step 5.

See attached Job Aid for a comparison of the new Form W-4 to the previous version.

If a new hire or an employee terminated in a previous year and rehired in 2020 does not submit a new Form W-4, the default withholding will be Single with no additional adjustments.

The new form W-4 is available on Payroll Online. Agencies are reminded that Payroll Online is a paperless option for their employees to update their State and Federal withholding.

Effective Date(s)

Institution paycheck dated January 2, 2020 Administration paycheck dated January 8, 2020

Agency Actions

Agencies are responsible for becoming familiar with the new Form W-4, IRS Publication 15-T, the attached Job Aid, and the Federal Tax Data panel(s), based on Form W-4 version, as depicted below:

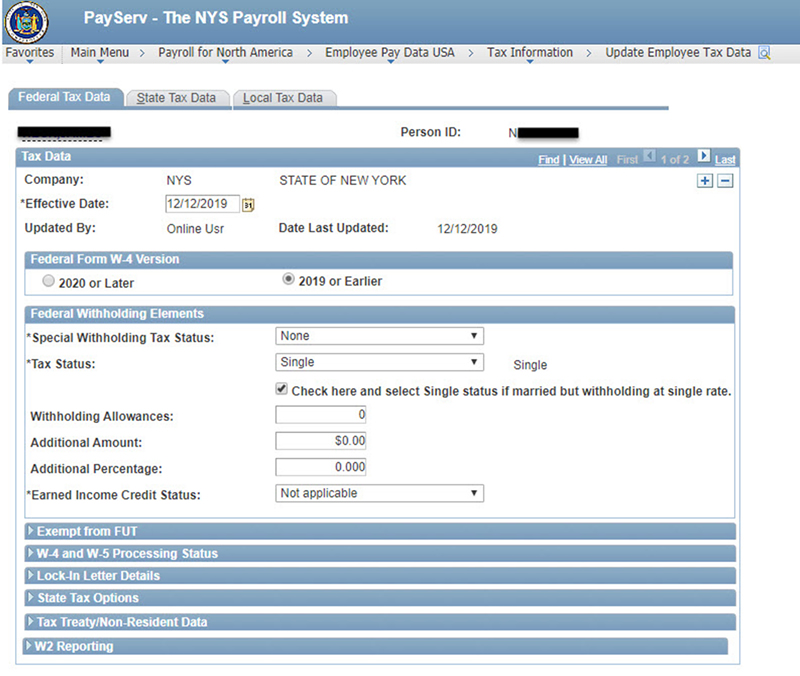

2019 or Earlier

Note: The Federal Tax Data panel is similar to the previous version for those employees who do not submit a new Form W-4. Their federal income tax withholding will be calculated using the same criteria as before, though the tax tables have been updated.

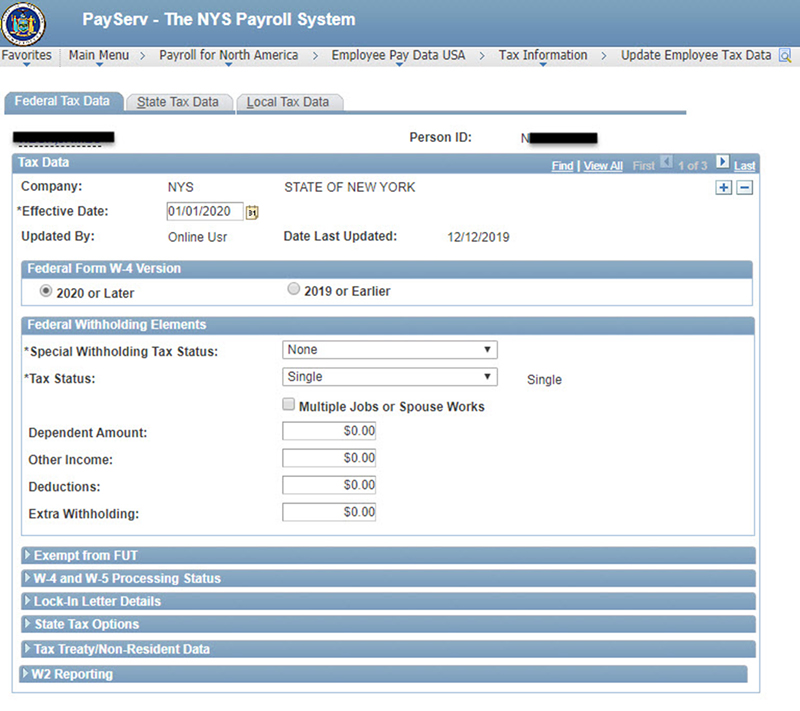

2020 or Later

Employees submitting a new Form W-4 must have their Federal Tax Data panel completed according to what is reflected on their form.

For new hires, the following fields should be populated according to the employee Form W-4:

- Federal Form W-4 Version: Default will be “2020 or Later” if you are hiring in 2020. If you are hiring in 2019 and the employee’s first paycheck will be in 2020, select “2020 or Later”.

- Effective date: If using the new 2020 Form W-4, use 1/1/2020 or later.

- Special Withholding Tax Status: Default is None. Guidance on employees claiming exemption from Federal income withholding tax will be provided when available.

- Employee Tax Status: Step 1 filing status (mandatory)

- Multiple Job check box: Step 2 (optional)

- Dependent Amount: Step 3 amount (optional)

- Other Income: Step 4a (optional)

- Deductions: Step 4b (optional)

- Extra Withholding: Step 4c (optional)

For rehires who were terminated in previous year or employees wishing to change their filing status or withholding in 2020 or later, add a row and populate the following fields:

- Federal Form W-4 Version: Default will be “2020 or Later”

- Effective date: According to IRS Publication 15, an employee’s new Form W-4 must be effective as of the first payroll period ending on or after the 30th day from the date when you received the form. If using the new 2020 Form W-4, use 1/1/2020 or later.

- Special Withholding Tax Status: Default is None. Guidance on employees claiming exemption from Federal income withholding tax will be provided.

- Employee Tax Status: Step 1 filing status (mandatory)

- Multiple Job check box: Step 2 (optional)

- Dependent Amount: Step 3 amount (optional)

- Other Income: Step 4a (optional)

- Deductions: Step 4b (optional)

- Extra Withholding: Step 4c (optional)

Agency staff will need to enter changes to the Federal Tax Data page on-line and not through AI.

Agencies are reminded that if an employee’s State or Local Tax Data page needs to be updated, they should add a row in the Federal Tax Data page, not make any further changes to the Federal Tax Data, and then navigate to the State/Local Tax Data. If agencies make any changes in the Federal tax data, a 2020 Form W-4 will be populated.

Agency staff are cautioned not to provide tax advice to employees. Employees should be directed to their tax advisor or to the IRS Tax Withholding Estimator for assistance.

OSC Actions

As guidance is provided by the IRS, OSC will issue bulletins for any changes related to lock-in letters, nonresident aliens, and claiming exemption from withholding.

In addition, OSC will provide Job Aids regarding New Hires and Tax Withholding calculations.

Questions

Questions regarding this bulletin should be directed to the Tax and Compliance mailbox.