Purpose

The purpose of this bulletin is to inform agencies of actions that must be taken to correct employees’ addresses and tax data.

Affected Employees

Employees with the following criteria are affected:

- Home Address is not in New York City but Local Tax Data Indicates New York City Residence or Additional Amount.

- Home Address is in New York City but Local Tax Data Does Not Reflect New York City Residence.

- Home Address is a P.O. Box.

Background

New York State Publication NYS-50 directs that employers must withhold New York City income tax from employees who live in one of the five counties designated to be within the City of New York:

- Bronx County (Bronx)

- Kings County (Brooklyn)

- New York County (Manhattan)

- Queens County (Queens)

- Richmond County (Staten Island)

The Office of the State Comptroller (OSC) has modified the New York City reportable program (NTAX702) to report New York City wages on the annual Form W-2s (Wage and Tax Statement) of employees who received a paycheck while their home address was in one of the five counties within New York City. As a result, an employee’s address, not the Local Tax Data page, determines whether New York City wages will be reported on the employee’s Form W-2. The Local Tax Data page determines whether local withholding taxes will be taken from the employee’s paychecks.

The form IT-2104 is the New York Employee’s Withholding Allowance Certificate for New York State and Local taxation of employees.

Payroll Bulletin No. 819 provides guidance to update employee addresses and directs that employee home addresses cannot be a postal box.

Payroll Bulletin No. 922 provides guidance regarding the automatic population of county in employee home addresses.

Effective Dates

Effective immediately.

OSC Actions

OSC has developed queries to identify employees who require agency action as follows:

- Employee’s home address is not in New York City but the Local Tax Data page indicates residence;

- Employee’s home address is not in New York City but the Local Tax Data page has an additional amount of withholding;

- Employee’s home address is in New York City but the Local Tax Data page does not indicate residence;

- Employee’s home address is a P.O. Box.

OSC will initially run these queries and send the query results of affected employees to each agency. Depending on the employees’ addresses and Local Tax Data, agencies may receive results from all or some of the queries.

Subsequently, OSC will provide tools to agencies for identifying employees requiring corrections in order to be in compliance with the NYS Department of Tax and Finance income tax withholding regulations.

Agency Actions: Employees with Home Address not in New York City but Local Tax Data Indicates New York City Residence Or Additional Amount

If the employee’s home address is not in New York City but the employee’s Local Tax Data page has Locality and/or Additional Amount populated, the agency must take the following actions by 09/04/2020:

- Inform the employee that the home address does not indicate New York City residence and request IT-2104 to stop New York City withholding

- Insert a row on the Federal Tax Data page (Payroll for North America\Employee Pay Data USA\ Tax Information\Update Employee Tax Data) with an effective date on or before the employee’s next check date;

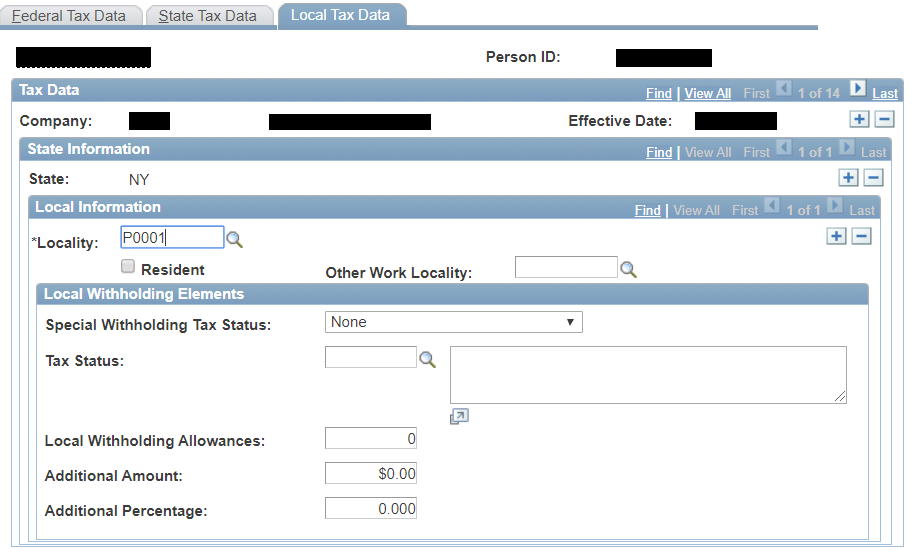

- Correct the Local Tax Data page on the new row so that the Resident box is unchecked and/or Extra Withholding is blank:

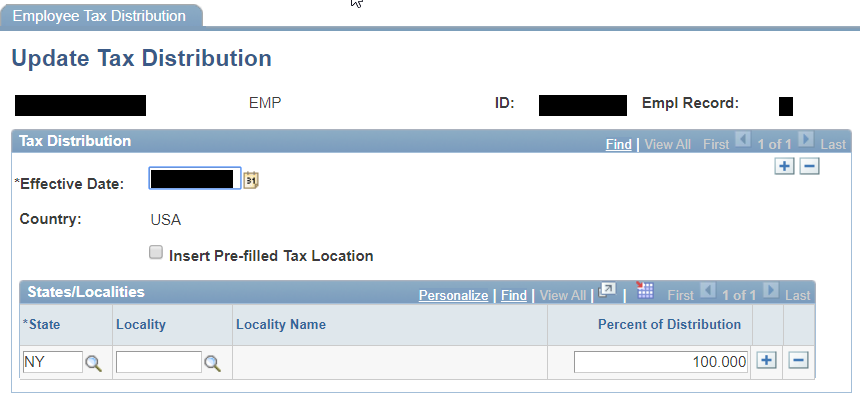

- Update the employee’s Tax Distribution page (Payroll for North America\Employee Pay Data USA\Tax Information\Update Tax Distribution) by adding a row with the same date as the new Tax Data page. The new row should not have the Locality populated and should appear as below:

- Calculate the 2020 New York City tax refund owed to the employee using the template (NYC Refund Template) and email the template with an explanation to the Tax and Compliance mailbox. This step is necessary to ensure that non-residents of New York City will not have New York City taxes reported on their 2020 Form W-2s.

Alternatively, the employee can use New York State Payroll Online (NYSPO) to stop New York City withholding. Once the employee has taken this action, the agency must calculate the 2020 New York City tax refund owed and send it to the Tax and Compliance mailbox as indicated above.

Agency Actions: Employees with Home Address in New York City but Local Tax Data Does Not Reflect New York City Residence

If the employee’s home address is in New York City but the employee’s Local Tax Data page does not reflect New York City residence, the agency must take the following actions by 9/18/2020:

- Inform the employee that the home address indicates New York City residence and request an IT-2104 to start New York City withholding;

- Insert a row on the Federal Tax Data page (Payroll for North America\Employee Pay Data USA\Tax Information\Update Employee Tax Data) with an effective date on or before the employee’s next check date;

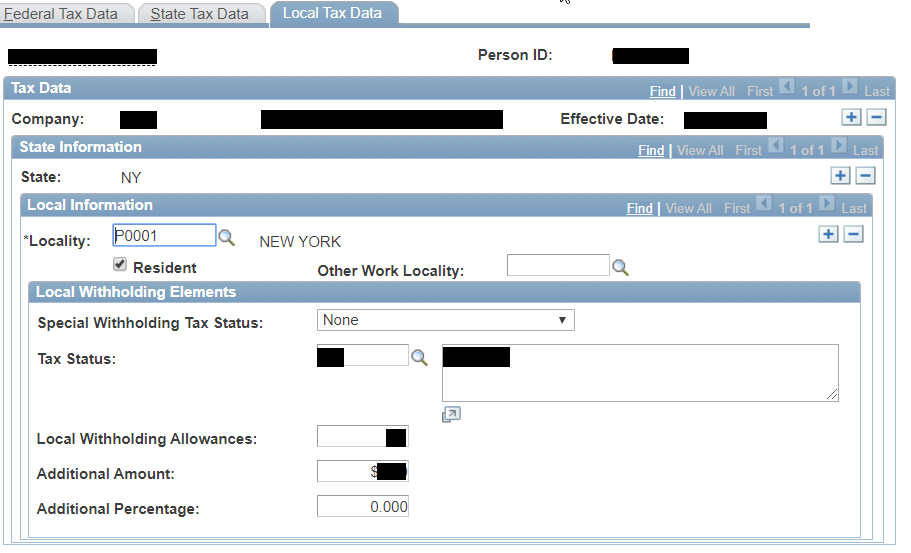

- Correct the Local Tax Data page on the new row to check the residence box and populate the Locality, Tax Status, Local Withholding Allowances and Additional Amount (if applicable) to reflect the employee’s submitted IT-2104 reflecting the New York City residence

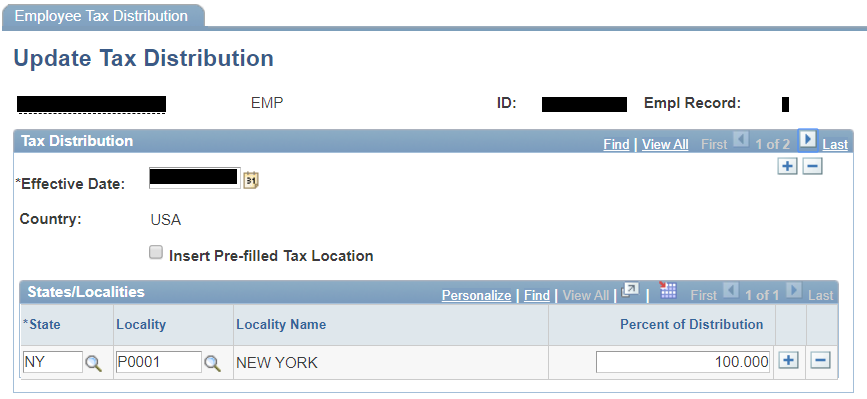

- Update the employee’s Tax Distribution page (Payroll for North America\Employee Pay Data USA\Tax Information\Update Tax Distribution) by adding a row with the same effective date as the new Local Tax Data page and populating Locality with ’P0001’. The new Tax Distribution page should appear as below:

Alternatively, the employee can use New York State Payroll Online (NYSPO) to start New York City withholding.

If an employee submits a new home address, agencies should use the instructions below for updating an employee’s home address.

Agency Actions: Employee’s Home Address is a P.O. Box

Per Payroll Bulletin No. 819, an employee’s home address should not be a P.O. box. In addition, since the New York City Reportable wage program uses home address to determine New York City wages; a P.O. box in the Home address will lead to errors.

As a result, agencies must update the Home address of employees with a P.O. box by 10/02/2020. A P.O. box may be used in the employee’s Check (CHK) and/or Mail Address.

Agency Actions: Update Employee’s Home Address

Whenever an employee provides an updated address, the agency must update the employee’s Personal Data for the new address. However, due to program processing requirements, the effective date of the address cannot be before January 1 of the current year.

If an employee indicates that the move occurred before January 1 of the current year, the date of the move should be included in General Comments but the date in the employee’s Personal Data cannot be before January 1 of the current year.

See Payroll Bulletin No. 819 for further details about adding or changing employee addresses. In addition, per Payroll Bulletin No. 922, agencies should review the NPAY708 and NPAY709 reports in Control-D on a weekly basis for employees with a mismatch between their postal code and county.

The following website can help validate an employee’s postal code:

https://m.usps.com/m/ZipLookupAction?search=address

The following Department of Taxation and Finance website can help determine if an employee’s address lies within New York City: https://www8.tax.ny.gov/JRLA/jrlaStart

Job Actions that Update Tax Data

Agencies are reminded that certain Job transactions, such as position changes and transfers, can trigger new Tax Data rows for an employee. As a result, agencies must review an employee’s Local Tax Data page whenever these Job transactions occur to ensure that the page still reflects the employee’s residence for tax purposes.

Questions

Questions regarding this bulletin may be directed to the Tax and Compliance mailbox.