This bulletin supersedes Payroll Bulletin No. 1971.

Purpose

The purpose of this bulletin is to provide step-by-step guidance for Direct Deposit entry and provide details of the Direct Deposit Audit Locked Queries for audit purposes.

Affected Employees

Employees hired on or after January 1, 2023 and existing employees with a change to their Request Direct Deposit record are affected.

Background

Form AC 2772, Direct Deposit Form for NYS Employees is submitted to agency payroll offices to change the Direct Deposit record. To assist with the audit of the change made, Locked query LQ_DDP_AUDIT_DD_ENTRIES has been provided.

In PayServ version 9.2, the Employee Record (Empl Rcd) is no longer attached to an employee’s Direct Deposit record. An employee has only one Direct Deposit record. For employees with multiple jobs, all payroll deposits are made according to the single Direct Deposit record for all jobs. As a result of the combined records for Direct Deposit a new Locked Query has been provided.

Per Chapter 442 of the Laws of 2022, on and after January 1, 2023, the Comptroller shall cause, in accordance with the rules and regulations promulgated pursuant to paragraph (b) of subdivision (4), a state employee’s net salary to be deposited directly in a bank for any purpose to an account in the name of such employee, and into which such employee has authorized such employee’s net salary be deposited, on forms provided by the Comptroller, and duly filed in accordance with such regulations. Provided, however, such employee may submit a request for exemption from the provisions on a form provided by the Comptroller.

The AC 2772, Direct Deposit Form for NYS Employees has been updated to include an exemption section. As a result, a Locked Query has been provided to identify new employees hired on or after January 1, 2023, who to not have an active direct deposit balance row present in the Request Direct Deposit Panel in PayServ.

Agency Actions

Direct Deposit changes should be entered per the current year’s Agency Submission Schedule. Agencies should not make Direct Deposit changes before noon on the Thursday before the check date. Change requests outside of the entry period should be directed to the DD Returns and Reversals mailbox.

The Direct Deposit Form for NYS Employees, form AC 2772, should be provided to all new employees. If an employee is being hired from another state agency and has an existing active Direct Deposit, their Direct Deposit panel should be verified at the time of hire. If an employee is rehired, a new AC 2772 form should be submitted at the time of rehire to confirm up-to-date Direct Deposit information.

Note: Employees’ Direct Deposit distribution will be the same across all jobs and paychecks.

Upon receipt of an AC 2772 - Direct Deposit Form for NYS Employees, it is an agency’s responsibility to validate the employee’s identification to ensure fraudulent activity does not occur. At a minimum, agencies must verify the following information has been provided on the form and validate it against the existing information in PayServ or on record with the agency:

SECTION A: Employee Information (Required)

Name (Last, First, MI): Agencies should ensure the spelling of employee name is accurate and matches employee name in PayServ. Agencies should not use employee name to search for the employee in PayServ as this leads to errors and the potential for entering the Direct Deposit account information for the wrong employee.

NYS EMPLID: Employees should know their NYS EMPLID or be able to locate it on their pay stub, direct deposit advice, or by signing into their New York State Payroll Online (NYSPO) account. Agencies should locate the employee in PayServ using the NYS EMPLID and must verify the NYS EMPLID matches the employee’s name and last 4 of the SSN. If the employee is a new hire and a NYS Emplid is not available, the last 4 of the employee’s SSN must be verified to ensure it matches the employee’s name in PayServ.

Last 4 SSN: Agencies must verify the information provided in this field matches the last 4 of the employee’s SSN.

Phone: OSC does not specify what phone number the employee must provide. However, if the phone number does not match what the agency has on record for the employee, OSC recommends the agency ensure all other employee identification information provided matches what they have on record. OSC recommends the agency contact the employee at the telephone number they have on file, not the phone number provided on the form, to verify the employee submitted the Direct Deposit enrollment or Direct Deposit change request.

Work Email: Most NYS employees have an agency assigned email address. OSC recommends agencies ensure the work email address provided matches what the agency has on record for the employee. When responding to Direct Deposit requests received via email, OSC recommends agencies are cautious and send a separate email using the employee’s work email on record. Fraudulent Direct Deposit submissions are most often received via email or fax.

Home Address: The home address field has been added to assist agencies in verifying the employee’s identity. Agencies should verify the address provided on the form matches the address in PayServ for the employee. This field should not serve as a method for change of address and should be used for verification purposes only.

SECTION B: Request For Exemption From Direct Deposit (Required for employees hired on or after January 1, 2023 with no Balance Account indicated in Section C). If the employee is claiming an exemption from the provisions pursuant to State Finance Law, Chapter 56, Article 14, §200(4), this section should be signed and dated.

SECTION C: Balance Account Information

Participating in full Direct Deposit requires a balance account. This account will receive any excess of funds after all other Direct Deposit distributions are issued. While listed first on the form, the balance account designated will be last in the deposit order when funds are distributed. Non-payroll amounts such as travel reimbursements will also be posted to the balance account. If no other accounts are listed, the full net pay will be deposited into the balance account.

SECTION D: Additional Account Information (Optional)

Up to seven (7) additional fixed amount or percentage deposits are allowed. The employee’s name must appear on all accounts. If a joint account holder exists, Section E of the form must also be completed.

A voided check or written verification from the financial institution showing the account number, bank routing number, the employee’s name and any joint account holder’s name on the account must accompany the AC 2772. Agencies should closely examine digitally produced voided checks for legitimacy.

Detailed instructions for entering the employee Direct Deposit account information can be found in the Payroll Manual.

SECTION E: Direct Deposit Statement Options

Go Paperless: Employees may check the box to opt out of receiving a printed copy of their Direct Deposit pay stub. Once paperless, employees can view or print their pay stubs, as well as change their Direct Deposit statement option with NYSPO.

If an employee chooses to go paperless, the agency must select the Suppress DDP Advice Print check box located in the Deposit Information section of the employee’s Direct Deposit panel (Main Menu>Payroll for North America>Employee Pay Data USA>Request Direct Deposit).

SECTION F: AUTHORIZATION (Required)

Joint Account Holder: If a joint account holder exists for account(s) listed in Sections C and D, the joint account holder must sign the form in Section F. By signing the form, the employee and any joint account holder allows the State, through the financial institution, to debit the account in order to recover any salary to which the employee was not entitled or that was deposited to the account in error.

Employee Signature: The employee’s signature is required. By signing the form, the employee certifies that they understand the instructions, including the authorization for recovery of funds, and authorizes the NYS salary payment to be sent to the designated financial institution(s) to be deposited into the specified account(s), as well as all non-payroll amounts (i.e., travel expense reimbursements) due to them to be deposited into the balance account they have designated. The employee signature also indicates they understand the form supersedes any previous forms they have submitted and acknowledges that changes may take up to two (2) payroll periods to become effective.

All AC 2772 forms submitted by the employee should be kept on file by the agency in a secure location.

Agency Audit

The day after all entries have been made in PayServ for the current pay cycle, agencies should run locked query LQ_DDP_AUDIT_DD_ENTRIES in PS Query as a tool to verify accuracy.

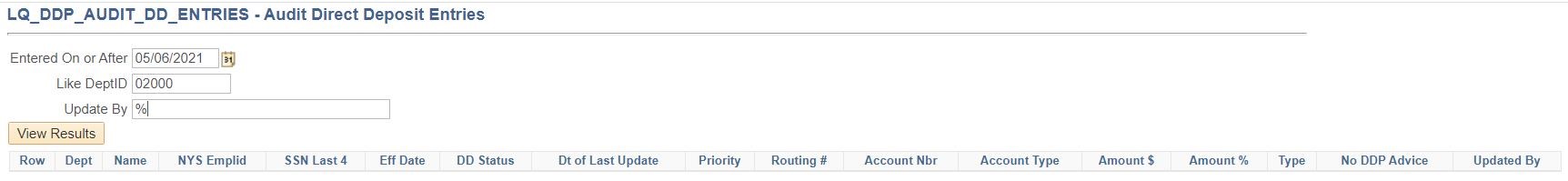

When entering search criteria for the locked query, search fields include Entered On or After, Like Dept ID, and Update By. This will allow the agency payroll officer to search the most recent transactions by their Department ID, eliminating results entered by other agencies (for employees with multiple jobs). When running the query, if attempting to search by all entries for a specific Department ID, not who the update was made by, the % symbol can be used in the Update By field along with the agency’s Department ID in the Like DeptID field and date updated in the Entered On or After field.

If a transaction is identified that was entered in error or needs to be changed for any reason after the cutoff for the payroll period listed on the Agency Submission Schedule, OSC’s Direct Deposit Team must be contacted as soon as possible to determine if this change can be made before the confirm of the paycheck.

Note: If a change is made by another agency payroll office, additional changes should not be made without a new request/form from the employee.

Locked Query New Hires:

The day after all entries have been made in PayServ for the current pay cycle, agencies should run Locked Query LQ_DDP_NEW_HIRES to remain compliant with Chapter 442 of the Laws of 2022.

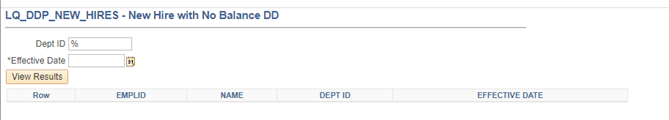

When entering search criteria for the Locked Query, the query should be run with the department ID you are auditing and a date prompt of the last day the query was executed. This will identify employees hired after the last audit who have a Job Action/Reason of “HIR APT” effective on or after January 1, 2023, with no active balance row in the Request Direct Deposit Panel. If you are running the query for multiple departments the “%” symbol can be used in the Dept ID field. This will provide results for all departments you have access to.

The results will provide the Employee ID, Employee Name, Department ID and Effective Date of the New Hire transaction.

Agencies should use this query to verify an AC 7227 was submitted with section B completed by all employees listed in the query results.

Questions

Questions regarding this bulletin may be directed to the DD Returns and Reversals mailbox.