Purpose

The purpose of this bulletin is to notify agencies of a new prior year NYSTRS arrears deduction code, reporting for the new code and provide instructions to enter employee arrears.

Affected Employees

Employees enrolled in NYSTRS, Plan Type 86, who owe NYSTRS arrears associated with a school year prior to the current school year (7/1-6/30) are affected.

Background

To enhance the reporting of NYSTRS arrears contributions, prior year arrears deductions withheld from employee paychecks will be reported to NYSTRS on a bi-weekly basis through the use of this new deduction code. Currently, NYSTRS bills agencies via monthly bill for prior year service credit due. This new, bi-weekly report of prior year arrears deductions will facilitate a means for NYSTRS to reconcile the prior year arrears deductions withheld from employees against the amounts billed to the agencies.

Effective Dates

As applicable, agencies should begin using the new TRS arrears deduction code beginning in paychecks dated September 14, 2022.

OSC Actions

OSC has created deduction code 516, TRS PY Arrears Before Tax, in PayServ.

OSC will provide NYSTRS with a detail file containing employees that have prior year arrears deductions withheld from their paycheck.

Agency Actions

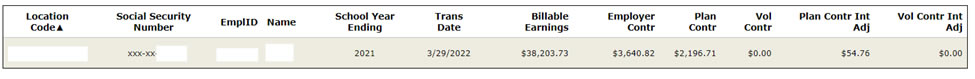

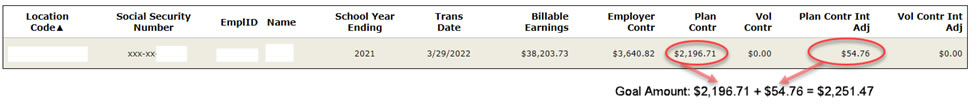

Agencies must routinely review the NYSTRS Employer Secure Area to determine if they have a monthly bill. If an employee owes prior year arrears, the monthly bill will include the Plan Contributions (Plan Contr) and the Plan Contributions Int Adj (Plan Contr Int Adj). These amounts must be added together to determine the total amount of the prior year arrears due; this will be the Goal Amount that must be entered into PayServ by the payroll officer for deduction code 516, TRS PY Arrears Before Tax.

Agencies must adhere to the Agency Submission Schedule when updating the General Deduction Data panel in PayServ.

Determining prior year arrears due and entering deduction code 516, TRS PY Arrears Before Tax:

- Agencies must login to the NYSTRS Employer Secure Area and download their Monthly Bill Detail. (Main Menu > Billing > Monthly, Estimated and Final Billing > select Bill Detail for applicable month):

- The agency will note the year listed in the School Year Ending column. Please note that the NYSTRS plan year runs from July 1 – June 30. This will indicate whether the arrears are current year or prior year.

- If an employee has multiple rows, the agency should enter the current year arrears under deduction code 613, TRS Arrears Before Tax, and the prior year arrears under deduction code 516.

- To calculate the Goal Amount, add the “Plan Contr” column amount to the “Plan Contr Int Adj” column amount.

- Biweekly arrears deductions should be set up in equal increments over the same period of time for which the goal/total amount is due (up to 26 for each impacted 7/1-6/30 TRS school year), with a minimum biweekly increment of $75.00, as supported by the employee’s paycheck. An accelerated schedule of repayment may be set up if agreed to by the employee.

- Agencies must verify the employee is enrolled in NYSTRS (Plan 86) as "Elect" on the USA Pension Plans page prior to adding the arrears deduction.

- Agencies are required to enter Deduction transactions into PayServ on the General Deduction Data page using the following instructions:

- Navigate to General Deduction Data (Main Menu >Payroll for North America > Employee Pay Data USA > Deductions > General Deduction Data).

- Enter the NYS EMPLID in the Empl ID field of dialog box and click Search.

- The employee's General Deduction Data page appears.

- Select View All.

- Determine if the employee already has a deduction record for the specific NYSTRS deduction by scrolling through the deduction codes using the scroll bar.

- If a record with the same NYSTRS deduction code exists, select the + sign to add a new row in the Deduction Details page, insert a row and continue onto Step 10.

- If there is not an existing row for the NYSTRS deduction code, select the + sign to add a new row in the General Deduction Data page.

- Deduction Code - Enter the Deduction code determined by the year indicated on the Monthly Bill Detail.

- Effective Date - Enter the Payroll Effective Date for the first day of the current, unconfirmed pay period according to the Agency Submission Schedule for the deduction to begin.

- Deduction Calculation Routine - Select Flat Amount from the drop-down box.

- Deduction End Date - leave blank.

- Goal Amount - Determined by Step 4 above.

- Flat/Addl Amount - Enter the individual deduction amount determined by Step 5 above.

- Save the transaction.

Questions

Questions regarding the new NYSTRS arrears deduction code may be directed to the agency NYSTRS editor as identified in the NYSTRS Employer Secure Area.

Questions regarding PayServ entry may be directed to the Payroll Retirement mailbox.