Approximately 79 percent of NYSLRS retirees live in New York State. During 2021, NYSLRS retirees were responsible for $15.2 billion in economic activity in New York State. Their purchases of goods and services provide opportunities for new businesses in New York, help grow existing companies and create jobs.

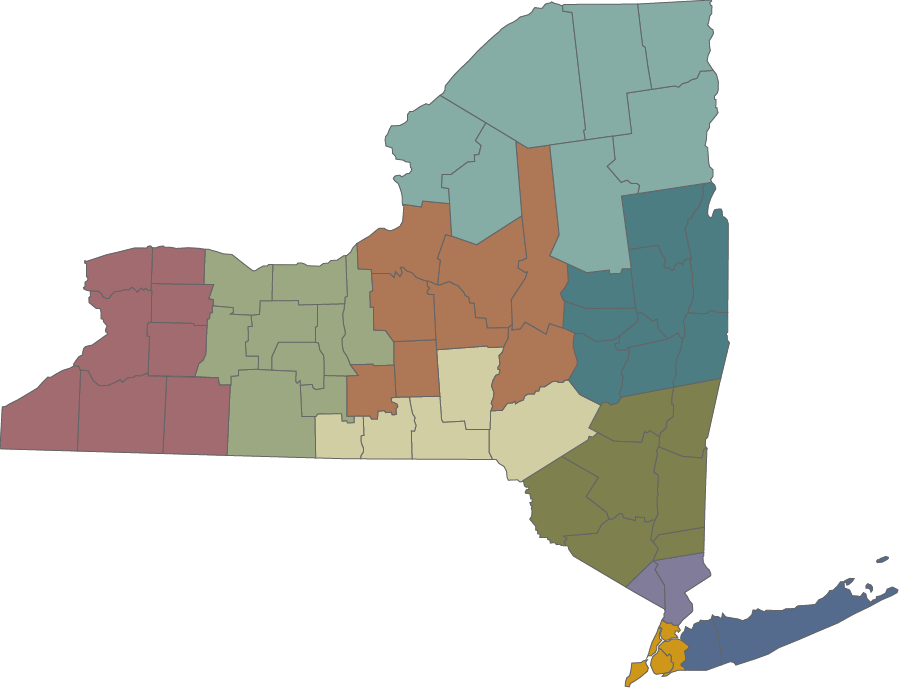

Click on a region or see statewide impact.

Retirees Contribute Map

Retirees Contribute - Upper Hudson Valley

Retirees and beneficiaries: 39,490

Benefits paid: $1,186,717,414

Spending on goods and services by NYSLRS retirees and beneficiaries created an estimated 7,600 jobs and generated $85 million in State and local sales tax in 2021. And, while they make up 3.4 percent of the Upper Hudson Valley population, they paid 6.1 percent ($245 million) of the region’s property taxes.

Retirees Contribute - Southern Tier

Retirees and beneficiaries: 18,670

Benefits paid: $420,659,482

Spending on goods and services by NYSLRS retirees and beneficiaries created an estimated 2,600 jobs and generated $30 million in State and local sales tax in 2021. And, while they make up 4.5 percent of the Southern Tier population, they paid 7.2 percent ($65 million) of the region’s property taxes.

Retirees Contribute - North Country

Retirees and beneficiaries: 22,533

Benefits paid: $578,077,180

Spending on goods and services by NYSLRS retirees and beneficiaries created an estimated 2,700 jobs and generated $30 million in State and local sales tax in 2021. And, while they make up 5.4 percent of the North Country population, they paid 8.1 percent ($75 million) of the region’s property taxes.

Retirees Contribute - New York City

Retirees and beneficiaries: 24,061

Benefits paid: $828,989,338

Spending on goods and services by NYSLRS retirees and beneficiaries created an estimated 4,500 jobs and generated $55 million in State and local sales tax in 2021. And they paid 0.2 percent ($50 million) of the region’s property taxes.

Retirees Contribute - Lower Hudson Valley

Retirees and beneficiaries: 24,311

Benefits paid: $874,443,924

Spending on goods and services by NYSLRS retirees and beneficiaries created an estimated 4,700 jobs and generated $55 million in State and local sales tax in 2021. And, while they make up 1.8 percent of the Lower Hudson Valley population, they paid 3.7 percent ($240 million) of the region’s property taxes.

Retirees Contribute - Long Island

Retirees and beneficiaries: 64,140

Benefits paid: $2,370,586,913

Spending on goods and services by NYSLRS retirees and beneficiaries created an estimated 17,000 jobs and generated $160 million in State and local sales tax in 2021. And, while they make up 2.2 percent of the Long Island population, they paid 5.2 percent ($715 million) of the region’s property taxes.

Retirees Contribute - Finger Lakes

Retirees and beneficiaries: 40,545

Benefits paid: $976,368,231

Spending on goods and services by NYSLRS retirees and beneficiaries created an estimated 6,800 jobs and generated $60 million in State and local sales tax in 2021. And, while they make up 3.2 percent of the Finger Lakes population, they paid 5.4 percent ($165 million) of the region’s property taxes.

Retirees Contribute - Central New York

Retirees and beneficiaries: 43,378

Benefits paid: $1,059,627,285

Spending on goods and services by NYSLRS retirees and beneficiaries created an estimated 7,300 jobs and generated $70 million in State and local sales tax in 2021. And, while they make up 3.7 percent of the Central New York population, they paid 6.3 percent ($155 million) of the region’s property taxes.

Retirees Contribute - Capital District

Retirees and beneficiaries: 64,721

Benefits paid: $2,020,959,088

Spending on goods and services by NYSLRS retirees and beneficiaries created more than 12,200 jobs and generated $105 million in State and local sales tax in 2021. And, while they make up 5.7 percent of the Capital District’s population, they paid 9.3 percent ($255 million) of the region’s property taxes.

Retirees Contribute - Western New York

Retirees and beneficiaries: 57,779

Benefits paid: $1,536,125,300

Spending on goods and services by NYSLRS retirees and beneficiaries created an estimated 10,000 jobs and generated $95 million in State and local sales tax in 2021. And, while they make up 3.7 percent of the Western New York population, they paid 6.2 percent ($195 million) of the region’s property taxes.