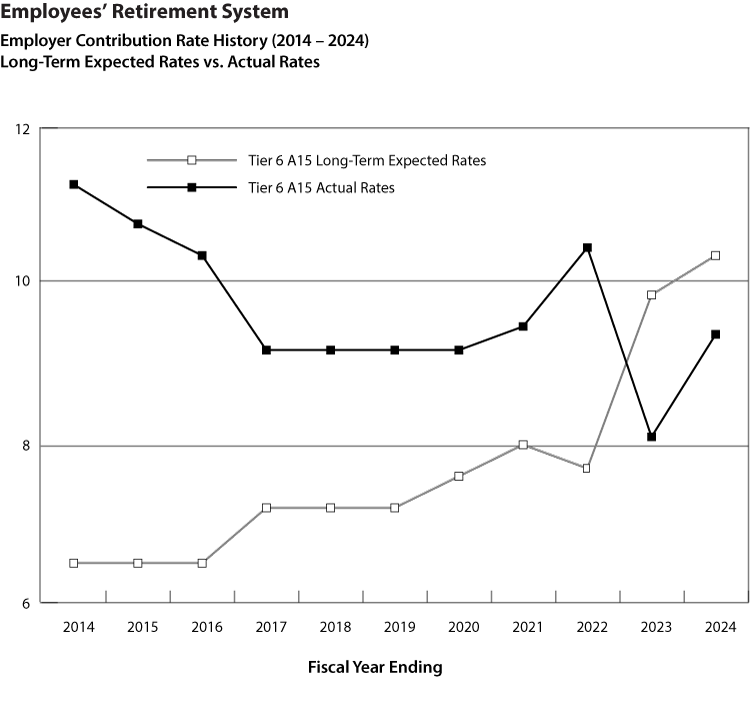

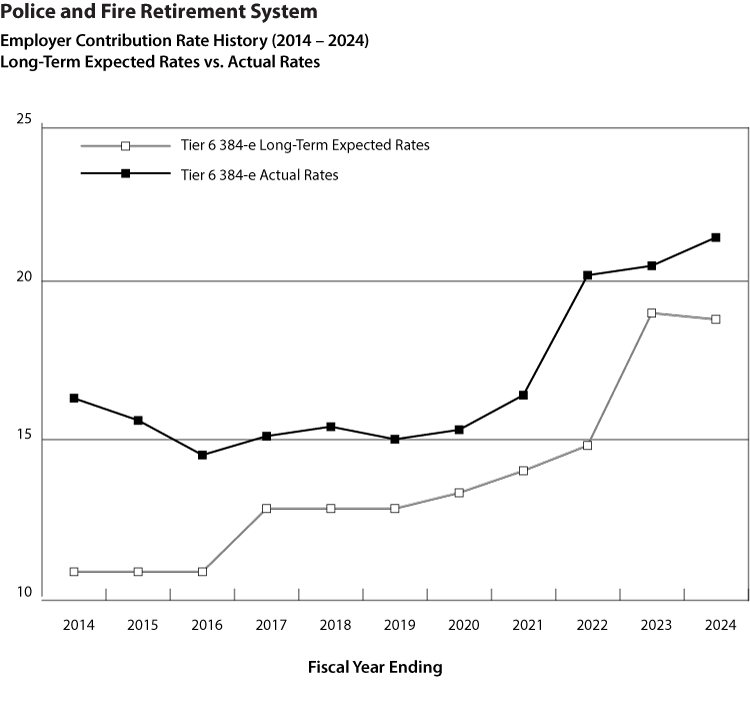

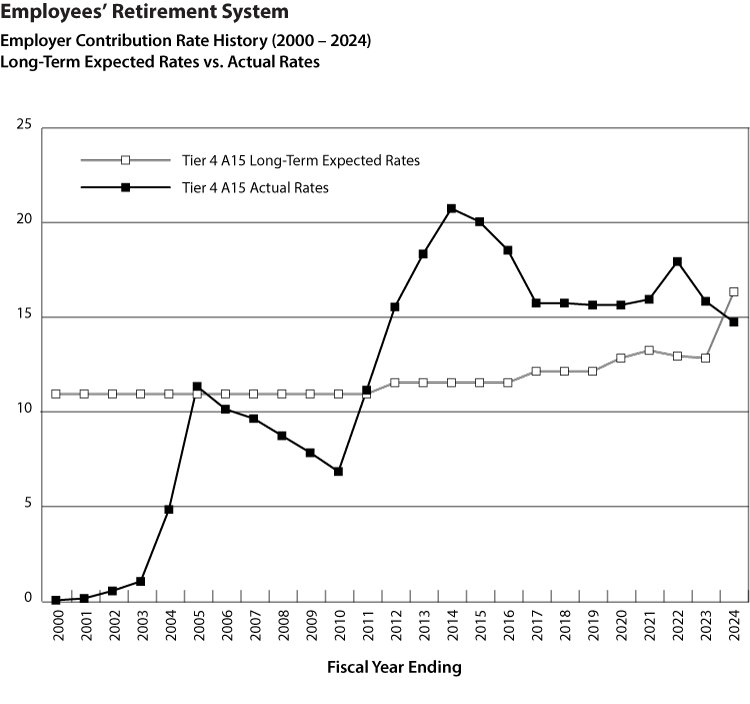

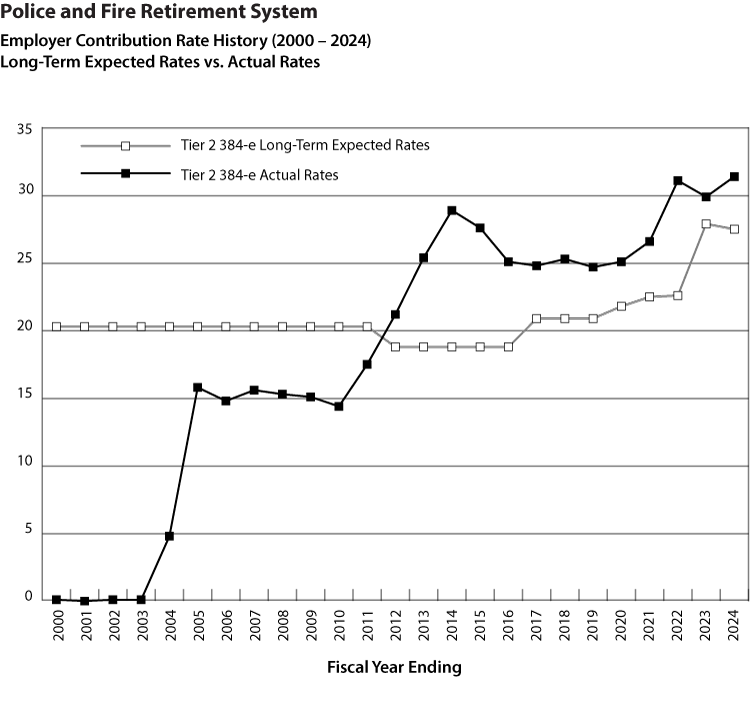

Long-term expected contribution rates are the rates that would be realized if the Fund consistently earned a 5.9 percent rate of return annually. On a long-term basis, employers should expect to pay these rates as a percentage of their payroll to NYSLRS each year. If the Fund averages more than 5.9 percent over an extended period of time, employers should expect their contribution rate to be less than the long-term expected rate. If the Fund earns less than 5.9 percent over an extended period of time, employers should expect their contribution rate to be higher than the long-term expected rate.

You can review long-term expected rates by retirement system, tier and plan by clicking on the Final Rates links provided on on the About Employer Contribution Rates – Overview page.

You can compare the long-term expected rates to the actual annual contribution rates from for both Employees’ Retirement System (ERS) and Police and Fire Retirement System (PFRS) employers on the charts below.

Most ERS members are enrolled in the Article 15 retirement plan. Most PFRS employers offer their employees the 384-e retirement plan, which allows members to retire after completing 20 years of service.

Rev. 2/23