Almost three million New York households are dealing with housing costs that consume more than 30% of their household income, with 1 in 5 households experiencing a severe cost burden of more than 50% of their income going to pay for housing, according to a report by State Comptroller Thomas P. DiNapoli. This is the third report in the State Comptroller’s “New Yorkers in Need” series. Previous reports focused on poverty and food insecurity.

“For too many New Yorkers, finding and keeping an adequate and affordable place to live has become more and more difficult,” DiNapoli said. “Rising costs are stretching household budgets and forcing trade-offs with other essentials, like food and health care. The consequences of housing insecurity are wide-ranging and while low-income renters are the most cost-burdened, these financial pressures are increasingly felt by middle class households. Action is needed by all levels of government.”

Housing insecurity is defined as the absence of, or limited or uncertain availability of, safe, adequate and affordable housing. DiNapoli’s report examines three categories of housing insecurity: high housing costs; physical inadequacy, including overcrowding and substandard conditions; and housing stress, including evictions and foreclosures, which may result in homelessness.

Major findings include:

- Cost burdens are the main cause of housing insecurity: In 2022, New York had 2.9 million households paying 30% or more of their income for housing. This constituted 38.9% of households, the 3rd highest rate of housing cost burden among states.

- New York consistently ranks as one of the states with the highest cost burden for both owners (3rd in 2022) and renters (13th in 2022). The share of New York’s renters who are cost burdened (52.4%) is far greater than the share of cost-burdened homeowners (28%).

- Several factors affect cost burden, including the availability of housing at a variety of price points. Between 2012 and 2022, New York added 462,000 housing units, an increase of 5.7%. This was far below other states, with New York ranking 32nd in the nation. Owner-occupied housing grew by 8.3% compared to 6.4% for renter-occupied housing. Monthly household costs grew more rapidly for renters (39%) than for homeowners (28%) between 2012 and 2022.

- Rates of rental cost burden increased across all income groups since 2012. Renters earning less than the median tend to be most burdened: 9 in 10 renter households with incomes below $35,000 experienced a cost burden, while 16% of households with income greater than $75,000 were burdened in 2022. Between 2012 and 2022 the greatest increases in rates of cost-burden were among renters with household income between $35,000 - $49,999 and between $50,000 - $74,999.

- Physically inadequate housing appears less prevalent than cost burden. Only 5% lived in crowded housing and less than 1% had housing with inadequate plumbing or kitchen facilities.

- Significant racial disparities exist among households suffering from housing insecurity. In New York, 55% of households headed by a Hispanic person, 50% of households headed by a Black or African American person and 48% of households headed by an Asian person had at least one housing insecurity problem, compared with 31% of households headed by a white person. People experiencing homelessness were also disproportionately Black, Hispanic or Latino.

- Housing insecurity among seniors exceeds the national average. 43% of New York households with a person 75 and older and 37% of those with at least 1 person 62 to 74 faced housing insecurity, compared to 34% and 29%, respectively, nationally.

- New York’s rate of homelessness, at about 5 per 1,000 people, was the highest in the nation and more than double the national rate of about 2 homeless per 1,000 people in Jan. 2023. The number of homeless grew by more than 39% in the most recent year, due in part to the influx of asylum seekers in New York City.

Regional Breakdown

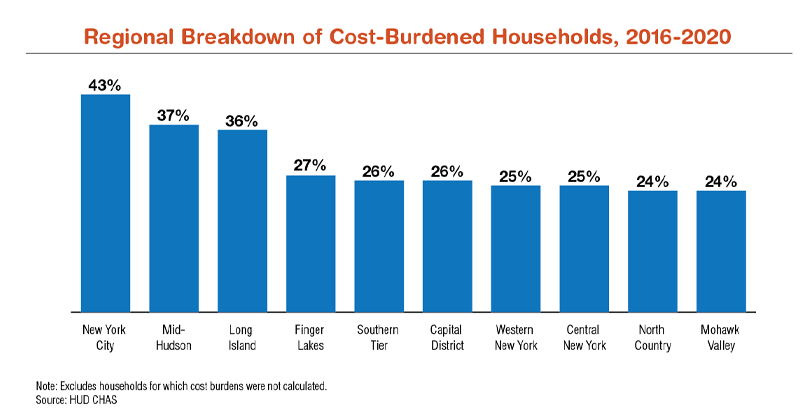

For both owners and renters, housing cost burdens are highest in New York City (43% of households). More than one-third of households in the Mid-Hudson and Long Island regions are cost-burdened, higher than regions in the rest of New York, where aggregate burdens range from 24% in the North Country and Mohawk Valley to 27% in the Finger Lakes. At least 40% of rental households were burdened across all regions. The greatest share was on Long Island (51.4%), which has the smallest share of renters (under 20%). While more than 30% of owners were cost-burdened in downstate regions, less than 18% were in upstate regions.

High-cost burdens are more prevalent in urban areas. More than one-third of households (owners and renters) were burdened in Buffalo, Syracuse, Albany, Rochester and Yonkers. Approximately half of all renters were burdened.

Recommendations:

As noted in the report, addressing this crisis will require action by all levels of government and must be geared toward increasing the supply and diversity of housing and providing increased assistance to renters to ease housing insecurity, including homelessness. The scale of the problem is beyond the capacity of state and local governments alone to solve and requires the federal government to take the lead in crafting solutions and providing resources to bolster a portion of the safety net that is letting too many Americans fall through.

DiNapoli recommended:

- Increase federal assistance, including increasing the number of Housing Choice Vouchers (HCVs) and authorizing additional Low-Income Housing Tax Credits (LIHTCs) and Private Activity Bonds (PABs). LIHTC is the nation’s largest source of affordable housing financing, and changes to LIHTCs should be considered to incentivize the development of more affordable housing units.

- Improve transparency and effectiveness of current state and local resources and programs. The state should enhance reporting around resources allocated for housing, including capital spending, tax credits, operating spending and local assistance. In addition, the state must better administer current housing programs, as recommended by audits completed by the Office of the State Comptroller.

- Stimulate community-appropriate development actions and enhance the diversity and supply of housing stock. This should build on the Executive’s recent actions to provide incentives to certified “pro-housing” communities. Community control and input into development is essential. Local governments should review zoning regulations, and the state should provide planning and logistical support to communities willing to take action and approve statutory changes requested by local governments with a home rule message.

- Mitigate evictions and homelessness, including determining how much financial support should continue for the Emergency Rental Assistance and other programs and continuing funding for legal representation for low-income households.

Report

New Yorkers in Need: The Housing Insecurity Crisis

Other "New Yorkers in Need" Reports

New Yorkers in Need: A Look at Poverty Trends in New York State for the Last Decade

New Yorkers in Need: Food Insecurity and Nutritional Assistance Programs

Other Housing Reports

The Cost of Living in New York City: Housing

Audits

Housing Trust Fund Corporation – Internal Controls Over and Maximization of Federal Funding for Various Section 8 Housing Programs and the COVID Rent Relief Program

Division of Housing and Community Renewal – Physical and Financial Conditions at Selected Mitchell-Lama Developments in New York City

Division of Housing and Community Renewal – Physical and Financial Conditions at Selected Mitchell-Lama Developments Located Outside New York City