COVID-19 Relief Program Tracker

A quote from State Comptroller Thomas P. DiNapoli: "My office is committed to full transparency in government spending. New York is seeing an historic level of federal funding right now and our job is to follow the money and ensure funds are used wisely and administrated efficiently." End of quote.

The Office of the State Comptroller has created this dashboard to track certain federal relief funds received during the pandemic and eight programs that offer targeted assistance to New Yorkers most severely impacted by the COVID-19 pandemic.

The tracker explains when each funding stream or program was authorized, how it is designed and how much has been received and spent to date. The tracker will be updated monthly and will be expanded over time as more information becomes available. We hope the information presented here can be used to help New Yorkers understand how federal aid is used and to inform future conversations about budget investments.

Select a relief program to view its funding and spending, or download this month’s data for all programs.

Data through December 31, 2023

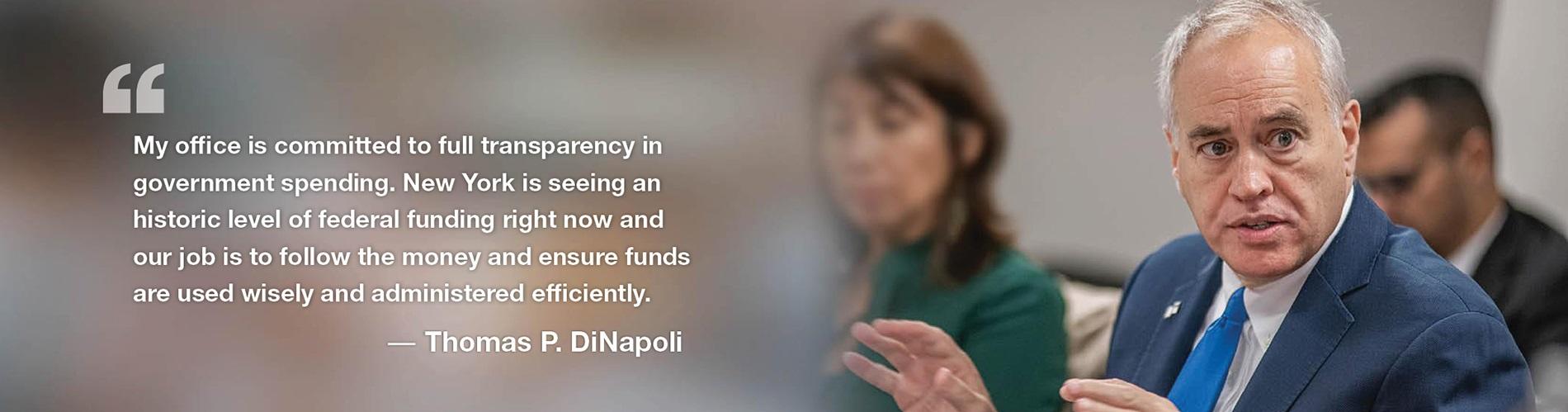

- Elementary and Secondary School Emergency Relief

Program Highlight

$14.0 billion in general aid for elementary and secondary education.

- Funds received to date: $9.5 billion

- Funds spent to date: $9.6 billion

Authorizing Legislation

- $1.0 billion, Coronavirus Aid, Relief, and Economic Security (CARES) Act

- $4.0 billion, Coronavirus Response and Relief Supplemental Appropriations (CRRSA) Act

- $9.0 billion, American Rescue Plan

Description

This funding administered by the State Education Department supports pandemic preparedness and response efforts, including maintaining operations and continuity of services, staff training and educational technology, and addressing learning loss related to the pandemic. Of the $14.0 billion in anticipated resources, $2 billion was spent in SFY 2021-22, and the balance is expected to be spent in subsequent years through SFY 2024-25.

See Technical Notes

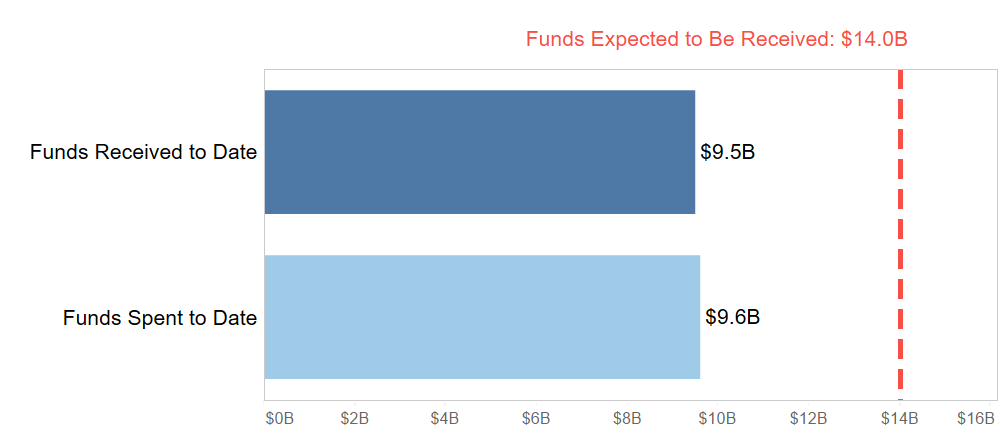

- State and Local Fiscal Recovery Fund

Program Highlight

$13.5 billion for State and Local Fiscal Stabilization ($12.7 billion for State purposes; $774 million for local purposes).

- Funds received to date: $14.3 billion (including interest earned)

- Funds spent to date: $7.6 billion

- Non-entitlement funds passed through to local governments: $774.2 million

- Transfers to General Fund: $6.85 billion

Authorizing Legislation

American Rescue Plan

Description

This program is administered by the Division of the Budget. New York State has received $12.7 billion in general relief aid that is available for a wide range of eligible State purposes. The SFY 2023-24 First Quarterly Update of the Financial Plan assumes that these funds will be spent from the General Fund over four years: $4.5 billion in SFY 2021-22; $2.35 billion in SFY 2022-23; $2.25 billion in SFY 2023-24; and $3.645 billion in SFY 2024-25.

In addition, New York State received $774 million in “pass through” funding to eligible “non-entitlement” local governments, with all $774 million for these local governments disbursed as of July 31, 2022. These local governments typically serve a population under 50,000 and were ineligible to receive direct payments due to federal program restrictions. These values do not reflect $9.94 billion in funding to New York City and other “entitlement” communities that represent larger populations and authorized to receive federal funding directly.

Download Detailed Payment Information on Non-Entitlement Local Governments (Excel)

See Technical Notes

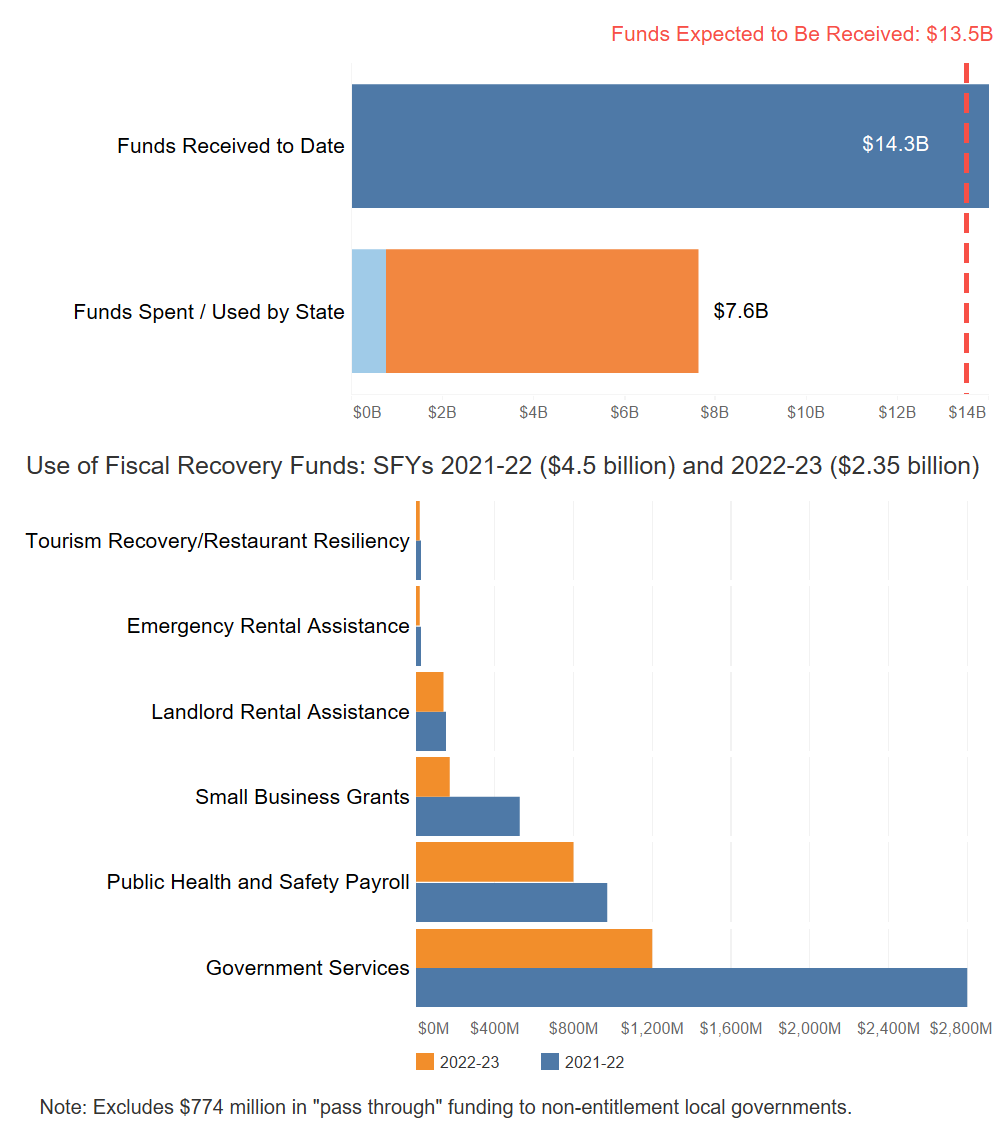

- Child Care Services

Program Highlight

$2.5 billion for child-care services, subsidies and provider stabilization grants.

- Funds received to date: $2.1 billion

- Funds spent to date: $2.2 billion

Authorizing Legislation

- $163.6 million, Coronavirus Aid, Relief, and Economic Security (CARES) Act

- $468.8 million, Coronavirus Response and Relief Supplemental Appropriations (CRRSA) Act

- $1.8 billion, American Rescue Plan

Description

This funding administered by the Office of Children and Family Services (OCFS) is intended to expand access to child care, lower costs to families, and provide stability for providers. Under the SFY 2023-24 Enacted Budget, up to $1.744 billion in federal funding is available for stabilizing currently operating or closed child care providers, with remaining funding to include expanding eligibility for subsidies, limiting co-pays for families receiving subsidies and other costs. Actual spending was $58.7 million in SFY 2020-21, $986.7 million in SFY 2021-22 and $343.0 million in SFY 2022-23. The SFY 2023-24 Enacted Budget reprograms remaining federal funding to make $277 million available for a second round of stabilization grants and $500 million available for a third round of stabilization grants. The SFY 2023-24 Enacted Budget also makes $376 million available to supplement existing federal, State and local funding for subsidized child care, including increasing eligibility for family subsidies from 300 percent of poverty (or $83,250 for a family of four) to 85 percent of State median income (or $99,250 for a family of four).

See Technical Notes

- Emergency Rental Assistance

Program Highlight

$4.5 billion in federal ($2.9 billion) and State ($1.6 billion) funding for rental assistance.

- Federal funds received to date: $2.9 billion (including interest earned)

- Federal funds spent to date: $2.6 billion

- State funds received to date: $1.6 billion

- State funds spent to date: $1.5 billion

Authorizing Legislation

Federal funds: $2.9 billion

- $1.5 billion, Consolidated Appropriations Act

- $1.4 billion, American Rescue Plan

State funds: $1.6 billion

- Chapters 53 and 418, New York State Laws of 2021: $250 million

- Chapter 53, New York State Laws of 2022: $925 million

- Chapter 53, New York State Laws of 2023: $391 million

Description

This funding administered by the Office of Temporary and Disability Assistance (OTDA) is intended to provide economic relief to low- and moderate-income tenants and help landlords obtain rent due. As of December 31, 2023, over $4.6 billion of federal and State aid has been made available for emergency rental assistance. A July 26, 2023 federal notice indicated the federal government does not intend to perform further reallocation of funds. Federal funds total under $3.1 billion, with over $2.9 billion received and administered directly by the State (reflecting federal reallocations to the State, as well as reallocations and the voluntary recapture of funds to/from locally administered programs) and a net $154 million paid directly to local jurisdictions. The locally administered payments are excluded from the tracker, but information is available for download below. The State is providing close to $1.6 billion, including $250 million enacted in SFY 2021-22, $925 million enacted in SFY 2022-23 and $391 million enacted with the SFY 2023-2024 Budget. For program information visit the Office of Temporary and Disability Assistance website.

See Technical Notes

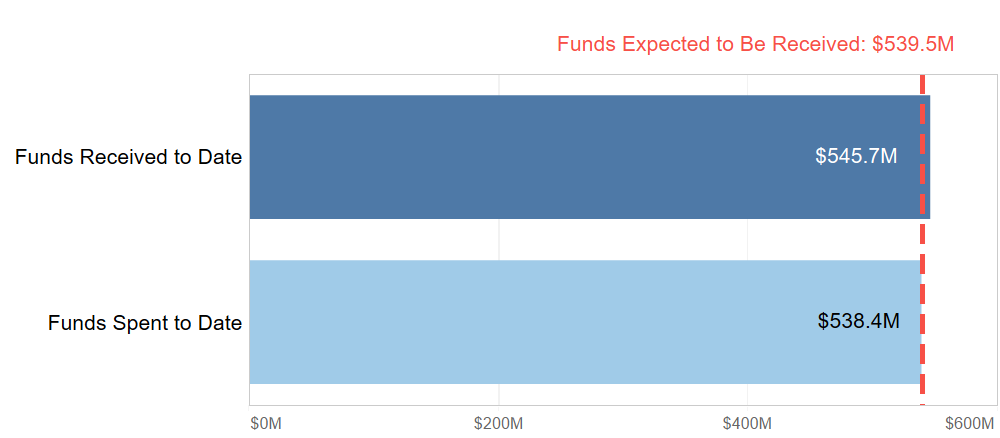

- Homeowner Assistance Fund

Program Highlight

$539.5 million to mitigate financial hardships faced by homeowners in the pandemic.

- Funds received to date: $545.7 million (including interest earned)

- Funds spent to date: $538.4 million

Authorizing Legislation

American Rescue Plan

Description

This program is intended to prevent homeowner mortgage delinquencies, defaults, foreclosures, loss of utilities or home energy services, and displacements of homeowners experiencing financial hardship. The program is administered by New York State Homes and Community Renewal. A program plan was approved by the U.S. Department of the Treasury on November 18, 2021. The program is no longer accepting applications as of February 19, 2022, and instead applicants can register for placement on a waiting list.

See Technical Notes

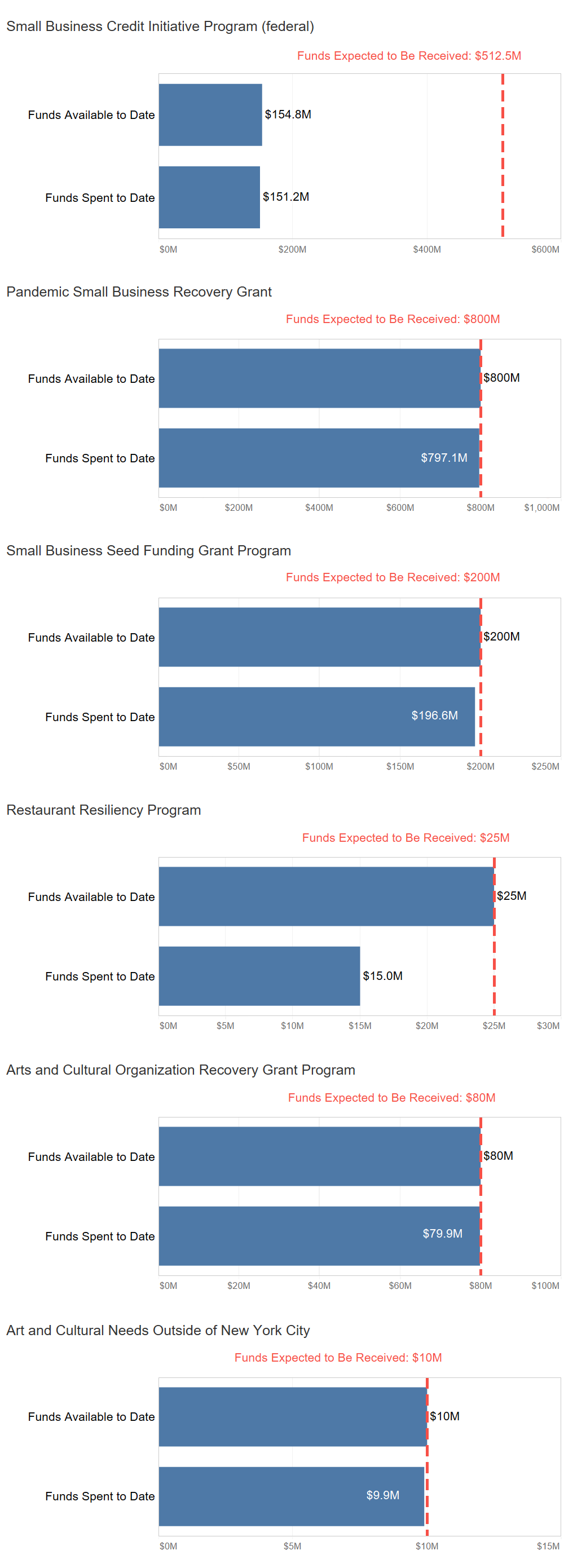

- Small Business Recovery

Program Highlight

$2.0 billion in federal ($512.5 million) and State ($1.5 billion including $385 million in tax credits) funding for small businesses, restaurants and arts and cultural organizations economic recovery.

- Federal funds received to date: $154.8 million

- Federal funds spent to date: $151.2 million

- State funds available: $1.1 billion

- State funds spent to date: $1.1 billion

Authorizing Legislation

Federal funds: $512.5 million

- American Rescue Plan

State funds: $1.1 billion (and $385 million in tax incentives)

- Chapters 53 and 59, New York State Laws of 2021

- Chapter 53, New York State Laws of 2022

- Chapter 59, New York State Laws of 2022

Description

State entities will administer $2.0 billion of support for small business recovery, including:

- $512.5 million of federal funds administered by Empire State Development for the State Small Business Credit Initiative (SSBCI) program to increase access to credit for small businesses impacted by the pandemic. The U.S. Department of the Treasury has allocated to New York State $501.6 million for capital purposes and $10.9 million for technical assistance. The $150 million rescission to the SSBCI resulting from the Fiscal Responsibility Act of 2023 affects only technical assistance funding. Application for, and receipt and status of, this allocation for New York State is unclear as of June 30, 2023.

- $800 million of State funds for grants for small businesses.

- $25 million administered by the Departments of Health and Agriculture and Markets for the Restaurant Resiliency grant program.

- $80 million administered by the Council on the Arts for the Arts and Cultural Organization Recovery Grant program. $40 million was included in the SFY 2021-22 budget and an additional $40 million was added in SFY 2022-23. An additional $10 million was added in the SFY 2022-23 Enacted Budget for art and cultural needs outside of New York City.

- $200 million added in the SFY 2022-23 Enacted Budget for the Small Business Seed Funding Grant Program.

- $385 million in tax credits covering COVID related costs for capital, food services and music and theater recovery. Because the tax credits must be applied for and can be claimed over multiple tax years, status information for $385 million in tax credits for the Pandemic Recovery and Restart Program and COVID-19 Capital Costs Tax Credit Program are excluded from this reporting.

Download Payment Information for Small Business Recovery Programs (Excel)

See Technical Notes

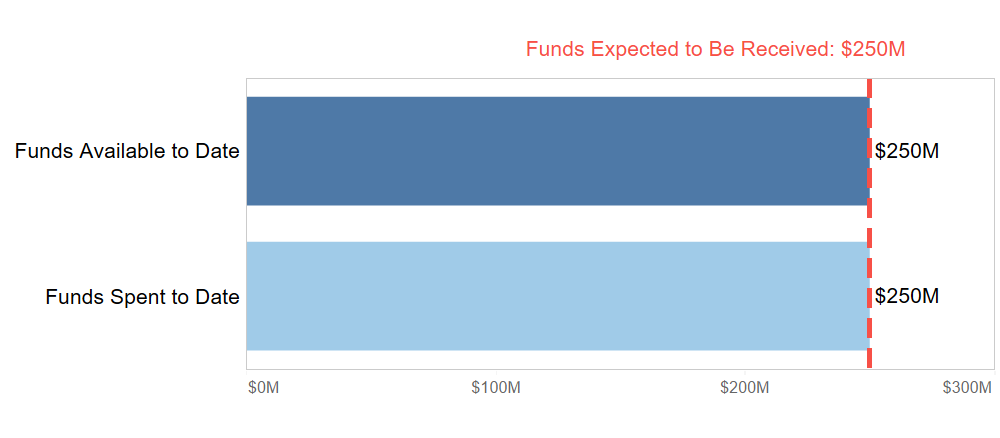

- Utility Arrears Relief Program

Program Highlight

$250 million in State funding to reduce utility bill arrears of customers eligible for energy assistance programs that accrued from March 7, 2020 through March 1, 2022.

- State funds available: $250 million

- State funds spent to date: $250 million

Authorizing Legislation

State funds: $250 million

- Chapter 53, New York State Laws of 2022

Description

The Enacted Budget for SFY 2022-23 established a $250 million fund to address low-income residential customer arrears. In June 2022, the Public Service Commission (PSC) established a program to allocate the $250 million among private and municipal utilities based on their share of eligible customers in arrears. The PSC also authorized utilities to allocate additional funds (which would be recovered in customer bills) to address low-income customer arrears in excess of the appropriation. In February 2023, the PSC adopted an additional order in this proceeding. The new order addressed COVID-19 related arrears accrued during the period of March 7, 2020 through March 1, 2022 for residential customers with higher incomes that are not eligible for energy assistance programs and small commercial customers. The order allocated additional utility rate payer funds and shareholder funds for this purpose.

See Technical Notes

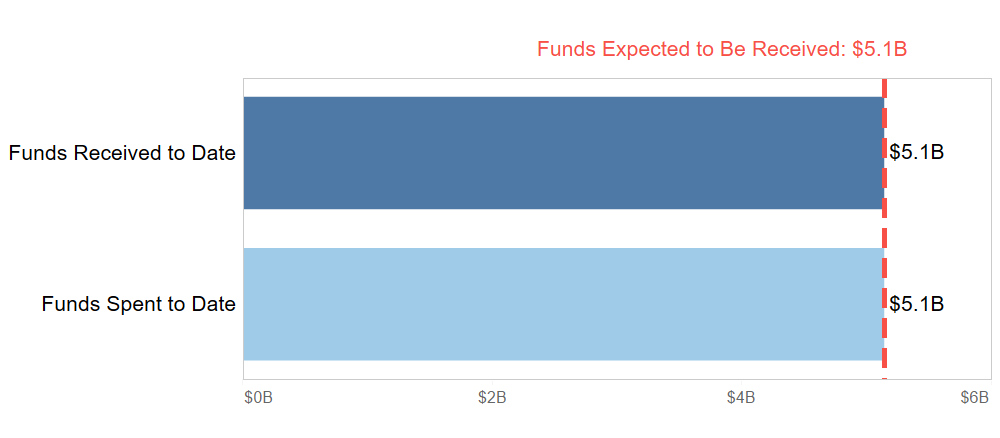

- Coronavirus Relief Fund

Program Highlight

$5.1 billion for State costs related to COVID-19 response.

- Funds received to date: $5.1 billion (and additional interest earned)

- Funds spent to date: $5.1 billion

Authorizing Legislation

Coronavirus Aid, Relief, and Economic Security (CARES) Act

Description

This funding administered by the Division of the Budget is available for certain health and public safety payroll costs and other costs related to the pandemic, thus reducing or avoiding unplanned State costs. Of the $5.1 billion disbursed since April 2020, the majority has been used for State agency operating costs. In addition, the CRF was also used to pay interest costs on short-term notes issued for cash flow relief in SFY 2020-21.

Download Detailed Spending Information on State Agencies (Excel)

See Technical Notes

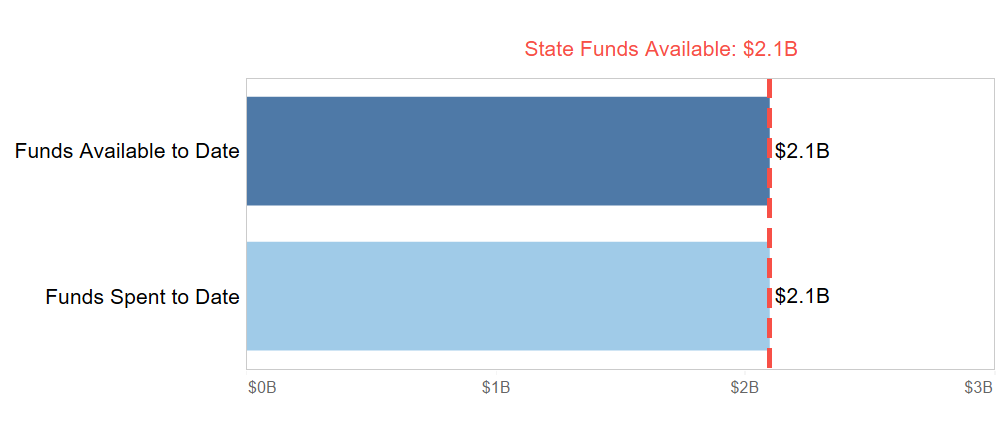

- Excluded Workers Fund

Program Highlight

$2.1 billion in State funding for income support for workers ineligible for other assistance programs.

- State funds available: $2.1 billion

- State funds spent to date: $2.1 billion

Authorizing Legislation

Chapter 53, New York State Laws of 2021

Description

Unlike many of the other relief programs, the Excluded Workers Fund is funded by State General Fund resources; the program is administered by the Department of Labor. It will provide benefits of either $15,600 or $3,200 less taxes to individuals that lived in the State before March 27, 2020 and continue to live in the State, are not eligible for unemployment insurance or other COVID-19 income relief programs and earned less than $26,208 in the 12 months before April 19, 2021.

See Technical Notes

Download Data

All Programs

State and Local Fiscal Recovery Fund

Coronavirus Relief Fund

Emergency Rental Assistance

Small Business Recovery

Technical Notes

Funds Expected to Be Received

Anticipated funding (federal and/or State) available for New York State or for “pass through” to other recipients, such as childcare providers, landlords, or local governments. These estimates are from sources including the Division of the Budget, legislative appropriations, federal and State agencies, and Federal Funds Information for States. Funds paid directly by the federal government to beneficiaries are not included.

Funds Received

Federal aid received by the State of New York, either for direct program administration or pass through to other recipients. In some cases, the State has already received all the funding for which it is eligible; in other cases, the State will be reimbursed by the federal government for spending made under a certain program. Funds paid directly by the federal government to beneficiaries are not included. Interest earned on received funds must be placed back into the program and used in a manner consistent with the guidance provided.

Funds Spent

Payments made by the State, either to direct beneficiaries or as a pass through to other recipients. Such payments may be backed with federal or State funds. Disbursements do not include disbursements made by entities other than the State, such as local governments or school districts, that receive federal funding directly. Executive Branch agencies may report different “spending” values that reflect stages of program management that occur prior to final payment, such as request for proposal amounts, awards or contract encumbrances. Disbursements may exceed estimated program receipts due to timing differences between State payments and federal reimbursement. Funds paid directly by the federal government to beneficiaries are not included.