File Annual Financial Report (AFR) here

- Enrollment Instructions [pdf]

- Notes to Financials Template [docx]

- Interactive User Manual

- Chart of Accounts Lookup

- Accounting and Reporting Manuals (ARMs)

- Accounting Bulletins

- Annual Report Filing Deadlines

- Fiscal Year End Dates and AFR deadlines for all counties, cities, towns and villages [xlsx]

- Municipalities with Odd Fiscal Year Ends [pdf]

- NYSLRS Employer Web Portal - Financial Statements and Supplementary Information

- Notice to CFOs [pdf]

Instructional Videos

The videos listed below contain tutorials on how to navigate and complete the Annual Financial Report. For more detailed instructions please refer to the Interactive User Manual in the Applications Resources section of this webpage. You may also contact our office at 1-866-321-8503, option 4.

- Application Navigation

Navigation of the Annual Financial Report Instructional Video

Description Length This tutorial provides a demonstration of how to navigate through all sections of the AFR. 8:23

- Fund Completion

How to Complete a Fund Instructional Video

Description Length This tutorial provides a demonstration of how to enter data, resolve fund validation rules, and mark a fund complete. 6:29 Related Resources:

- Webinar presented

- Validation Rules

Financial Statement Validation Rules Instructional Video

Description Length This tutorial explains how to resolve critical and non-critical validation rules that apply to financial statements. 5:02 Related Resources:

- Statement of Indebtedness

Statement of Indebtedness Instructional Video

Description Length This tutorial demonstrates how to complete the Statement of Indebtedness and resolve triggered validation rules. 8:51 Related Resources:

- Bond Repayment Schedule

Bond Repayment Instructional Video

Description Length This tutorial demonstrates how to complete the Bond Repayment Schedule and resolve triggered validation rules. 4:47 Related Resources:

- Bank Reconciliation Schedule

Bank Reconciliation Schedule Instructional Video

Description Length This tutorial demonstrates how to complete the Bank Reconciliation schedule and resolve triggered validation rules. 7:20 Related Resources:

- Employee and Retiree Benefits Schedule

Employee and Retiree Benefits Schedule Instructional Video

Description Length This tutorial demonstrates how to complete the Employee and Retiree Benefits schedule and resolve triggered validation rules. 6:22 Related Resources:

- Bulk Load (Import) Feature

Bulk Load Instructional Video

Description Length This tutorial demonstrates how to use the Bulk Load feature to import data into the financial statements of the AFR. 8:16 Related Resources:

Summary of Annual Financial Reporting Changes (Effective Fiscal Years Ending in 2023) [.pdf]

- Financial Statements

- Municipalities that maintain sub-funds will aggregate this activity into one fund. Sub-funds will no longer be reported separately.

- Police and Fire retirement system contributions will be reported separately. Fire contributions are to be accounted for in the new code 9016.8 – Fire Retirement – Employee Benefits.

- Enterprise funds will require the reporting of adopted budget information. Previously, information from enterprise fund budgets was not required.

- Reporting of negative values in the financial statements will be very limited. In most cases, issues resulting in a negative entry will need to be resolved by reporting in the appropriate account code in the Annual Financial Report (AFR). For example:

- Cash must be reported as a positive amount, and negative cash (if any) must be reported (as a positive number) in the new code 633 – Due to Financial Institution for Overdrawn Accounts.

- Bank Reconciliation

- Bank accounts will be associated with their respective funds in the financial statements.

- Fire District Questionnaire

- Fire districts will be required to report their statutory spending limit.

- Energy Costs and Consumption

- The Energy Costs and Consumption schedule will not be collected in the AFR.

- Statement of Indebtedness

The chart below indicates the changes in Statement of Indebtedness reporting from the current AUD to the new AFR:

Current Annual Update Document (AUD) New Annual Financial Report (AFR) Debt issuances broken out as separate debt records if issuance has multiple purposes. Debt issuances reported as a single debt record, even if there are multiple purposes. Interest rates are reported for each debt issuance. Interest rates are not reported. Interest paid is not reported in the schedule. Interest paid is reported for each debt record. Bond Anticipation Note (BAN) renewals reported on SOI by updating maturity dates. BAN debt records will collect amount renewed and the amount of any new money issued. Debt records grouped by constitutional debt limit status (exempt and non-exempt). Exempt status from constitutional debt limit is not reported. Paid amounts for bonds and bond anticipation notes include refunded amounts. Any refunded portion of a bond or bond anticipation note is reported on a separate line from principal payments. Debt that is issued or paid by proprietary funds is reported the same as debt supported by governmental funds, resulting in several system edits that require explanation. Users can indicate whether debt is issued for a proprietary fund or whether debt payments are made from proprietary funds to avoid unnecessary edits. In addition to the above, the new AFR will also require users to:

- Indicate whether the debt is issued by the Environmental Facilities Corporation (bonds and BANs only),

- Indicate whether the debt is administered by the United States Department of Agriculture (bonds only),

- Indicate whether the debt was a private sale and, if so, provide the name of the lender,

- Identify which fund(s) is (are) responsible for servicing the debt,

- Provide an explanation for any debt that has an outstanding balance beyond its maturity date, and

- In the case of a bond refunding, indicate whether the refunding was current or advanced.

- Bond Repayment Schedule

This new supplemental schedule will collect the total bond principal and interest due for each year through the final maturity of all bonds reported on the statement of indebtedness. All principal and interest payments for bonds should be combined and reported in one schedule. An example is shown below.

Fiscal Year Ending Aggregate Bond Principal Payments Aggregate Bond Interest Payments Aggregate Principal and Interest Due Remaining Principal Balance 2023 $5,000 $1,000 $6,000 $10,700 2024 $5,200 $800 $6,000 $5,500 2025 $5,500 $500 $6,000 $0 Total $15,700 $2,300 $18,000

- Bulkload of Financial Statements

The AFR application has recently added a bulkload feature for the financial statements. See a summary of that feature in the document below.

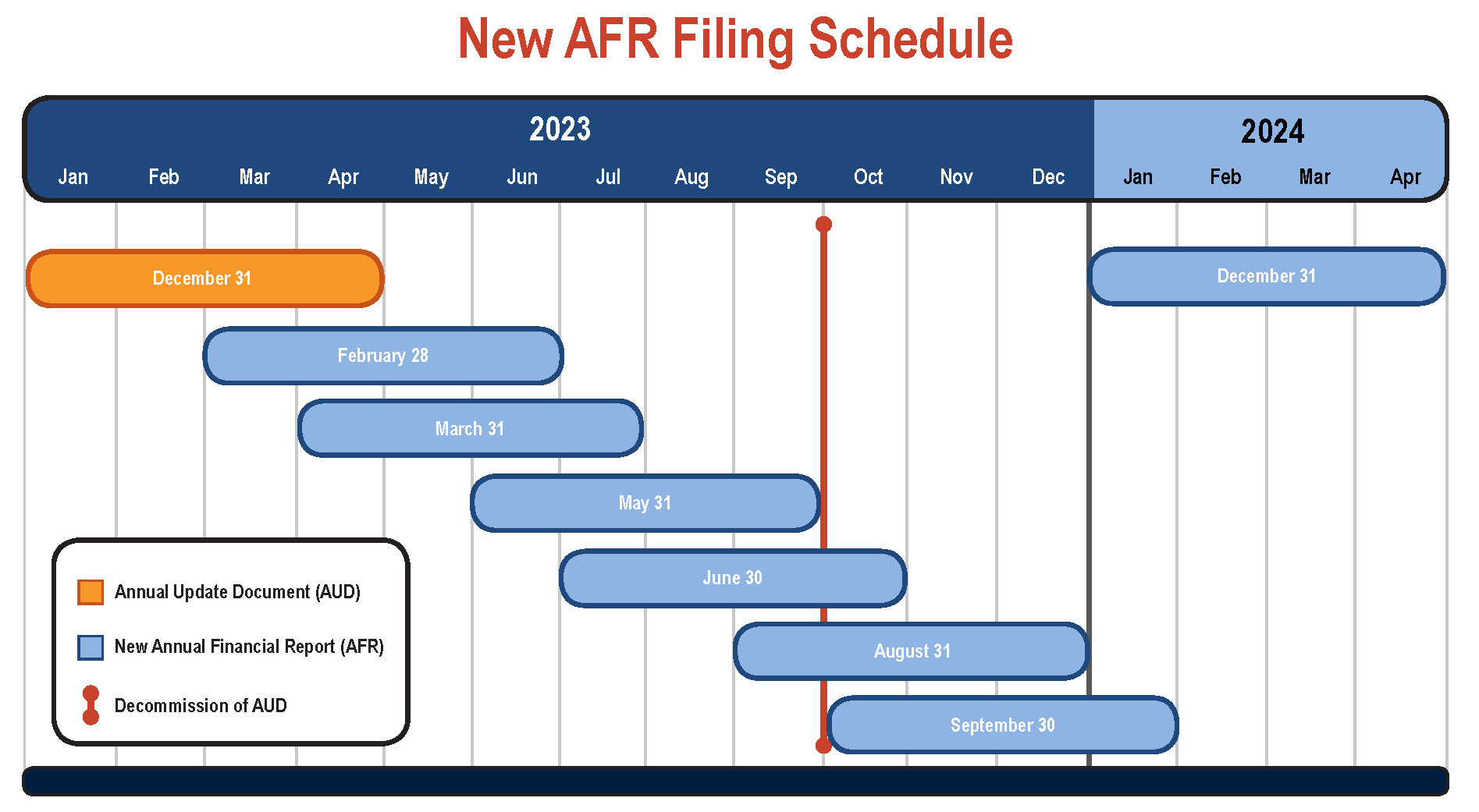

The graphic above illustrates when municipalities will transition to submitting their annual reports to the Office of the State Comptroller using the new Annual Financial Report (AFR) application. The illustrated filing periods are based on the different fiscal year ends used by local municipalities and include the longest possible filing deadline of 120 days.

If you have any questions regarding the new Annual Financial Report, please contact our staff by filling out and submitting the form below.