The debt burden of a governmental entity creates fixed costs that directly affect its ability to provide current services, as well as its long-term fiscal health. High borrowing levels may:

- Indicate reduced ability to support current programs with current revenues.

- Force future program reductions, increased taxation or additional future borrowing.

- Limit the capacity to finance future capital assets and grants.

New York State Ranks Second Highest in Outstanding Debt Nationwide

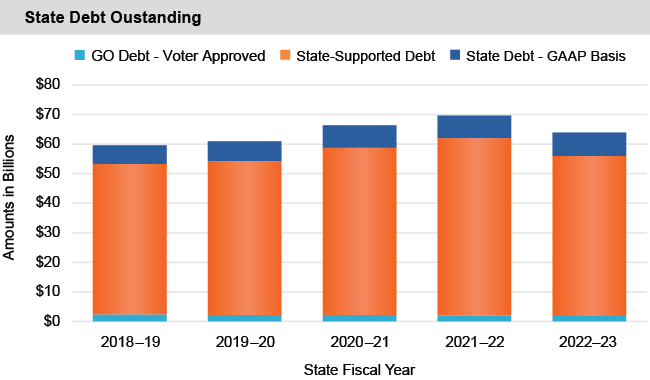

- At the end of SFY 2022-23, the State reported the following debt levels:

- $1.8 billion of constitutionally authorized, voter-approved general obligation (GO) debt, a decrease of $451 million or nearly 20 percent since SFY 2018-19.

- $55.9 billion of State-Supported debt, as defined in State law, an increase of $2.7 billion or 5 percent since SFY 2018-19. Nearly 97 percent of State- Supported debt outstanding is so-called “backdoor borrowing” issued by public authorities without voter approval.

- $63.9 billion of State debt reported in accordance with Generally Accepted Accounting Principles (GAAP), an increase of $4.3 billion or 7.3 percent since SFY 2018-19.

- According to Moody’s Investor Service, New York State had the second highest debt burden in 2021, behind only California. It was sixth highest among all states in their measure of debt per capita.

- At the end of SFY 2022-23, State-Supported debt per capita was $2,841. State-Supported debt was equivalent to 3.6 percent of State personal income.

- State-Supported debt outstanding is projected to grow from $55.9 to $86.5 billion over the next five years, an increase of $30.6 billion or nearly 55 percent.

- New York issues State-Supported debt to fund certain capital purpose grants to other entities, which creates State liabilities without corresponding State assets.

New York State Projects Increasing Debt Levels in Coming Years

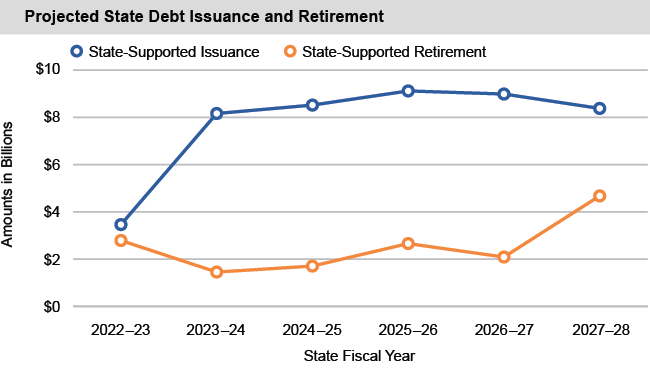

- The SFY 2023-24 Enacted Budget Five-Year Capital Program and Financing Plan projects that the State will issue over 3.4 times more debt than it will retire over the next five years, with:

- $43.2 billion of new issuances of State-Supported debt; and

- $12.6 billion of State-Supported debt retirements.

- The Debt Reform Act of 2000 defines State-Supported debt and sets limits on the amount of debt outstanding and debt service, based on affordability measures such as State personal income and All Funds Receipts. The State projects reduced statutory debt capacity over the next five years, declining to $3.7 billion in SFY 2027-28. For both SFYs 2020- 21 and 2021-22, new debt issuances were excluded from the caps on debt outstanding and debt service. The State has since resumed counting new debt issued under the caps, but continues to exclude debt resulting from the $17.9 billion issued during those two years. It also continues to authorize debt issuance for MTA purposes in excess of the 30-year maximum term limit, up to 50 years.

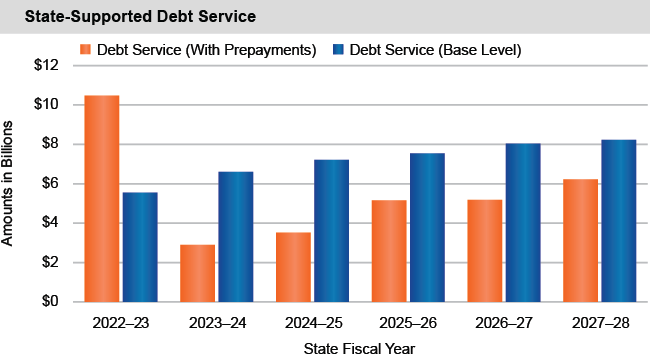

- $6 billion in State-Supported debt service otherwise due during SFY 2023-24 through SFY 2027-28 was prepaid or defeased in SFY 2022-23. Prepayments typically do not reduce the State’s interest costs, and artificially reduce reported year-over-year growth in both debt service and overall spending levels. Excluding the distortions from prepayment actions, base level debt service costs are projected to grow from $5.6 to $8.2 billion over the next five years, an increase of nearly $2.7 billion or over 48 percent.

New York State Bond Ratings

At the end of SFY 2022-23, the State’s general obligation bond ratings were assigned as follows:

- AA+ by Fitch Ratings;

- Aa1 by Moody’s Investors Service; and

- AA+ by Standard & Poor’s (S&P) Rating Services.

These ratings are one step below the highest investment grade ratings. Ratings can influence interest rates and bond pricing. Higher ratings provide greater confidence to the investment community that the issuer is willing and able to meet the financial commitments of its obligations. The rating agencies have previously cited issuing additional debt for operating purposes as a potential risk factor that may lead to a downgrade of the State’s credit rating.