The Economic Outlook: Uncertainty Remains

Looking ahead, numerous factors will continue to present risks to economic growth, and many forecasters continue to believe that a recession is more likely than not. These factors include persistent inflation, the effects of elevated interest rates due to Federal Reserve Bank actions, and global uncertainty. In New York, lagging employment and labor force recovery relative to the nation will heighten those risks. For example, nearly three years after the end of COVID-related shutdowns, other large states and most of New York’s neighboring states have returned to pre-pandemic employment levels. As of July 2023, the State had regained only 93 percent of jobs lost in March and April 2020. The rate of job gains has also lagged, only one-third the rate of the rest of the nation in the first seven months of 2023.

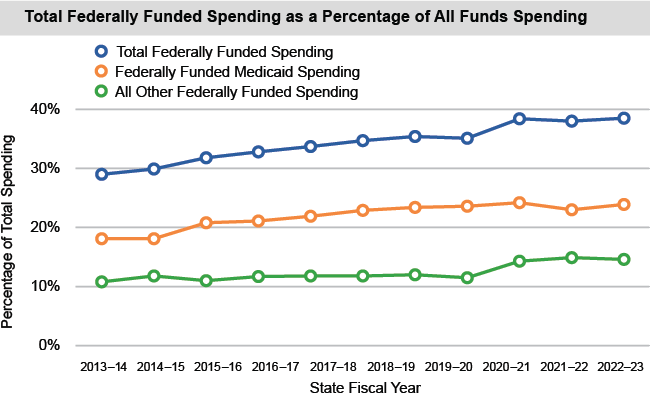

The Importance and Expected Decline of Federal Funding

Federal aid has long played an essential role in the State’s budget and its ability to provide health care, education, human services and other essential programs. In recent years, for example, new federal funding has helped to extend health coverage to more than 1.5 million additional New Yorkers. In SFY 2022- 23, federal aid was 38 percent of total State receipts, higher than the 29 percent average in the 10-year period ending in March 2020 prior to the impact of COVID-19. The largest share of federal aid supports Medicaid and other health care programs.

Significant federal COVID-19 recovery funding helped support State spending for both pandemic needs and new initiatives. However, that extraordinary aid will be depleted in the coming years. According to the Division of the Budget (DOB), disbursements related to pandemic assistance totaled $14.7 billion in SFY 2022-23, but will decline to $5 billion by SFY 2024-25 and approximately $100 million in the next two fiscal years. In addition, the State received $12.7 billion from the American Rescue Plan Act for a wide range of discretionary purposes, including the offset of lost revenues. These funds are expected to be exhausted by the end of SFY 2024-25.

Up until Federal Fiscal Year (FFY) 2020, New Yorkers consistently paid more in federal taxes than the State received in federal spending, as several reports by the Office of the State Comptroller have shown. However, the most recent report, issued in April 2023, found that every state, including New York, received more than it paid in FFY 2021. For every dollar New York paid, it received $1.51 in return; however, this was still well below the $1.70 national average.

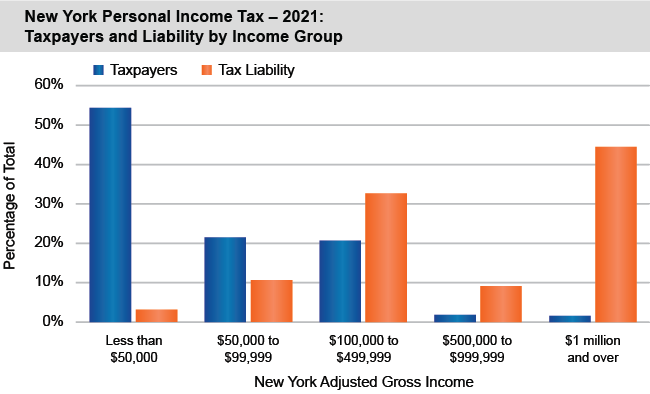

The State Relies Heavily on a Small Segment of Taxpayers

New York State’s budget relies heavily on its Personal Income Tax (PIT), which produces over half of all State tax revenues. The SFY 2021-22 Enacted Budget increased rates for high-income taxpayers and increased dependence on the personal income tax and the potential volatility of tax collections even more. High-income individuals generate a large share of PIT receipts. In 2021, the top 1.6 percent of taxpayers in New York generated 44.5 percent of all PIT liability. An economic downturn may cause taxable income and tax liability from such individuals to drop sharply because they tend to rely on non-wage income, such as capital gains, which are more volatile than wages. This disproportionate volatility in the State’s revenue mix magnifies the impacts of both good and bad economic times on the State’s budget.

Continue with Commitment to Increasing Statutory Reserves

Comptroller DiNapoli repeatedly warned in the years before the COVID-19 pandemic and ensuing recession hit New York that the State’s budgetary reserves were not sufficient to guard against unwanted spending cuts, tax increases or other actions in case of an economic downturn or catastrophic event. Unfortunately, the fiscal impacts of the pandemic proved those warnings were well founded and DOB had to rely on other budget actions, including withholding payments and raising taxes to keep the budget in balance.

More recently, progress has been made by increasing statutory rainy day reserves to a record level of $6.3 billion. When combined with other informal reserves, the State has set aside nearly $19.5 billion, which is more than 15 percent of State Operating Funds spending. The State also increased allowable annual deposits to statutory reserves to 15 percent of General Fund spending, and increased the maximum allowable balance to 25 percent of General Fund spending. The State should make efforts to increase the level of statutory reserves rather than relying on informal reserves that do not have safeguards including mandatory repayment requirements. And, while these resources are an important budget management tool, they are not a substitute for prudent fiscal practices.