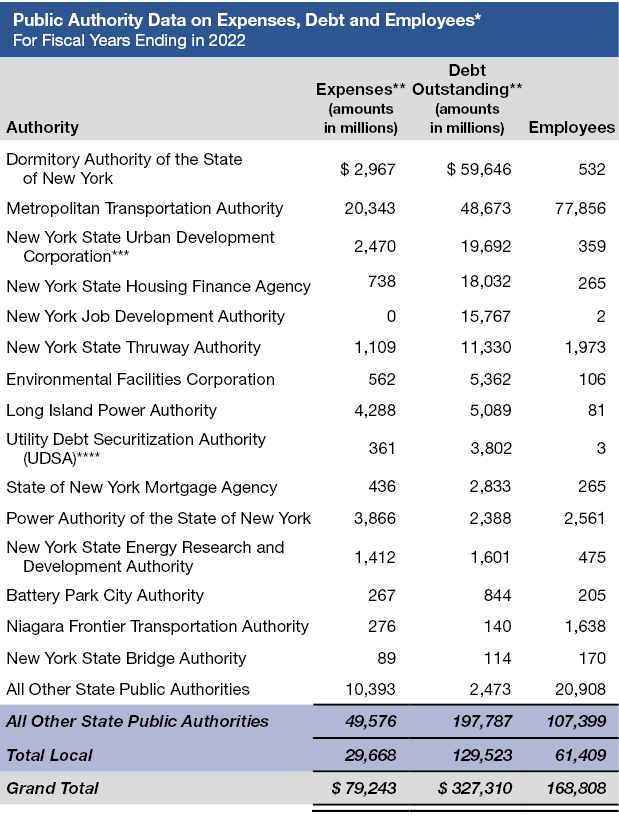

Public authorities are distinct legal entities that provide services to the public as well as to the State and local governments. New Yorkers pay for public authorities in a variety of ways including service charges, tolls, fees, and in some cases, taxes. Public authorities are generally self-supporting through their revenue-generating activities; however, in some cases, governmental financial assistance and support is provided for operating and other expenses. In 2022, public authorities and subsidiaries reported almost $88 billion in revenue and capital contributions, employed almost 169,000 people, and made $21 billion in contract payments.

The fiscal stability of the State is often intertwined with certain public authorities. In 2022, public authorities reported more than $327 billion in debt outstanding. The State’s access to public credit markets could be impaired if public authorities closely associated with the State were to default on their obligations. In addition to issuing debt for their own purposes, public authorities issue debt on behalf of the State for which the State provides the funds for repayment.

The Enacted Budget for State Fiscal Year 2023-24:

- Increased bonding authorizations for 26 programs financed through State-Supported debt issued by public authorities.

- Added one new authorization for a potential back-up to repay a loan from the State’s Short Term Investment Pool (STIP) for the New York Racing Association’s Belmont Park redevelopment, which coincided with a $455 million appropriation in the Urban Development Corporation’s capital budget; and

- Provided for a combined increase in State-Supported public authority bonding authorizations of $15.5 billion, or 10.9 percent over previous limits. Most of the bond cap increase was for economic development and transportation, and included $500 million more for the Hudson Tunnel Project, part of the Gateway Program to improve rail infrastructure between New York and New Jersey.

For more information on public authorities, please see www.osc.state.ny.us/public-authorities

* The data reported are submitted by public authorities through the Public Authorities Reporting Information System (PARIS). The data contained in PARIS and used in this section of the report are self-reported by the authorities and have not been verified by the Office of the State Comptroller. As required by Public Authorities Law, certain data submitted are required to be approved by the board of directors and/or the accuracy and completeness certified in writing by the authority’s chief executive officer and chief financial officer. Not all authorities have complied with reporting requirements for 2022.

** Numbers may not add due to rounding.

*** Certain New York State Urban Development Corporation staff are also reported as employees of the Job Development Authority.

**** Certain Long Island Power Authority (LIPA) staff are also reported as employees of the Utility Debt Securitization Authority (UDSA).