Government-wide financial statements provide a long-term view of finances. They record revenues and expenses when the earnings process is complete (full accrual basis), as opposed to when they are actually received or paid (cash basis).

Each statement breaks down the activities of State government into two types:

- Governmental activities: includes most of the State’s core services as well as general administrative support.

- Business-type activities: includes activities that are partially or fully supported by user fees.

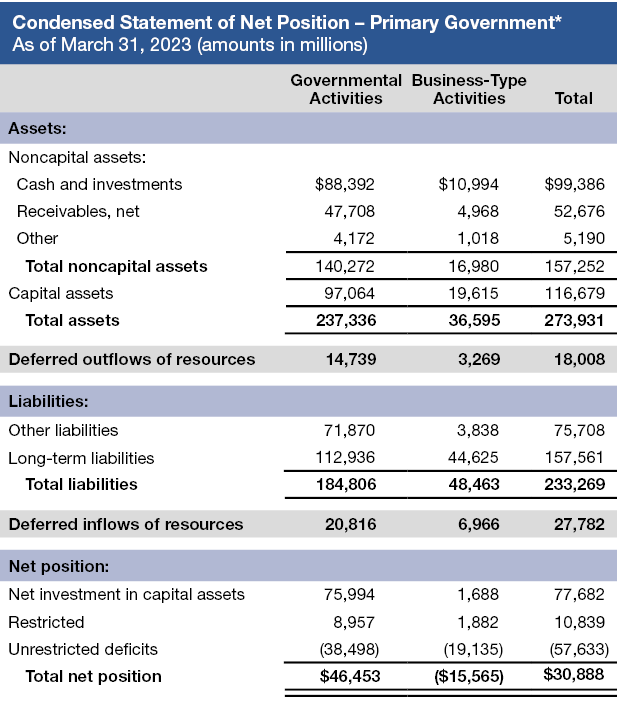

Statement of Net Position

This statement reports:

- Assets;

- Deferred outflows of resources (the consumption of net assets applicable to a future reporting period);

- Liabilities;

- Deferred inflows of resources (the acquisition of net assets applicable to a future reporting period); and

- The difference between assets and deferred outflows of resources, and liabilities and deferred inflows of resources in three categories:

- Net investment in capital assets

- Restricted net position

- Unrestricted net position (deficits)

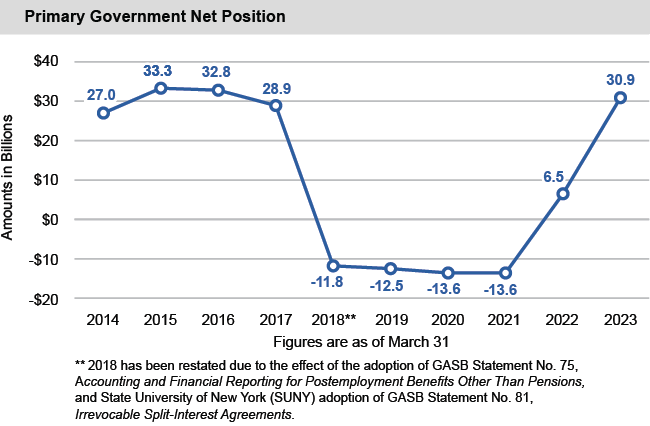

- The 2023 year over year increase in net position is most notably related to increased tax revenue resulting from a decline in unemployment, continued economic recovery from COVID-19, and the effects of inflation on consumption and use taxes.

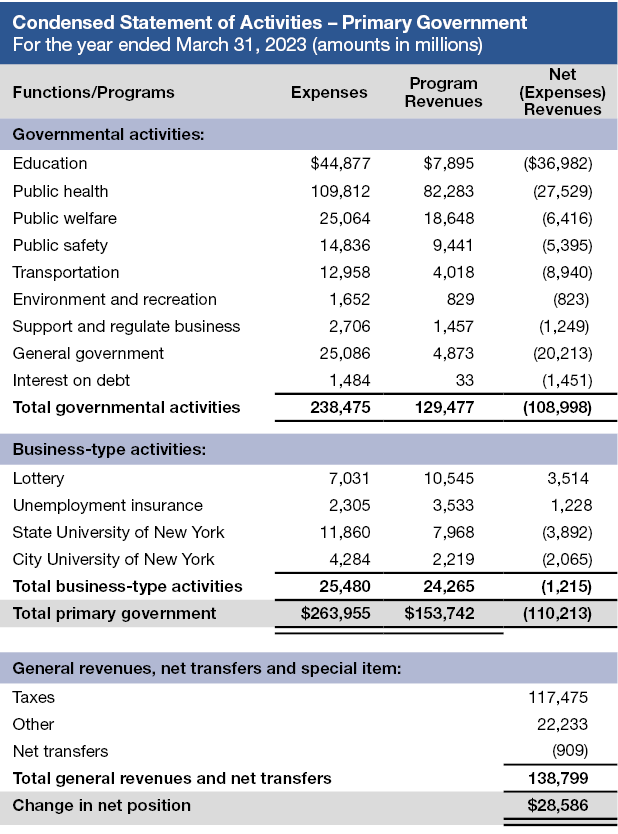

Statement of Activities

This statement reports the change in net position, which is calculated by:

- Reducing the expenses of each of the State’s programs by the revenues generated by those programs to arrive at net program expense; and

- Reducing the net program expense by general revenues and other gains and losses.

Program revenues include:

- Charges to customers or others for services related to the program;

- Grants and contributions that can only be used to pay for the operations of a particular function or segment; and

- Capital grants and contributions, including special assessments. General revenues include internally dedicated resources, taxes and other items not included as program revenues.

General revenues include internally dedicated resources, taxes and other items not included as program revenues.

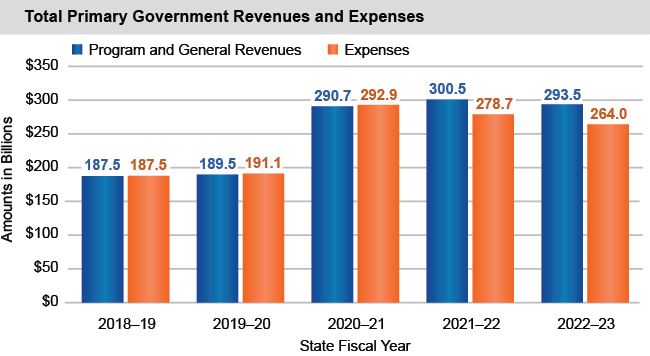

For prior years’ comparative government-wide data, please see the Statistical Section of the Annual Comprehensive Financial Report (ACFR) (Net Position by Component, Changes in Net Position, and Program Revenues by Function schedules). For an overview of the reasons for changes in revenues and expenses, please see Management’s Discussion and Analysis in the ACFR.

* The primary government category includes governmental activities and business-type activities combined.