SECTION OVERVIEW AND POLICIES

All vendors providing goods/materials or services to New York State must be registered in the Statewide Vendor File.

This Subsection provides the agency with guidance on how to request individuals or businesses be registered in the Statewide Vendor File in the following instances:

- foreign vendors (see Section 3.B - Add a Foreign Vendor to the Statewide Vendor File of this Chapter for more information)

- single payment vendors ID (see Section 3.B - Single Payment Vendor Add of this Chapter for more information) and

- special use vendor ID (see Section 3.B - Special Use Vendor ID Request of this Chapter for more information).

Agencies initiate the process by collecting the necessary information from the individuals or businesses and providing the required forms to the Vendor Management Unit (VMU). The VMU uses this information to add the individual or business to the vendor file or obtain a single payment or special use vendor ID.

Additionally, this subsection provides information on the Specially Designated National match the VMU performs (see Section 3.B - Specially Designated Nationals Failures of this Chapter for more information).

- Add a Foreign Vendor to the Statewide Vendor File

-

SECTION OVERVIEW AND POLICIES

A foreign vendor can include a corporation created or organized outside the United States (US), with a legal address or a permanent residence outside of the US. It can also include an individual whose permanent residence is outside of the US. In order to do business with New York State, US foreign vendors must have a New York State Vendor ID and be enrolled in the Statewide Vendor File.

The Vendor Management Unit (VMU) will add any foreign individual or entity not already registered as a New York State Vendor to the Statewide Vendor File. Each Agency will initiate this process by obtaining the appropriate Internal Revenue Service (IRS) and New York State Substitute W-9 forms, and completing the New York State Foreign Vendor Registration form. The Agency will submit these forms to the VMU for their use in registering a foreign vendor.

Process and Transaction Preparation:

Agencies should complete the following steps for the VMU to add a foreign individual or entity to the Statewide Vendor File:

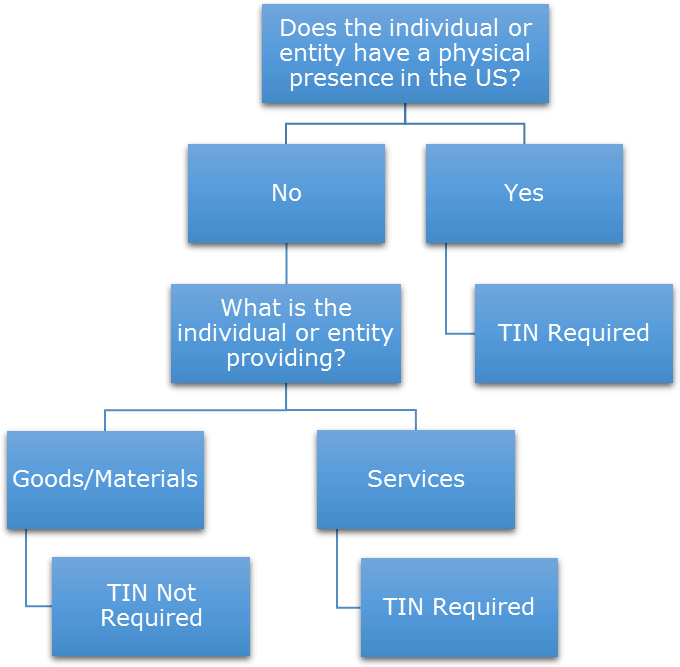

- Determine if the individual or entity is required to have a valid US issued Taxpayer Identification Number (TIN) by considering the following questions:

- Does the individual or entity have a physical presence in the US?

Physical presence can include having an office or a store in the US or providing a service within the US. - Is the individual or entity providing goods/materials or a service?

Please use the following chart as guidance in this determination:

Agencies will use this determination to ensure the individual or entity provided the appropriate IRS Form(s) in step 2 below.

If the individual or entity needs to obtain a TIN, refer them to the IRS directly to apply. The vendor may apply online at www.irs.gov or by calling the toll-free phone number (800) 829-4933. International applicants must call (267) 941-1000 (not toll-free).

- Does the individual or entity have a physical presence in the US?

- Collect all required information, using the New York State Substitute Form W-9, the Foreign Vendor Registration Request Form, and the appropriate IRS Form(s)

Collect the following required information using the New York State Substitute Form W-9:

Legal Business Name The individual or organization name as it appears on legal documents (e.g., social security card, charter, federal tax documentation, etc.) Business Name/Disregarded Entity Name Doing Business As (DBA) Name Required, if different from Legal Business Name Entity Type Individual sole proprietor, partnership, corporation, etc. Taxpayer Identification Number (TIN) Nine digit federal identification number Taxpayer Identification Type Employer Identification Number (EIN), Social Security Number (SSN), etc. Remittance Address Mailing address for payments, 1099s, if applicable, and official correspondence Ordering Address Mailing address for purchase orders Ordering Email Address* E-mail address where purchase orders will be electronically sent Primary Vendor Contact Name A person who makes the legal and financial decisions at the business Primary Vendor Contact Email Address E-mail address for the Primary Vendor Contact Primary Vendor Contact Phone Number Direct phone number for the Primary Vendor ContactRequired, when available Backup Withholding Certification Indicates the vendor’s exemption status from backup withholding *Note: Please note that purchase orders will be sent via email by default.

Complete the following Foreign Vendor Registration Request Form with the following required information:

Legal Business Name The individual or organization name as it appears on legal documents (e.g., social security card, charter, Federal tax documentation, etc.) Payee Alternate or DBA Doing Business As (DBA) Name Required, if different from Legal Business Name Does vendor have a physical presence in the US? If yes, enter the US location under Physical Address What is the vendor providing? Goods/Materials, Services, or Both Is the vendor required to have a US TIN? Refer to Step 1 to make a determination Taxpayer Identification Number (TIN) Nine digit Federal identification number Remittance Address Mailing address for payments, 1099s, if applicable, and official correspondence Physical Address List the location where the business is physically located Vendor Contact Information Provide the contact information for an executive at the organization. This individual should be the person who makes legal and financial decisions for the organization NYS Agency Information Provide the contact information for the agency staff requesting the foreign vendor registration Classification Select the classification which reflects the type of business relationship the vendor will have with the State. See Section 4.A – Vendor Classifications for this Chapter for more information. Please note that only vendors which are marked as open for ordering based on the selected classification will be eligible to be issued purchase orders. Foreign vendors who wish to do business with New York State will be required to fill out the appropriate IRS form(s). The Office of the State Comptroller relies on the agency to obtain accurate and completed IRS form(s) for any individual or business not already registered with a New York State Vendor ID.

The following forms for foreign vendors can be found on the IRS website:

TIN Required:

- Form W-8 ECI – Certificate of Foreign Person’s Claim That Income Is Effectively Connected With the Conduct of a Trade or Business in the United States

- Form 8233 – Exemption from Withholding on Compensation for Independent (and certain dependent) Personal Services of a Nonresident Alien Individual

TIN May Not Be Required:

- Form W-8 BEN – Certificate of Foreign Status of Beneficial Owner for United States Tax Withholding

- Form W-8 EXP – Certificate of Foreign Government or Other Foreign Organization for United States Tax Withholding

- Form W-8 IMY – Certificate of Foreign Intermediary, Foreign Flow-Through Entity, or Certain US Branches for United States Tax Withholding

- Submit completed forms to the VMU via email at [email protected], fax (518) 473-9533, or mail to:

NYS Office of the State Comptroller

Vendor Management Unit

110 State Street – Mail Drop 10-4

Albany, NY 12236-0001 - The VMU will initiate a request for the New York State Vendor ID upon receipt from the agency of all necessary information for the foreign vendor. The VMU will run the IRS TIN match process if required. This process verifies the legal name matches the TIN provided for Federal reporting purposes.

- VMU will assign the individual or entity a New York State Vendor ID once the vendor passes TIN matching if required. The New York State Vendor ID will be available for use the next business day. Agencies are able to monitor the approval of their requested vendors and obtain the assigned New York State Vendor ID by using the following SFS reports:

- New Added Vendors – Agencies can query the Statewide Vendor File using a date parameter to view all vendors added to the Statewide Vendor File over a set period.

- Vendor Inquiry\Lookup – Agencies can search this report by TIN, Vendor Name or other vendor information in the search criteria to obtain the assigned New York State Vendor ID.

For additional instruction on this topic, visit job aid how to use the Vendor Add and report applications published to SFS Coach. SFS Coach is accessible from the SFS home page after logging in with your SFS user ID and password.

QUESTIONS

For questions about this process, contact VMU at (518) 486-4602 or email at [email protected].

- Determine if the individual or entity is required to have a valid US issued Taxpayer Identification Number (TIN) by considering the following questions:

- Single Payment Vendor Add

-

Generally, vendors in the Statewide Vendor File have an ongoing business relationship with the State. However, certain payments are made to vendors not managed in the Statewide Vendor File, such as customer refunds, recipients of certain benefits, or other identified groups of payees. In these instances, agencies will process payments to these payees via Single Pay Voucher using a Single Payment Vendor ID established for this specific use.

Process and Transaction Preparation:

Agencies can use single payment vendors to process payments to multiple payees for claims or refunds. These vendors do not provide goods and services to the State, and the Office of the State Comptroller’s Vendor Management Unit (VMU) does not maintain their information in the Statewide Vendor File. Agencies must submit a request to the Vendor Management Unit (VMU), for a new Single Payment Vendor ID to use in the Statewide Financial System. Only the VMU can establish a Single Payment Vendor ID Number. Refer to Section 5.B – Requesting a Single Payment Vendor ID of this Chapter for additional information related to Single Payment vendors.

If an Agency determines it has a need to request a Single Payment Vendor ID, it should:

- Complete the New York State Single Payment Vendor ID Request form.

- Submit the New York State Single Payment Vendor ID Request form to the VMU via fax at (518) 473-9533 or email at [email protected] with “Single Payment Vendor Request” in the subject line.

QUESTIONS

For questions about this process, see Section 5.B - Requesting a Single Payment Vendor ID of this Chapter concerning Single Payment Vendor Identification Numbers or contact VMU at (518) 486-4602 or email at [email protected].

- Special Use Vendor ID Request

-

Special Use Vendor IDs are a ten-digit number starting with ”0” and are established for a specific business purpose other than for routine business use, such as debt service, advance account, payroll or eminent domain vendors. Agencies cannot add Special Use vendors through the regular vendor add process. These vendors require Vendor Management Unit (VMU) entry and communication to the applicable agencies to ensure appropriate payment processing.

Process and Transaction Preparation:

Agencies must submit a request to the VMU for a new Special Use Vendor ID to use in the Statewide Financial System. Only the VMU can establish a Special Use Vendor ID Number. Refer to Section 6 – Special Use Vendor Identification Numbers of this Chapter for additional information related to Special Use Vendors.

To request a Special Use Vendor ID, agencies should:

- Complete the New York State Special Use Vendor ID Request form.

- Submit the New York State Special Use Vendor ID Request form to the VMU via fax at (518) 473-9533 or email to [email protected] with “Special Use Vendor Request” in the subject line.

QUESTIONS

For questions about this process, see Section 6.A – Special Use Vendor Identification Numbers of this Chapter or contact VMU at (518) 486-4602 or via email at [email protected].

- Specially Designated Nationals Failures

-

The U.S. Department of Treasury, Office of Foreign Assets Control publishes a list of Specifically Designated Nationals – individuals and organizations with whom United States citizens and permanent residents are prohibited from transacting business. The Vendor Management Unit (VMU) uses this list to identify whether any SDNs are in the Statewide Vendor File.

Process and Transaction Preparation:

During this process, if VMU identifies any matches, the VMU will inactivate the vendor in the Statewide Vendor File. The VMU will also contact the vendor to resolve any issues.

Once any issues have been resolved, the VMU will reactivate the vendor in the Statewide Vendor File.

Guide to Financial Operations

REV. 04/01/2017